After Bitcoin Gold and Verge have been 51% attacked recently, this kind of attacks became a hot topic in the cryptocurrency world. It is remarkable easy to carry out an 51% attack on several coins, so it will probably happen again in the future. Bcash is not the easiest crypto to attack, but it is the most profitable one. The recent attacks might just be a test before a big hit on Bcash can be perfectly made. It would be smart for exchanges to delist Bcash or at least increase the required confirmations to avoid being victim of a major theft.

After Bitcoin Gold and Verge have been 51% attacked recently, this kind of attacks became a hot topic in the cryptocurrency world. It is remarkable easy to carry out an 51% attack on several coins, so it will probably happen again in the future. Bcash is not the easiest crypto to attack, but it is the most profitable one. The recent attacks might just be a test before a big hit on Bcash can be perfectly made. It would be smart for exchanges to delist Bcash or at least increase the required confirmations to avoid being victim of a major theft.

attack.jpg

What is an 51% attack?

An 51% attack can be carried out when one player has more than 50% of the total hash power on a certain PoW chain. When this is the case, the attacker can reverse his transactions and thus double spend. An exchange is the most likely place for it to happen, a huge double spend can be made to buy another cryptocurrency. It can send immediately to an external wallet.

51% attack.png

Especially cryptocurrencies with a minority of hash power using the same algorithm are an easy target, because miners of the coin with a majority of hash power can allocate their existing hardware temporary during the attack, while for an attack on a coin with a majority of hash power someone would need to invest in the hardware because there is simply not enough available, so it have to be bought new. On top of that, the hardware might become obsolete after an attack on a chain with a majority of hash power, because there is no valuable coin to mine anymore.

How much will an attack cost?

This website tracks how much it will cost to 51% attack a cryptocurrency for one hour. Many of them are extremely cheap to attack. It is important to note that a 51% attack on small coins is probably not really rewarding, it is hard to double spend a big amount because it is simply hard to find someone to transact big amounts with.

51% cost.png

Why is Bcash a perfect target?

There are multiple reasons why Bcash would be a perfect target for a 51% attack. Firstly, it is the biggest cryptocurrency without a majority of hash power, so a maximal double spend is possible with a relatively small effort. More importantly, Bcash is the only easy to attack cryptocurrency that can be shorted on Bitmex with 100x leverage.

This means that the 7200 USD that the attack will cost can be easily earned back with a high leveraged short position, because a tanking price after the attack is very certain. Last but no least: Bcash is hated in the community, who wouldn’t enjoy destroying Bcash while earning a lot of money doing it?

Bcash investors will lose a lot of money when a 51% attack occurs, but you certainly don’t want it to happen on your exchange. Be smart and DELIST BCASH!

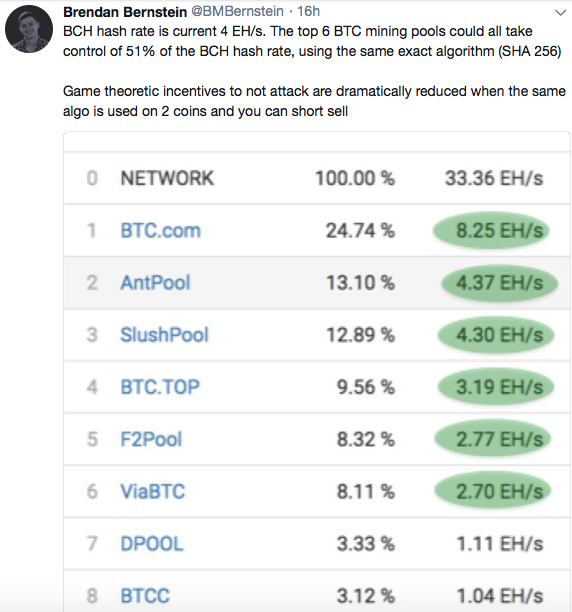

Screen Shot 2018-05-29 at 19.46.25.png

Many single mining pools can 51% attack Bcash and make a lot of money doing so, comfortable owning it?

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

PROMOTE

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/bitcoin/@michiel/bcash-is-extremely-vulnerable-for-an-51-attack-attacker-will-make-huge-gains

Thanks

Congratulations @brightdavid! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your Board of Honor.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last announcement from @steemitboard!