Do you know who you're doing business with? In the world of cryptocurrency and blockchain, it's crucial that you do.

Initial coin offerings (ICOs) are becoming a popular platform for fundraising, but they're also attracting greater scrutiny from regulatory agencies. Many ICOs want to ensure the highest standards, but such compliance and pre-sale legal groundwork can be cumbersome and cost-prohibitive for smaller organizations.

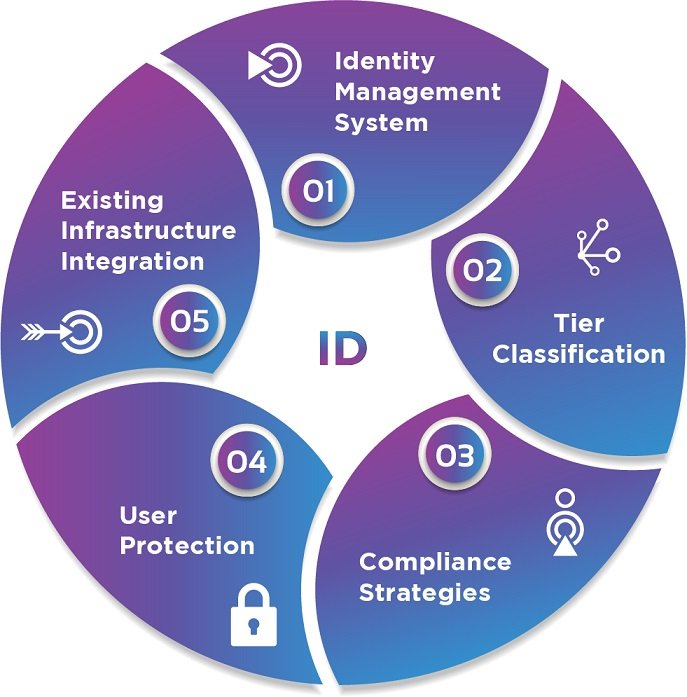

Newly-launched Bridge Protocol says it can simplify know-your-customer (KYC) compliance and reduce costs for token sales by creating a tiered verification assurance system on a private blockchain.

ID Verification

Crypto-based crowdsales present a new way to fund startups, but many are known to be fraudulent. Some facilitate the laundering of fiat currencies. Thus, companies and legal groups are seeking better standards of procedure, but cost-effective solutions is key. Token sale consultant ProjectICO says the cost of corporate structuring and general counsel for a token sale can range from $125,000 to $250,000.

Stephen Hyduchak, founder of ProjectICO and CEO of Bridge Protocol says that Bridge can improve verification assurance and reduce legal costs by digitizing compliance standards. The North-Carolina-based firm's whitepaper says it will offer "tangible digital solutions" that include trusted token sale templates and better KYC processes for participants. These "microservices" can reduce regulatory scrutiny and compliance costs while offering high-assurance products through storefronts designed to serve community needs.

"We know this is going to bring a lot more trust to token sales. We hope to be the gold standard here for operations," Hyduchak said. "Bridge interfaces with NEO framework and allows users to manage, protect and utilize sensitive information in new ways," according to the project's website. "The protocol offers a new standard for whitelists and allows participation in multiple ICOs. Bridge Certificates build trust so users can transact with confidence."

Bridge uses a tiered system of verification. It doesn't hold sensitive information and instead employs "vague user traits" that will meet KYC compliance requirements without identifying individuals. The system will keep sensitive information off the chain but also give users power to securely transact with their own encryption when necessary.

In turn, this will eliminate the need for traditional KYC processes while enhancing compliance, improving security and reducing costs.