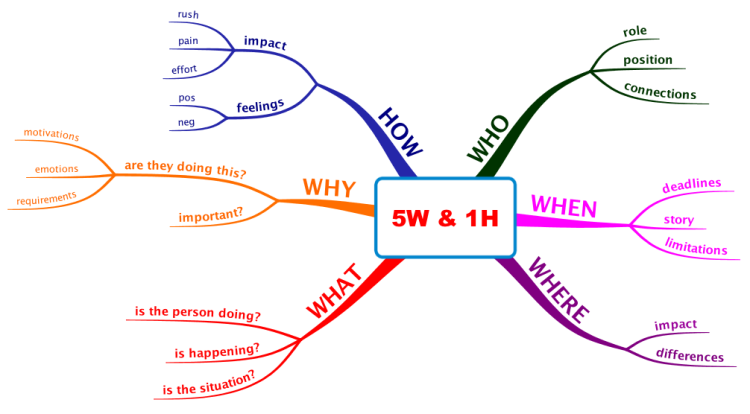

5W1H concept

With today 5W1H ICO review, I'll introduce to you BrickBlock, whose public token is coming to and end soon.

Disclaimer: The information on this article is for educational purposes only and is not investment advice. Please do your own research before making any investment decisions. I make no representations, warranties, or assurances as to the accuracy, currency or completeness of the content contained in this article or any sites linked to or from this article.

What is it?

Have a look at their video explainer for a comprehensive understanding at this project

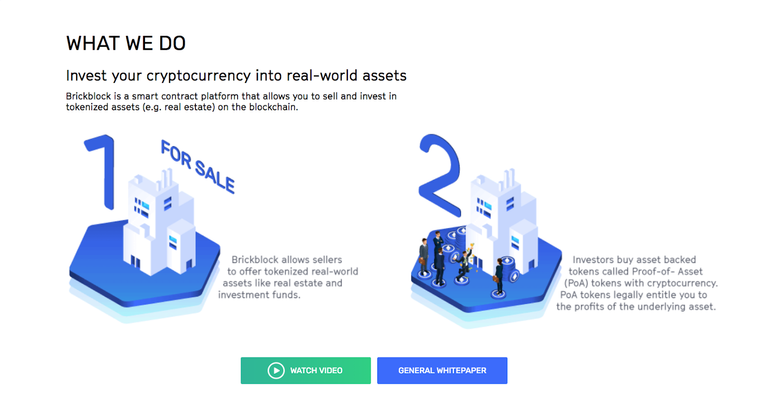

BrickBlock (https://www.brickblock.io/) is a blockchain project dedicating their effort to establish a permission-less infrastructure platform to securely and transparently connect cryptocurrencies with real estate assets, providing everyone around the world with the investment opportunity in this giant industry which is estimated to worth $200 trillion USD - according to Radboud Vlaar, specialist from the early institutional backer of the Bricblock project - Finch Capital.

Why is it there?

Because there are many problems that the world is facing in this industry which restrains our development progress. Here are a few points:

Accessibility

Due to the geographical barrier, not every has access to private equity investment opportunity in foreign countries to gain the beneficial share that asset generates.

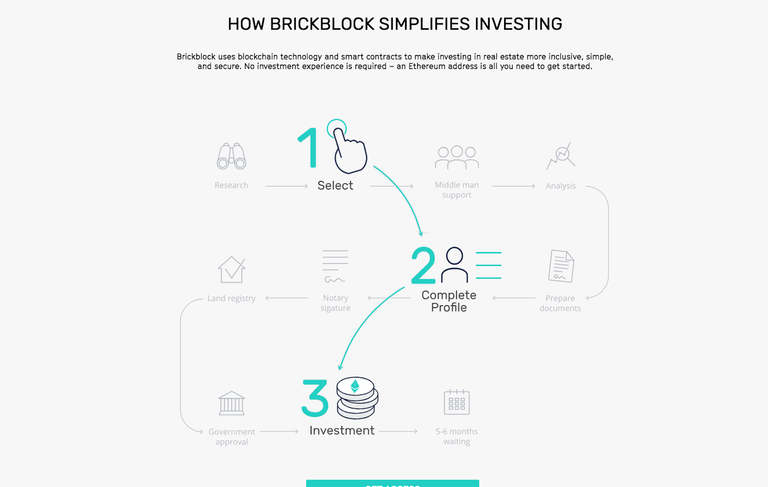

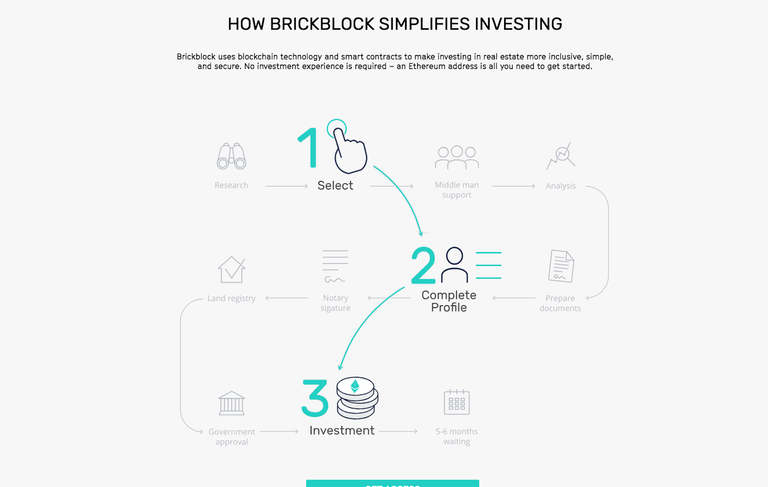

The inefficiency of the conventional process

Including:

Cost and other fees: Because of its nature, small fund investors can get in this industry as doing so the proportion of costs and fees, such as middlemen or paperwork, would be even higher the return they gain.

Lengthy procedures and paperworks: as mentioned, the lengthy procedures of researching, analyzing, monitoring middlemen,etc. takes so much time and effort of the investors, preventing them from earning money with their main job.

How will it solve those problems?

First, let's look at how it works:

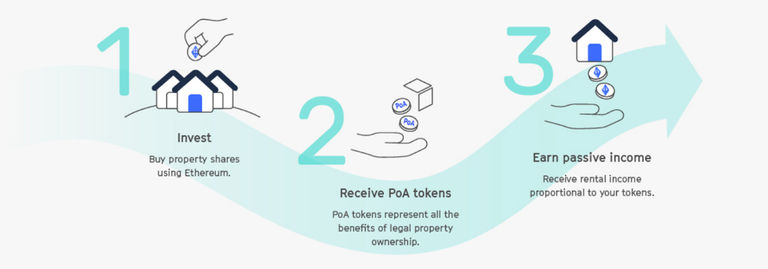

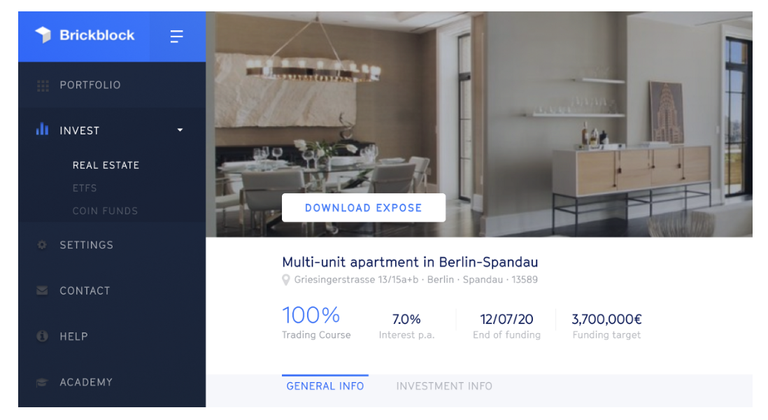

Through the BrickBlock smart contract platform, investors buy tokenized shares of the residential property with Ethereum (ETH): After investors send the payment, the smart contract will issue Proof-of-Asset (PoA) tokens accordingly to the amount they invested compared to other investors. That PoA is unique for each asset listed on the BrickBlock platform with the syntax for naming it PoA tokens will be: BBK-{RE|ETF|CTF}-{2-letter-iso-country-code}{numerical-id}. Because of its uniqueness and credibility of storing information, the PoA tokens are the perfect fit to be the one representing the asset’s financial benefits for the token holders.

Note that as you invest in this, you are buying the share of the financial benefit that that asset generates, you are not buying it totally. (like the right to live in it or else).

So it’s like, you co-invest 50% of the fund with your friend to hire an apartment, renovate it and then set it for rent again with higher price, now you get 50% of the payment that your tenants make monthly.

But, instead of doing it in your area where might not be a hot market or the opportunity for you do so is not high.

With the BrickBlock solution, you can freely target at hot spots around the world listed on the platform which are verified and assessed by a third party fiduciary with transparent metrics such as ROI and IRR.

Moreover, by utilizing the blockchain technology, the BrickBlock platform efficiently reduce costs for investors and making it a frictionless and more liquid investment asset class.

And that, is their solution.

For now, they already their MVP - the Brickblock Platform which you can access right here - https://platform.brickblock.io/. So you're investing in a real product, not imaginary ones on some broken English whitepapers.

For now, they already their MVP - the Brickblock Platform which you can access right here - https://platform.brickblock.io/. So you're investing in a real product, not imaginary ones on some broken English whitepapers.

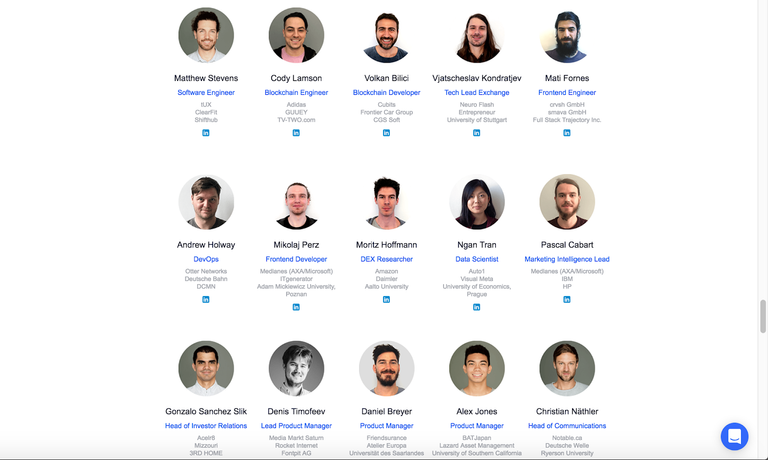

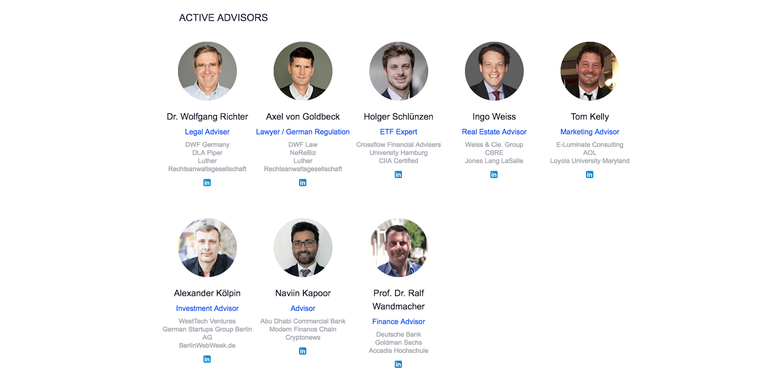

Who're behind the project?

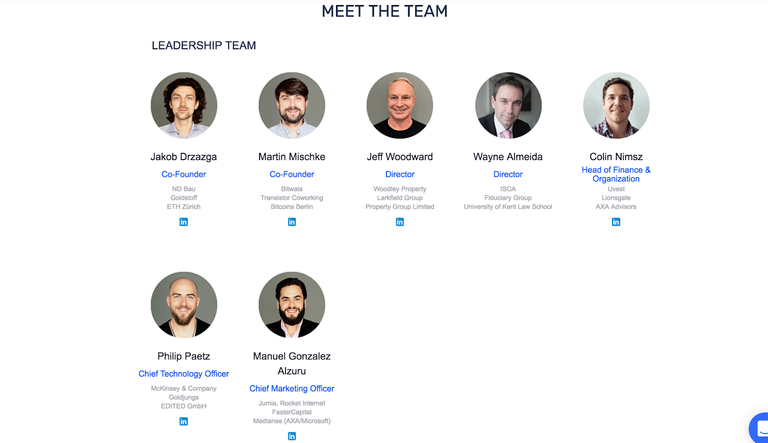

Brickblock is led by Martin Mischke (Co-Founder, on the right) and Jakob Drzazga (Co-Founder).

On the IT side, Martin is the co-founder and ex-CFO of Bitwala, co-founder of Bitcoins Berlin and runs Transistor, Germany’s largest fintech co-working space.

On the business side, Drzazga is a real estate developer who brought up the idea of an infrastructure platform to connect cryptocurrencies with real world assets.

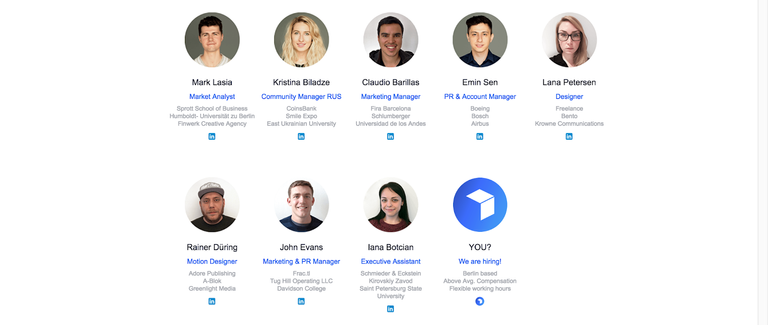

They even have an Ambassadors team consisting of 9 members helping the team to spread the information

Where do they aim at deploying the project

Their company is located in Germany and Brickblock is the first platform attempting to gain EU-wide regulatory approval for its Proof-of-Asset (‘PoA’) security tokens - they've already submit a prospectus with the Commission de Surveillance du Secteur Financier (‘CSSF’) in Luxembourg, whose result is about to be released within this week. Therefore this would be their primary market in my opinion. Besides, as far as I'm concerned, they’ve already established enterprises partnership in the Czech Republic, Brazil and Singapore

When does it happen + Token info

Token Symbol: BBK

Token type: ERC20

ICO Token Price: 1 BBK = 0.60 USD

Softcap: 2,000,000 USD

Hardcap: 50,000,000 USD

Total Tokens: 500,000,000 BBK

Available for Token Sale: 51%

Whitelist: YES

Know Your Customer (KYC): YES

Country excluded: USA, Canada, China, Singapore

There are, in fact, 3 different tokens in the Brickblock’s ecosystem: Brickblock tokens (BBK), Access tokens (ACT), and Proof-of-Asset tokens (PoA).

The ICO (ends on May 15th, 2018) is the last chance investors can purchase the token directly from the team, after that they need to buy it from exchanges. You can activate the BBK token with just one click to generate the Access tokens (ACT) which is the platform fuel and could be sold for Ethereum or deactivate the BBK token so that you can trade it on exchanges since it only becomes tradable when deactivated. Meanwhile, Proof-of-Asset (PoA) tokens are the digital shares which are uniquely generated once an asset on the BrickBlock platform successfully raises its fund - it entitles its holders with the financial benefit that asset generates accordingly to the amount of share they hold.

Personal Assessment

I do like projects with token utility that is closely related to the company business operation like this one since there were other projects raising funds via ICOs and offering investors with tokens that are not really useful. As for the BrickBlock project, the team has more incentives to keep on striving for their projects, which increases the value of the tokens that holders own, since it’s the core activity of the business.

Besides, their performance on Medium is such an achievement. I have always consider Medium as professional mean of message delivering for blockchain projects yet haven’t seen many ICOs utilize this platform. The BrickBlock is an exception, they did extraordinarily on Medium with lots of explanation articles as well as IT development progress update and business partnerships announcements, which does not increase the credibility but also widespread their project’s ideas and performances to more and more people in this closely crypto-related community.

Links and media

Website: https://www.brickblock.io/

Telegram: https://t.me/brickblock

Twitter: https://twitter.com/brickblock_io