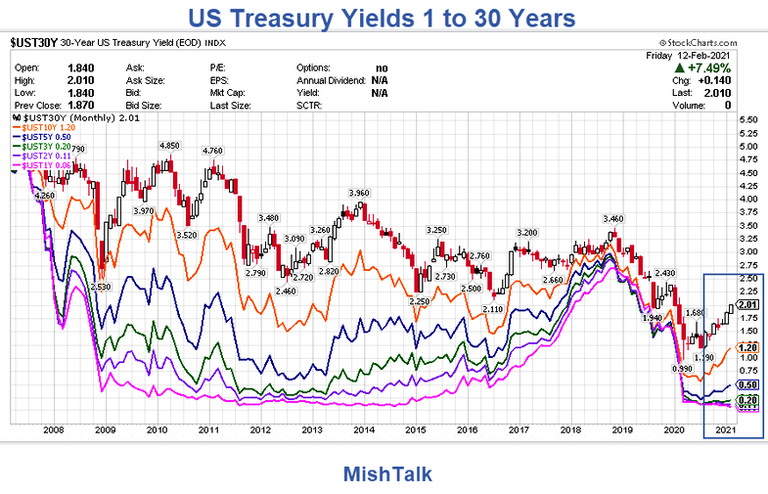

The Fed pledged to hold interest rates low for a very long time. What about the long end of the curve?

US Treasury Yields 1 To 30 Years Chart  US Treasury Yields 1 To 30 Years Chart

US Treasury Yields 1 To 30 Years Chart

YIELDS REVEAL A MINI-REVOLT ON THE LONG END

- 3-month Yield: 0.04%

- 1-year Yield: 0.06%

- 2-year Yield: 0.11%

- 3-year Yield: 0.20%

- 5-year Yield: 0.50%

- 10-year Yield: 1.20%

- 30-year

Yield: 2.01%

Tweet  Tweet

Tweet

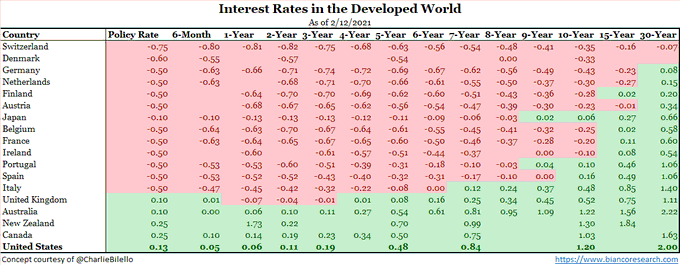

Interest Rates In Developed World  Interest Rates In Developed World

Interest Rates In Developed World

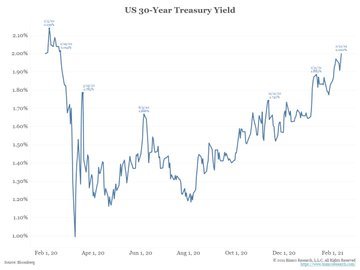

US 30-Yr Treasury Yield  US 30-Yr Treasury Yield

US 30-Yr Treasury Yield

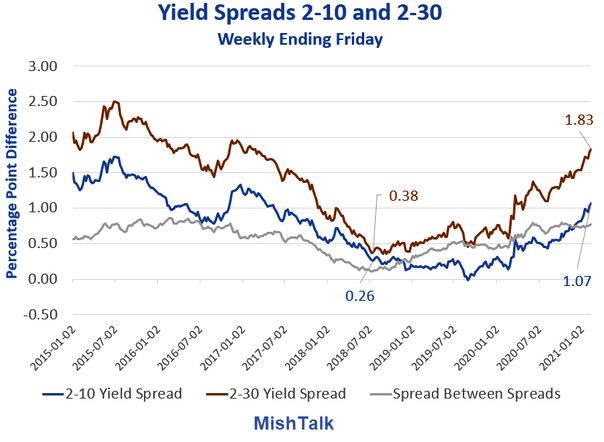

YIELD CURVE DRAMATICALLY STEEPENS

Yield Spreads 2-10 And 2-30 Yrs Chart  Yield Spreads 2-10 And 2-30 Yrs Chart

Yield Spreads 2-10 And 2-30 Yrs Chart

NOTES

- In July of 2018 the spread between the spreads was only 12 basis points with the 2-30 spread at 38 basis points and the 2-10 spread at 26 basis points.

- The 2-30 spread at 1.83 is higher than any time since February 10, 2017.

- The 2-10 spread at 1.07 is higher than any time since April 7, 2017.

FED LOSING CONTROL OF LONG END

- On Feb. 8, the Fed noted Monetary Policy Will Stay Accommodative For a Very Long Time. I commented "Like Forever".

- On Feb. 10, in a speech on the labor market Powell said the True Unemployment Rate is Actually 10%

In Powell's speech, he reiterated the message rates would stay low.

But spreads have widened dramatically which begs the question:

How long before the Fed openly intervenes to push rates lower on the long end of the curve?