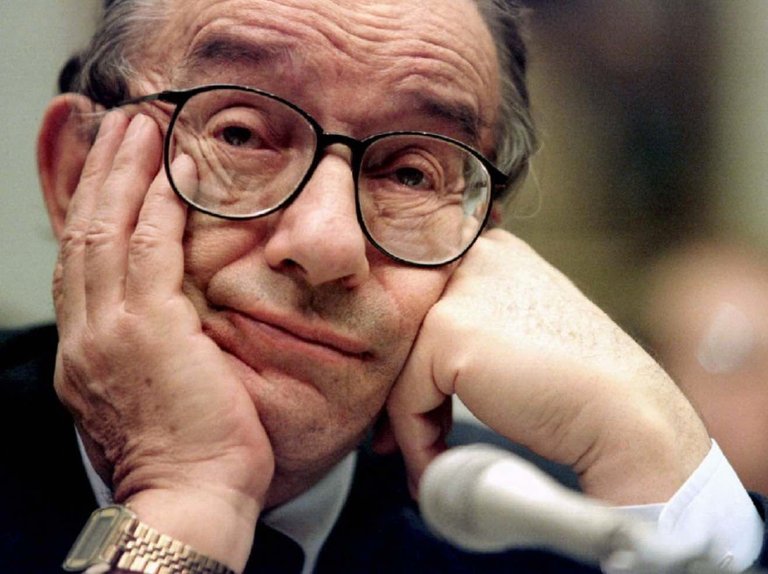

Alan Greenspan, former Fed chairman during the go-go Reagan-Thatcher era of deregulation and Bull Market debauchery of the 1980’s - is warning of a bond market bubble pop.

Viewers of “Keiser Report” know that this particular market call has been a graveyard for market pundits for years.

Starting in the wake of the 2008 GFC (Global Financial Crisis), market observers have warned of a crash in the bond market.

Initially it was believed that the trillions printed to bail out the banks would cause inflation and, therefore, a flight from bonds.

Wrong.

The modern Bond Bull Market, that started in 1980 (when interest rates peaked under Paul Volcker), screamed higher.

After it became clear that, despite post-GFC bank bailouts, bonds were not going to fall - hitting new all time highs, in fact - the debate among economists and market pundits switched to the theme of ‘inflation vs. deflation.’

The thinking: Bank balance sheets around the world were deteriorating faster (deflation) than the central banks could print money (inflation) resulting in a net deflationary trend that supported higher bond prices.

The truth is: Central bank have been buying their own bonds - with Japan being the most aggressive. And this insatiable trend of debt-monetization by central banks is what has driven the bond bull. To the point where nobody questions it anymore. Except Greenspan, suddenly.

Greenspan’s reasoning for a bond bubble pop, according to Bloomberg:

“By any measure, real long-term interest rates are much too low and therefore unsustainable. We are moving into a different phase of the economy."

To rewrite Greenspan’s statement honestly, including the bits he left out to save face:

“By any measure, [the rate of central bank market interference monetizing its own debt on an unprecedented scale to keep insolvent banks alive have kept] real long-term interest rates much too low and therefore unsustainable."

Putting aside the morals Greenspan seems to be lacking for a moment.. Is he right? Is the 37 year bond rally over?

A previous, and famous, call by Greenspan was in 1996 about the NASDAQ and the dot-coms.

“But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”

The dot-coms had 4 more years of rising prices before they crashed.

I think Greenspan is right about bonds and I don’t think we’ll be waiting four years to find out.

If you trade bonds, the old maxim might apply:

“Better three hours too soon than a minute too late." - William Shakespeare

Or, as another financier once said:

“I made my money by selling too soon." - Bernard Baruch

(Signed - Max Keiser: 8-1-2017)

I am more interested in how the bond market plays out than any other financial sector. Sometimes my passion comes across as crazy. Not bat shit crazy, just the usual, "who talks about the bond market?" Kinda crazy.

I recently spent time with family in Charlotte. BofA higher ups. My cousin is a top dog. After a night of celebration(her son graduated from high school) we were enjoying breakfast together. I was mentioning crypto and blockchain technology. I was surprised from her blank stare and lack of knowledge. This was June '17. I'm a carpenter and had to break it down the best i could...to a high level bankster. WTF! It felt awkward.

Anyways, thanks @keiserreport for everything you both do. Keeping it real from the ILM✌

All the more reason to buy physical gold and silver, and cryptocurrency.

Keep stacking.

Yes Dear

good

That's an awesome post it can be helpful and even..

Followed and resharing @phibetaiota

It's VERY nice to have you here @keiserreport.

Your combined efforts in economics and education is greatly appreciated and this story is a great example.

Please consider interviewing Robert David Steele again on your show. We believe there are some important developments that you'll want to cover concerning your North American tour. Thank you for the contribution.

~The Management

I upvoted you and your amount went up. Did you take my money?

no.

Read the manual please. I do not instruct people how SteemIt works. That's someone else's job.

That was a joke, eh? But, I understand not good because others may not understand. My bad.

The excessive amount of money printing should create inflation, yet, government policy and corporate collusion create an alternate PERCEPTION that defies the facts.

Here's how they make it seem like there is less money available than is factually true:

Meanwhile, the Velocity of M2 keeps falling and falling, verifying the fact that, DESPITE the unbridled money printing - the actual movement of money is altered substantially enough to offset any inflationary pressures to date.

All ponzi schemes come to an end however...even though this one seems like it never will?!?!

I would have bet good money that was a fake Shakespeare quote, or maybe as they (you know who) say today "alternative Shakespeare". But no, apparently it is for real from "The Merry Wives of Windsor, Act 2 Scene 2":

Source: http://shakespeare.mit.edu/merry_wives/merry_wives.2.2.html

I read a report yesterday about Venezuela's Bonds having 100 year maturity rates when they've defaulted 10 times in the last 100 years.

I'm sure this time will be different though and Murica won't ever default, ever.

I'm buying those bonds. Not!

"Nothing has happened, and nothing will happen." That's what my spouse keeps saying. She's wrong of course. The music is fading. A lot of people are going to be without chairs too. Tick tock, tick tock...

In this market e ery one should be vigilent& go through the proper study about the behaiour of the

been lead the way with crypto, no turning back now, everything is brighter today, roll on $10K BTC

great post !!!!!