Last week, Federal Reserve Chair Jay Powell reiterated his stance that he’s keeping rates at zero for a while. It was no surprise, but it confirms that we’ll continue to ignore US Treasury bonds. They might not pay enough in our lifetimes to warrant our attention ever again!

Instead, we’ll turn our focus to higher paying fixed income vehicles. I’m talking about corporate bonds, convertible bonds and “preferred” stock. They all dish more dividend per dollar than lame T-Bills.

But is this the best time to buy them, with an election just around the corner? It’s a common question, as I’m seeing many subscribers writing in to ask:

First, let’s use the most accurate tool out there, the prediction market.

You can ignore the “gurus” who have developed models to predict the election. First, they were all wrong in 2016. Second, it’s not necessary to listen to them because we can tap the “wisdom of crowds” (really, the wisdom of gamblers!) by looking at a site like Predict

It.

We shouldn’t use a random poll to base our investment decisions on. We should follow the money that is flowing through a site like Predict

It to make actual wagers on real outcomes.

When making our dividend decisions, we do need to plan for any version of 2021-22 politics. As I write, the presidential election is being bet 56/44 in favor of the Democrats. It’s basically a toss-up.

The Senate is being priced pretty close too with a 60/40 betting lean in favor of the Democrats. Only the House (83% chance of continued Democrat control) can be assumed to be a done deal.

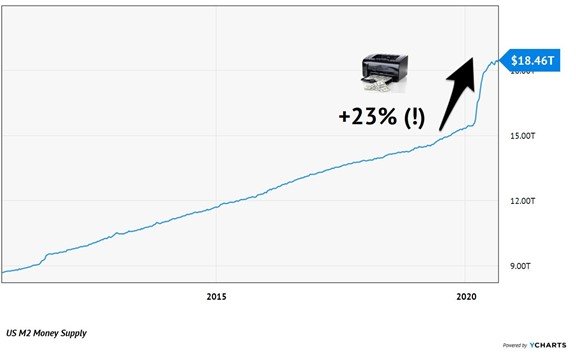

Now what do the incumbents and challengers all have in common? What is the one area where they almost certainly agree? They are likely to let Fed head Jay Powell do whatever he needs to do to support the stock market economy. That will probably involve Powell’s sleek office printer:

The “economy” is a convenient excuse to ramp up greenback printing. However, we contrarians know that stock prices and the actual economy are two different things. Wall Street (sadly) does not care that our favorite restaurant is shutting its doors on Main Street. The stock market indices trade off of the profits of big businesses. And big firms are still making lots of money.

Plus, there’s still a ton of “new cash” out there. Powell cranked up his money printer and flooded the world with liquidity starting in March. Other central banks around the world were generous as well. Here in the US, our M2 money supply is up an astounding 23% year-over-year:

“M2” Money Supply: +23% Year-Over-Year

M2 Money Supply  M2 Money Supply

M2 Money Supply

Let’s not let the current pullback distract us from this “big picture” view. We were due for a breather, as stocks do not always go up. We’ve got the pullback, it’s taken down most stocks and some fixed income, too, and now it’s time to go shopping.

That said, what are the best bonds to buy before, during or after the November election? We income seekers should consider:

- Preferred shares, which pay 7% or more today,

- Convertible stocks, which benefit from a rising stock market because they “convert” from bond to stock as their underlying equity price rises (the fund I like pays 4.4%), and

- Overseas bond funds, which pay up to 11% today thanks to the big yields offered by emerging market governments.

Another benefit of these funds, beyond their big dividends, is their downside protection. For example, the S&P 500 topped on September 2 and is down 9.3% (as I write). Meanwhile, my favorite preferred stock fund, the Flaherty and Crumrine Dynamic Preferred and Income Closed Fund (NYSE:DFP), is up by 0.6%. (Its positive total return is represented by the monthly dividend the fund just confirmed yesterday!)

If you’re wondering where I’m finding these pullback-proof monthly dividends… and perhaps the type of glue I’m sniffing to see these 4%, 7% and even 11% yearly yields in Bond-land, I’ve got three letters for you:

CEFS

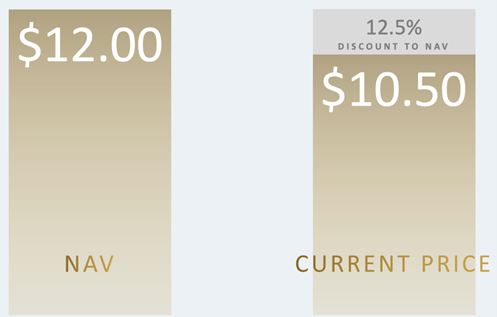

There are some great closed-end funds (CEFs) that dish income investors these generous dividends. The great thing about CEFs is that they trade like stocks because they have fixed pools of shares. Which means that when the market slides, they can often trade at discounts to their NAVs (net asset values).

Their popular and overrated ETF cousins, on the other hand, simply issue more shares when supply overwhelms demand. As a result, they typically trade around their par, or fair, value. (Never a deal there!)

Bond CEFs are where the real fixed-income party is. Not only can we get more dividend for our dollar, but we can also buy $12 worth of bonds for just $10.50. All it takes is a 12.5% discount to NAV:

Buying a Dollar in Bonds for 9 Dimes or Less

CEF Discount NAV Chart  CEF Discount NAV Chart

CEF Discount NAV Chart

A 12.5% discount is unheard of for a bond ETF. However, there are many bond CEFs that are currently trading at discounts this generous. In fact, we can buy some secure foreign bonds for as little as 86 cents on the dollar (a 14% discount to NAV), thanks to this recent pullback and general ignorance about CEFs.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."

Congratulations @bondstrader! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: