It’s not often that the head the world’s most important central bank recognizes that inflation is heating up while promising not to do much about it anytime soon. But that was Thursday's message from Federal Reserve Chairman Jerome Powell, who reaffirmed a policy of keeping interest rates lower for longer even as inflation expectations rebound.

“We do expect that as the economy reopens and hopefully picks up, we’ll see inflation move up,” Powell said on Thursday. He qualified the comment by explaining that inflation remains low and below the Fed’s 2% target. The central bank’s tolerance for reflation, in other words, remains high for the foreseeable future.

Driving the point home, Powell also reaffirmed that there are no plans to raise interest rates. Raising interest rates, he added, would require the economy a return to full employment and inflation reviving to a sustainable level above 2%. Neither on the agenda for Fed expectations this year, he explained.

“There’s just a lot of ground to cover before we get to that,” he said. Even if the economy experiences “transitory increases in inflation … I expect that we will be patient.”

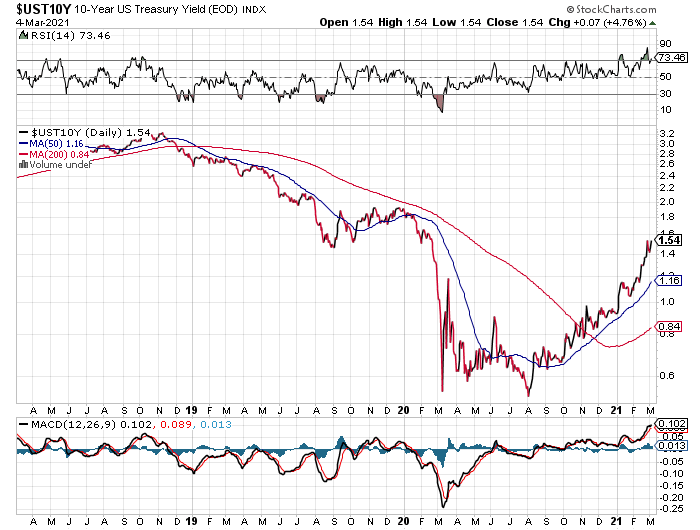

Markets, however, seem to be anything but these days. After Powell spoke, the 10-year Treasury yield rebounded, closing Mar. 4 at 1.54%, which matched the previous week’s peak—the highest rate in over a year.

UST10

Y Daily Chart

Y Daily Chart  UST10

UST10

The counterpoint is that the backup in yield is reflation rather than a return of worrisome inflation. The disinflation/deflation run triggered by the pandemic is fading as the economy heals, vaccines are distributed and the general mayhem unleashed by the coronavirus crisis gradually wanes. This rebound looks stark vs. last year’s darkest point, but it’s a return to levels that preceded the onset of the coronavirus crisis.

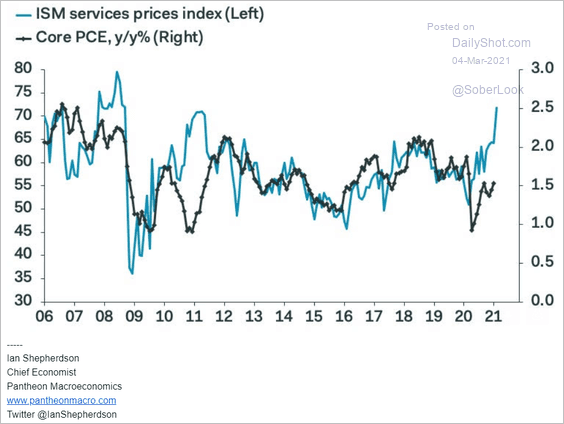

The revival of pricing pressure, in other words, is part of the healing process in the economy. True, but the sudden change is nonetheless striking. Prices paid in the services sector, for example, have shot up recently, based on the ISM Non-Manufacturing Index survey data. Although business activity slowed in February in this crucial slice of the US economy, prices paid by companies for inputs surged to the highest pace in nearly 12-plus years.

ISM Services Prices Index & Inflation  ISM Services Prices Index & Inflation

ISM Services Prices Index & Inflation

The revival in economic growth expectation for this year’s first quarter is also juicing forecasts of higher inflation. As reported in last week's article, Q1 GDP nowcasts have ramped up sharply in recent weeks.

The embedded assumption in the Fed’s policy of letting inflation run hotter while leaving extraordinarily easy monetary policy unchanged: reflation will be modest and temporary and pricing trends will soon return to pre-pandemic levels and stop there. Deciding if that’s an accurate forecast will take time. Perhaps by the second half of 2021 the markets will have clear visibility of the wisdom (or lack thereof) of this assumption.

Meantime, markets are inclined to demand some degree of insurance if the central bank is wrong—a hedge in the form of higher yields on the long end on the curve. On the short end, by contrast, the markets appear confident (for now) that the Fed will keep its promise to forgo rate hikes.

Consider the 2-year Treasury yield, which is widely considered to be the most sensitive maturity for rate expectations. Despite the run higher in the 10-year rate, the 2-year yield continues to hold steady in a tight range that’s near its pandemic lows.

UST2

Y Daily Chart

Y Daily Chart  UST2

UST2

The 2-year rate’s implied forecast—that the Fed will leave its current zero-to-0.25% target range extend for the foreseeable future—finds support in Fed funds futures, which are pricing in a near-zero probability of a rate hike through the end of this year.

The question is whether letting reflation run hotter for longer risks letting the cat out of the bag? No one knows at this point, but clarity is coming. Meantime, the decades-long run of disinflation isn’t easily dismissed since the key forces driving the trend remain (aging workforce, savings glut, rising technology-related disruption/efficiency, etc.) remain in place and don’t appear set to disappear.

Nonetheless, thinking through the implications of what could go wrong with the Fed’s experiment is topical for 2021. The stakes are certainly high for markets and the economy, which are effectively leveraged to low interest rates.

To take one example, if interest rates continue to rise beyond expectations there could be severe fallout in the housing sector, which in turn has the potential to cast dark shadows over a nascent but crucial recovery in consumer sentiment.

Exactly where the tipping point between productive vs. destructive higher rates is remains unclear. For now, there’s still plenty of upside left for, say, the 10-year before the yield rise becomes worrisome. Recall that in 2019, a 10-year rate as high as the mid-2% range was considered “normal” as well as helpful for economic stimulus.

But a lot has changed and the crowd will be watching to see if the Fed is ceding control of rate policy to the markets. There was a hint of that yesterday, when Powell attempted to calm the bond market by reaffirming that rates will remain low for longer than usual. If that was an effort to keep yields steady, it was a failure.

“The message, which Powell sent very clearly, was lower for longer,” says Subadra Rajappa, head of rates strategy at Société Générale. “It was the market reaction I was quite surprised by.”

Are there more surprises ahead? Unclear, but as the Fed embarks on what’s shaping up to be a grand experiment there’s a non-zero possibility that its policy is misguided and the central bank loses hard-earned credibility in the markets. We’re a long way from regime shift on this front, assuming it arrives–unless we’re closer than we think.

By some accounts, the writing’s on the wall. “The market is having a crisis of confidence with Powell and the Fed,” opines John Petrides, portfolio manager at Tocqueville Asset Management.