The web is full of articles and personal opinions labeling Bitcoin’s current high valuation as being in a bubble. Shark Tank star and Dallas Mavericks owner Marc Cuban has been tweeting to his 7 million followers about bitcoin on a regular basis, but says that he believes Bitcoin is currently in a bubble, “I just don't know when or how much it corrects.”

“If there is such a thing as a healthy bubble, this is it,” the Economist stated recently. Forbes predicted that all the recent cryptocurrency gains are one large bubble. From looking at the cryptocurrency trading price patterns this year, it is hard to disagree that it matches the shape of a standard bubble pattern.

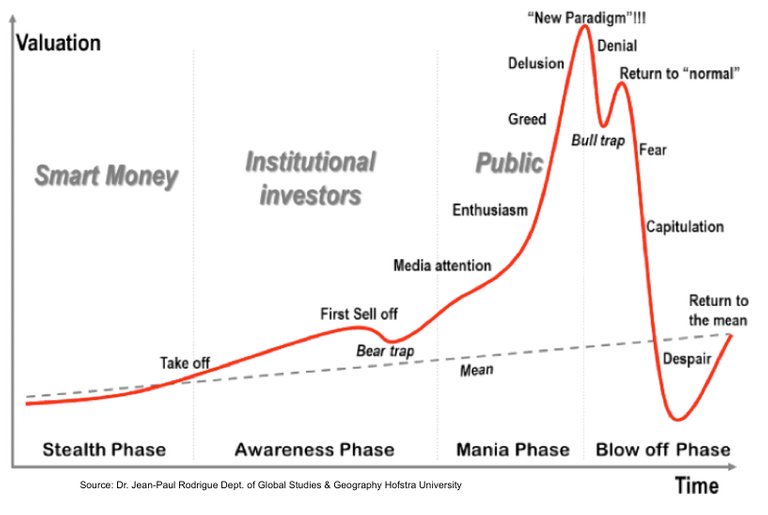

In an effort to determine which bubble phase Bitcoin’s price is currently in, BraveNewCoin turned to the original chart’s source, Dr. Jean-Paul Rodrigue, who became famous for creating the “Phases of a Bubble” chart, a specific, investor-oriented variation of Gartner’s hype cycle.

Dr. Rodrigue, a professor at the Department of Global Studies and Geography at Hofstra University in New York, became well known for his bubble model in 2008. His model and chart are often cited and used to predict bubbles in many investment types, including stock markets, bond markets, housing markets, and now, cryptocurrencies.

Defining market terms like the “Bull trap,” the chart explores the lifestyle of all types of investment bubbles, concluding that technology moving through it is all in one of four distinct stages; Stealth, Awareness, Mania, and Blow-off. Strong arguments could be made for bitcoin being in at least three of these phases today.

In the first phase, Stealth, only investors “who understand the new fundamentals realize an emerging opportunity for substantial future appreciation get involved in the asset,” Dr. Rodrigue explained. “Prices gradually increase, but often completely unnoticed by the general population.”

Few would suggest that Bitcoin has not even seen the first stage of a bubble yet. Early adopters began investing in the digital currency via mining equipment the year it was created, and then directly into bitcoins themselves the following year, 2010. For the first four years of its existence, the vast majority of the world had not even heard of bitcoin, and to this day, less than one in ten thousand people has even one bitcoin address.

The second phase, Awareness, is described as the period of time when “Many investors start to notice the momentum, bringing additional money in and pushing prices higher,” Dr. Rodrigue explained. This is also the phase where institutional investors start to invest in the asset. “In the later stages of this phase the media starts to notice with positive reports about how this new boom benefits the economy by ‘creating’ wealth; those getting in becoming increasingly ‘unsophisticated’.”

The media has inarguably noticed Bitcoin lately, even more so than during the 2013 bubble and resulting crash in 2014. The digital currency has been reported on by mainstream media in several countries around the world. Bitcoin commonly graces the cover of magazines too, and for the first time, the Wall Street Journal's print edition featured the digital currency on the first page of its Business & Finance section on Wednesday.

With more media attention and a fairly consistent weekly all-time high price, new investors are unsurprisingly drawn to the digital currency, raising the price again as the new people buy more. Bitcoin has gained over 160% year-to-date, after touching 200% for a moment on several exchanges last Sunday.

Alternatively, gains in the traditional investment markets are negative at worst, or an order of magnitude smaller at best. According to a May report from the Capital Spectator, year-to-date, Emerging Market Stocks (MSCI EM) was the best performing asset class with 17.3% year-to-date return, while the US dollar index lost 5.2%, and Crude Oil lost 10.1%.

Meanwhile, institutional investments have been, for the most part, precluded from bitcoin investments in most markets. This result of Bitcoin’s hard-to-regulate nature keeps them off securities exchanges for the most part, where institutional investors do the bulk of their trading.

Analysts have predicted that Bitcoin’s price would skyrocket if the US Securities and Exchange Commission (SEC) approved the Bats BZX Exchange filing to list and trade shares of the Winklevoss Bitcoin Trust.

The Mania phase of the bubble model is described as the period when, “Everyone is noticing that prices are going up and the public jumps in for this ‘investment opportunity of a lifetime’," Dr. Rodrigue described. “This phase is however not about logic, but a lot about psychology.”

This phase sees floods of money from new investors, the public, who may not have an understanding of the investment, pushing prices to all-time highs. Meanwhile, “the smart money as well as many institutional investors are quietly pulling out and selling their assets.”

In absence of the Institutional investment market, there have been reports of various, existing retail investment merchants, those who sell directly to consumers, starting to allow investments in bitcoin. Throughout the US, Europe, and Southern Asia, services that sell investment products have been dipping their toes in the water with the new generation of cryptocurrency exchanges to sell bitcoins and products derived from them to consumers.

Ever since Japanese government's made bitcoin a legal form of payment in the country, more retail investors have been taking advantage of the phenomenal gains that bitcoin can offer. The largest Forex market by volume, Z.com, recently opened a Bitcoin exchange to overwhelming demand.

In the final phase of the bubble model, Blow off, “everyone roughly at the same time realizes that the situation has changed,” leading to many trying to unload their assets. Meanwhile, “everyone is expecting further price declines,” according to Dr. Rodrigue’s model. “Prices plummet at a rate much faster than the one that inflated the bubble.”

However, when the price has sunk to record low and the public considers the asset “the worst possible investment one can make,” the “smart money starts acquiring assets at low prices.” This is the only category that bitcoin isn’t likely to be in currently, the price of bitcoin is near its all-time high once again, having dipped 10 percent recently and rebounding.

A fifth option may be that the chart simply doesn’t apply to Bitcoin, and it doesn’t have any set bubble pattern to follow in the first place. As Wired recently pointed out about the nature of bitcoin, “It's not something that will improve what the world has, such as money or stock. It's something that will give the world stuff it has never had. Maybe.”

I think if this chart applies to BTC, were in the awareness phase now. It is still no mania where everyone is buying, but it looks like it is starting. Maybe we are between 2 and 3 now. I think BTC isn't overvalued yet, because the supply of tokens is exactly known and I think the current market cap is still very small for the possible user cases of BTC.

I was in the game since 2014 and this article was also used when bitcoin first hit $1000 and everyone was yelling bubble ... I think time will tell again ... let's be patient and see ...

Is it possible to "bubble" imo would take a long time to meet the requirements .

14,000,000 wallets so still a fraction of the western world let alone the world .

and divisible means it will take a long long time for each division to become unaffordable to the average person .

when 0.00000001 is £100 and 200 million user pluss and fiat currency are stable again , ill agree .

Check out the new law Congress is about to pass! This is serious! https://steemit.com/bitcoin/@tomm/you-won-t-believe-this-insane-new-law-against-cash-and-bitcoin

I think the fifth applies and/or a pattern is playing out of an ever upward movement by types of Gartner swings. Pump, dump, consolidation and despair and repeat. Seen it happen twice and the bear of 2014-2015 won't be the last. Since the idea of cryptocurrency will not go away, my strategy is HODL.

I'm more with the fifth option. It's money some places, property others, but it's global. And it just gets bigger and bigger. But what will the rise of ethereum do to the trajectory of bitcoins rise? Accommodate? You just seem like the right person to ask. Thanks for sharing. Following now!

Lets be patient !

Thank you for your effort to place this information here @bravenewcoin !

I think we're at the bull trap.