The U.S. Treasury market is confused, or so it appears. While nominal yields have been rebounding recently, real (inflation-adjusted) rates keep falling, plumbing deeper into the sub-zero realm. One of these trends will eventually break and fall in line with the other. Which one will cry “uncle” first? The answer probably resides with how the incoming inflation data shakes out in the months ahead.

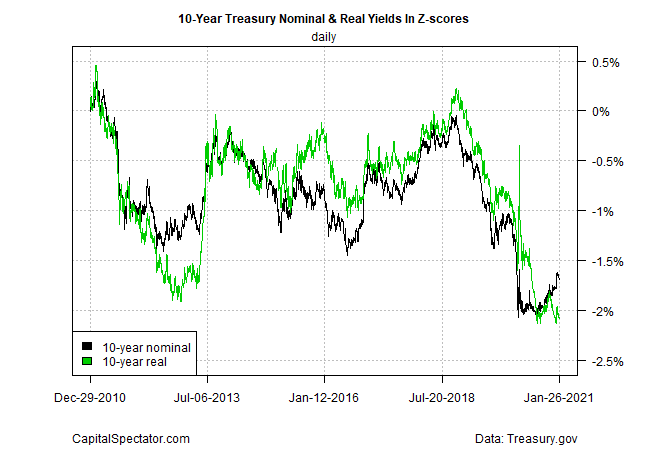

What’s clear now is that a divergence in yields has been unfolding recently, as shown by the nominal 10-year Treasury yield vs. its real-yield counterpart. For easier visual comparison the yields are converted into z-scores in the chart below.

10-Year Treasury Nominal And Real.  10-Year Treasury Nominal And Real.

10-Year Treasury Nominal And Real.

The key takeaway: the two yields generally track each other, although not perfectly and at times there are relatively wide divergences. But the gaps are temporary and eventually the glue provided by market trading and the economic activity prevails. The challenge is that in real time it’s difficult if not impossible to know how and why the divergence will correct. Sometimes the real yield gives way and returns to a closer correlation with the nominal; other times it’s the reverse.

What will drive the convergence this time? Many factors, although incoming inflation data will likely be the main catalyst. The key question: Will inflation accelerate in 2021? The nominal 10-year yield is arguably front and center on expecting exactly that. After falling to just above 0.5% in 2020, the 10-year rate has been rebounding lately and is currently 1.05% (Jan. 26), which is close to the highest level since last spring.

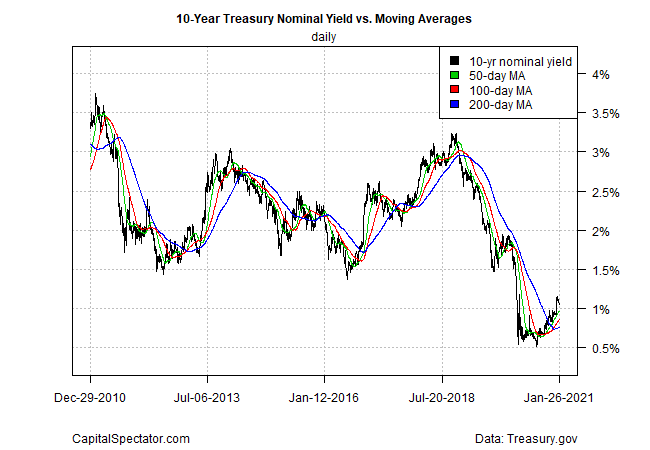

10-Year Treasury Nominal vs. Moving Averages.  10-Year Treasury Nominal vs. Moving Averages.

10-Year Treasury Nominal vs. Moving Averages.

The recent U-turn in the nominal 10-year rate is exhibiting strong upside momentum at the moment, based on a set of moving averages. This is a clear break with the downside trend that prevailed previously. Note, however, that the secular decline in interest rates that’s been in force since the 1980s periodically reverses before resuming its slide. No one knows if that long-running trend will again reassert itself. Incoming inflation data will probably determine the answer.

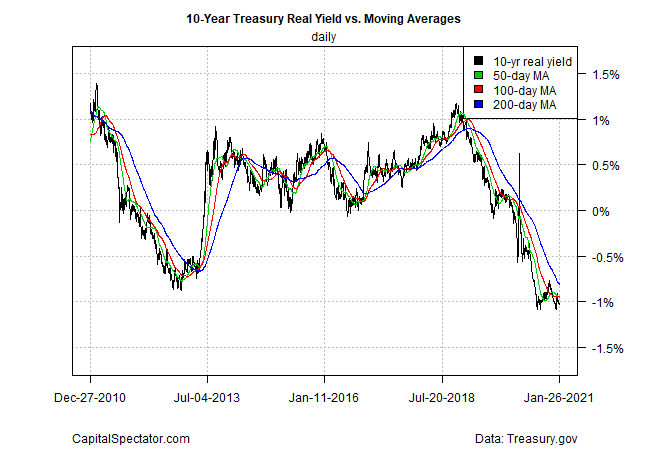

Meanwhile, the real 10-year Treasury yield (via the 10-year Treasury Inflation Protected Security) continues to slide. The current real yield for this maturity is -1.03% (Jan. 26), close to a record low for this data set (which begins in 1997). Moving averages suggest that the downside bias for this security’s yield remains intact and we may see even lesser negative rates in the months ahead.

10-Year Treasury Real Yield Vs. Moving Averages.  10-Year Treasury Real Yield Vs. Moving Averages.

10-Year Treasury Real Yield Vs. Moving Averages.

Perhaps inflation’s trajectory in 2021 will sort out the divergence between nominal and real yields. Some economists are predicting that the extraordinary fiscal response from the federal government last year, combined with the potential for a follow-up spending program in the weeks ahead, will lift inflation by triggering a surge in consumer spending as the pandemic (hopefully) winds down amid wider vaccine deployment. Inflation’s sails may also pick up because of a reduced supply factor in the economy following higher-than-usual business failures due to the coronavirus.

The possibility of a bump-up inflation in the second half of this year and into 2022 is reasonable forecast – assuming the pandemic eases and vaccines prove to be effective and widely distributed. The bigger question is whether a rise in inflation due to government stimulus/relief spending is a temporary blip in the decades-long disinflationary trend or the start of a new secular era of higher/rising inflation? The answer won’t be known until 2022 at the earliest.

Meanwhile, what to make of rising nominal Treasury yields and falling real yields? One way to think about this is to view standard and inflation-protected Treasuries as complimentary in terms of locking in yields. Standard Treasuries offer a fixed nominal yield combined with a floating real yield once you buy a bond or note. TIPS offer the opposite mix: floating nominal and fixed real yields.

One explanation for why TIPS yields are still falling despite expectations of higher inflation is related to the fact that TIPS’ principal adjusts upwards if pricing pressure (measured by the Consumer Price Index) picks up. As a result, the price of TIPS will rise if inflation increases. In turn, a TIPS investment will generate capital gains in a rising inflationary environment.

Of course, the future path of inflation is unknown in the here and now. Meanwhile, nominal Treasury yields appear to pricing an inflationary regime change… or is it one more head fake?