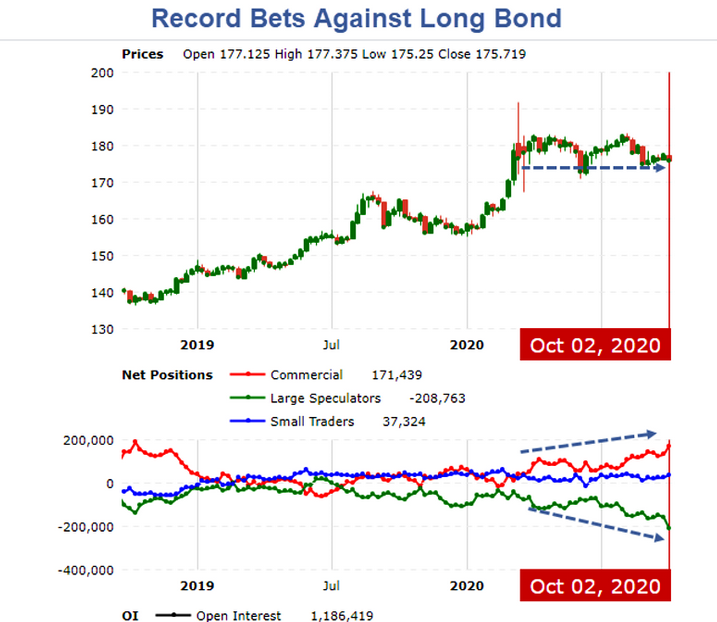

Record Bets Against Long Bond  Record Bets Against Long Bond

Record Bets Against Long Bond

Speculators are net short a record number of United States 30-year long bond contracts.

Record Short Position

The Commodity Futures Trading Commission (CFTC) COT report shows Record Bets Against the 30-Year Treasury Bond.

The amount of speculators’ bearish, or short, positions in 30-year Treasury futures exceeded bullish, or long, positions by 230,312 contracts on Oct. 6, a record, according to the CFTC’s latest Commitments of Traders data.

The 30-year yield, which moves inversely to prices, has rallied to a four-month high since August, when Federal Reserve Chair Jerome Powell announced that the central bank would allow periods of higher inflation in order to average its target 2% rate.

Bets on lower bond prices have also been fueled by expectations that the nascent U.S. economic recovery will continue, as investors await an additional round of fiscal stimulus from lawmakers and breakthroughs in the search for a vaccine against COVID-19.

30-Year Long Bond Yield

30-Year Long Bond Yield  30-Year Long Bond Yield

30-Year Long Bond Yield

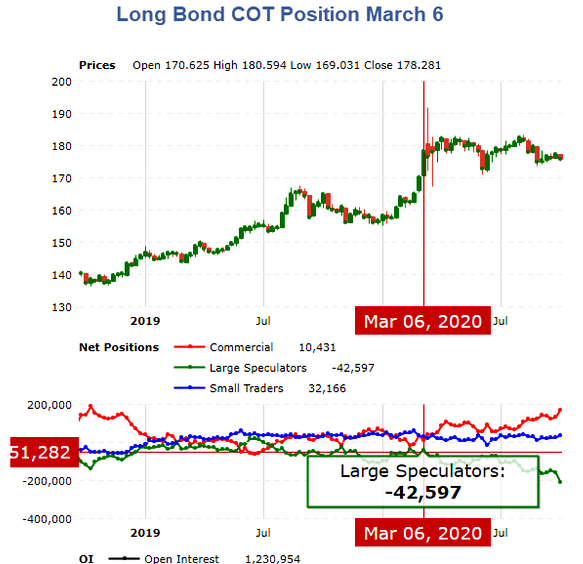

March 6 Long Bond Position

March 6 Long Bond COT Position  March 6 Long Bond COT Position

March 6 Long Bond COT Position

Treasury Bears Pile On

The 30-year long bond yield is about where it was on March 6.

Yet speculators keep piling on with record bets.

Short Squeeze Coming

Any bit of sustained economic weakness will cause the long bond yield to drop blowing the long bond shorts out of the water.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://financialpost.com/pmn/business-pmn/net-short-bets-against-30-year-treasury-bond-hit-record-high-cftc

Congratulations @bondstrader! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP