To buy the dip, or not to buy the dip? That is the question. BTC, and quality crypto in general as well, is sitting on classical buy levels when the longer term trend has proven to be bullish. What do you think? Is the long term trend bullish? Bullish enough to be felt now?

See my previous posts on the past 6 weeks of crypto bullishness, starting with BTC Swing Trade Update, for more complete specifics on how I see the current technicals (and how other contributors and I agree on other important underlying fundamentals too).

Read the "The Dos and Don’ts" here if you're not aware of my rules.

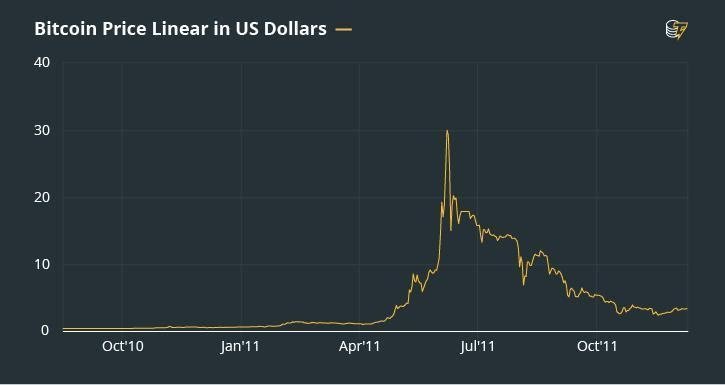

If we have a bigger dip, I never pull the trigger with everything I have. I recently purchased bitcoin at 9.3k. Before I bought it at 14k the same amount. This means my average buy price thanks to buying this dip at 9.3k is now about 11.5k. I plan the same if we get to 7k. This would lower my buy average price even more. As I previously mentioned, I still have this feeling to go lower. However, long therm I can bet all my crypto investment we are going higher 😆. If you compare today’s downtrand with previous, it’s sooo similar almost to the point. My guess is staying between 7-9.5k for few more months before we shoot up, many people will give up. It will be frustrating. But eventually, it will shoot up just like previous seven times. We just have to be patient!

2011

Now

$10,000 is key. We have recently seen a nice leg higher, which could ultimately turn out to be the first leg in a 1-2-3 reversal: http://thepatternsite.com/123tc.html We're in the zone where we get a higher low (point 2). That, of course, would have to be followed by a higher high (constituting point 3). For now it's a waiting game, but with the primary downtrend broken, the possibility of a retest taking us to a higher low that holds is good, in my opinion. In any event, I think that 20k short term is unlikely at this point. All of which brings me to say that I'm in basic agreement with you, but just slightly more bullish and at slightly higher levels perhaps.

I looked at your link with 1-2-3 trend reversal and as a believer of history mostly repeating itself, it perfectly makes sense. If you want to know the future, look at the history. In many cases it eventually plays out with the same outcome. I believe you are right. If we sooner than later break 10k even with this nice gap (even though in crypto there are no gaps, there is 24/7) your words will be the first that pop in my head 😆. I would think “@cryptographic was soo right!” I also noticed Thomas N. Bulkowski‘s stock market prediction and I couldn’t agree more.

Last night there were several alt-coins that triggered swing trade buys. OmiseGo, NEO, LTC to name a few. But there was no post and for the simple reason, Bitcoin -0.32% is the herd leader right now and that buy signal failed. This is where having a broader perspective of market conditions kept us out of potential losing swing trades. My focus is on Bitcoin -0.32% right now and until Bitcoin -0.32% signals I'm staying, neutral, though we may take this opportunity to add to a few coins for the long term, by slowly entering into the market with small positions. If I want to buy $450 of OMG I'm coming in with $150 positions. I use this for an example so those with smaller accounts understand size does not matter the strategy is the same. Bad habits with small accounts lead to really bad habits with big ones!!!

Yeah, market leader, but not exactly the first to signal. Nice risk/money management tip too!

Most people tend to panic at these dips and eventually they sell. Just like the euphoria at the top, they buy instead. Most of us would tell you to buy the dip paradoxically, right? When emotions are involved it’s taugh. Best way to avoid this is to have a plan ahead, buy only what you can loose and set your mind for a long therm even if the price turns against you. Right now, it’s hard to tell where we go from now. The sentiment is sideways. Even moving averages are confused which way to go. It’s really tight. I always say “hope for the best and expect the worst”. My worst case is sideways as of now. Long therm, definitely bullish. The way we are sitting on 50MA makes me nervous, one bad news and we are below. Perhaps that’s what we need, getting rid of weak hands. My portfolio is set as of now. However if I had extra cash on the sideways I would probably wait and see how it plays out.

Unfortunately, it is just like you say it is, and I agree 100%: with speculative investments like crypto, if you're disciplined and only invest what you can lose, then you're much more likely to do well in the long run.

It is always hard to tell what is the lowest possible dip and how high it can go. The best is to invest with spare cash at the low price for BTC that one is comfortable with it and hodl till it rises again. The problem with many new comers is panic selling when they see great drop in price. Patience is the key to getting the profit then.

Yep. Managing emotions is probably the most important aspect of trading and investing!

Red And Grey Zones: Let me start to say, why I think it's unlikely we will go below 6,900 USD. S.P.Y is my main reason - it tells us, if we apply those price movements to BTC -0.32% , that we won't go as low. Also strong support levels before.

Orange Zone: Around 6,9k to 7,6k is definitely likely. The big bear flag could take us down in this area, we have super strong support around 7,2-7k USD, where we have the up trend line and also 78,6 % retrace.

Green Zone: +7,700 USD where we have 61,8 retrace. Minor waves matches this area pretty good. On top of that there could also be some strategic reasons for whales to pump it around 7,7k-7,8k IF a lot of people start to entering short positions.

I think the 61.8 is key. Bullish above, bearish below level.

I have feeling that we might break out of this triangle in the next month and bulls will take the hold.

I have seen that short term wise this market is driven by emotion and sentiments. There is FOMO building up and hopefully it should bubble up by mid June

Market psychology is a key ingredient to keep an eye on. The more I see everyone saying the same thing, the more likely I am to take the contrary position, and most assuredly to double check my own psychology on the matter!

It think I was reading this quote by Mark Twain. I don't remember the exact words but it was something like - If you find yourself at the side if the majority then it is time to re-examine your position. I find it true and applicable in a lot of scenarios.

Sorry, I forgot to thank you before for sharing your analysis - Thanks!

I wouldn’t say for sure that it is the best long term hold, but it is definitely a more stable investment in relative. The outlook for Bitcoin wasn’t that appealing when its scalability issues become apparent during the time when Bitcoin was all over the headline. However, with the introduction of Lightning Network and given the current market dominance of Bitcoin, I think that it is definitely here to stay. The more people joining the cryptocurrency revolution, the more Bitcoin value will appreciate ( given it retains its current dominance ). I am not too sure if it will be the ” best ” long term hold, but I bet it will bring you some decent return in the near future.

I don't think it's one of the best long term holds given the very high quality alternatives that have much greater appreciation potential, but I think you're right in thinking that it will be around for a long time . . . being the bluest of the crypto "blue chips".

Well, the market seems to be taking a pounding as of lately because of all the negative news. Bing joining in the fun by making a decision to ban crypto ads like google and other platforms. While bing might not be as big as google for example, it's still bad news and people are scared. Oh and I thought we will be seeing more greens in the charts, haha.

Anyway, the situation is as always good for investors I believe, because everything is at a lower price. I think by the end of the month we will see Bitcoin cross 10k and have a strong resistence there. We simply have to wait it out as usual!

We'll have to wait and see if this is dumb/scared money selling the bad news or not. With the nice pump we got on Monday that coincided with the weekly open of futures trading suggesting professional buying, my bet is that it could well be the case, but, like I've said, we'll have to wait and see.

Markets behave weirdly over the last few months.

I mean yeah...we had that bull run during January and of course the correction later on,but it lasted very long. Actually it still does.

We use to say “the market” but it is us. People determine prices. And when inexperienced people get involved these are the results. (I exclude forms of manipulation) since we cannot do something about it.

Someone would expect that positive news would come from the annual event. But till now silence...

And if I remember correctly two years in a row there was a bullish run after the event.

So to the question: Everything has to do with what kind of investor you are.In the long term cryptos and especially the big names (here I will include Steem since I believe in it) will show major profits.

Actually I think it is always a good time to buy.

Would it really matter if someone buys BTC at 8k at 10 or 12?Since we all believe that it could eventually end up at 100k?

I'm still one who very much doubts 100k, not to mention some of the more outlandish figures. I put a $5,000 fair value figure on BTC a long time ago, perhaps for the first time even as much as 2 years ago when it was trading in low triple figures. I was obviously conservative with that target, but the truth be said, I still use that as my baseline relative figure based on a 5 trillion dollar crypto cap split among 50 survivors. Of course we can double that if there are only 25 survivors, or even come up with a $20,000 target if there are only 12 main players splitting the pot. The 5 trillion figure could also double, or quadruple, and that would, of course, move long term targets up to $40,000-$80,000. Throw in a little euphoric hysteria, and anything can happen, but, like I said, I'm not so sure.

What I am sure about is that the still largely "undiscovered" quality issues like STEEM and BitShares have much better chances of seeing potential 10x gains, not to mention their very real 100x and 1000x possibilities - because if you do the math, those are real figures if they turn out to be one of the survivors and gain their rightful market share.

50 or even 25 survivors?i think we won't reach that numbers...But i do believe that BTC will end up way more than 100k. Either we like it or not it is the leader and people are still uneducated to do their own research and find undiscovered quality..

As for this

I too believe in Steem and BTS.I only have one concern.Can you imagine this platform with a Steem price 100x?Pretty much everyone in here is gonna be a millionaire...and to be honest I don't see it happening...But a realistic scenario of 20$ per steem is possible.

and actuallly you know what frightens me with BTS?The fact that it has really big supply...

And history showed than a coin with a supply of almost 4bil never reached those highs...

On the other hand if we see 5 tril market cap...everything is possible

Thanks for the response @cryptographic,and i d love to hear your thought

You're spot on my friend

In my opinion the overall cryptocurrency market is still in its infancy and will likely continue to grow for the foreseeable future. For many of these coins, their lower price does represent a great buying opportunity. While many of the mainstream media outlets would have you believe that cryptocurrency markets are crashing, they remain at all-time highs from just 120 days ago. In the past, various similar corrections have taken place and some even worse than the one we just witnessed. In my biased opinion, I believe that the entire sector has a lot more growth ahead of it.

It's a repeating pattern, and it's bullish!

. . . until it isn't, but I think that's a long ways away. 😁

So I'm going to just patiently sit back and wait for this swing trade to come to me. We will most likely break 8200 soon which means 8k won't hold and we will test and probably break 7800-7200. Once we get back to the former low we will break that too and once that breaks... BTC -0.39% is falling into a sinkhole as there is no support for another $1000 till possibly the high 5k range. If that doesn't hold then 3k is the next real support. 6k-3k is my Swing Trade target where I will be scaling in buys, anything below 3600 I'm just going to buy like no tomorrow and dollar cost average.

The price could not break 10000.00 resistance level and we saw a downward movement to a possible support zone . It can give us new reversal signals with further upward wave. This support zone is formed by 0.50 and 0.618 Fib levels and it also includes 8000.00 support level and SMA50 from the daily time frame. We can consider this zone as a strong one and we should expect for a price reversal with further upward movement to 9000.00 and 10000.00 resistance levels. The bullish divergence gives a trend reversal signal. If the price bounces from the support zone and breaks the downtrend line, we'll get the trend reversal confirmation. It will give us a new buy opportunity as well. If the price drops below the support zone , the uptrend line we'll be another place providing possible reversal signals and buy opportunities.

Sir @cryptographic,

you have presented blog post in a community about a great way of marketing about trading and you can do a great deal of analysis. I think you are important for the community in the community and you are an outstanding analyzer.

Nice description of the key levels and what to watch for on the intraday timeframe. You've got some ambitious targets. Those would be some fantastic buys if we were to see those levels.

There has been a lot of bad news concerning cryptocurrency in the past few months and hence the markets are taking a big hit.

I hope some good news comes our way quickly because things haven't been looking so great for the past few months and inexperience of investors is costing us.

I don't see any exponential increase in the near future but I believe the price will shoot much higher at by the end of year.

So buying right now doesn't seem all that bad, if you're in it for the long term you'll definitely make profits (huge profits).

I think you're very correct in your analysis regarding long term investors. Like you said, anything parabolic from where we are at present is very unlikely - perhaps just as unlikely as a major crash from current levels - but, if you're adequately diversified and patient, it should be fairly difficult to lose long term if you're buying now.

Exactly.

The best thing IMO right now would be to Hodl and not give in to the FUD..

Just believe in Bitcoin, it's not called the king for nothing

I too hope for the same @rjunaid12

Nice perspective, and nice volume pop on the last rally off what could be a secondary low.

Cannot really answer your question as I have just continued to hold Bitcoin for the long term despite price movement. While I continue to be bullish on it, I feel that better returns can be deployed in other related assets as well. So I continue to diversify into other assets but follow Bitcoin as well. However, I cannot rule out buying more if prices become too good to be true.

To buy the dips one would do either one or more of the following:

Buy incrementally as the price goes down, creating an average position and aiming to buy more as the price decreases further.

Wait until the price settles, and perhaps even shows signs of recovering, and buy at that point.

Set buy orders at lower prices than the current price and let them fill. Setting buys just before historic support levels, large “buy walls,” and psychological levels is an especially good strategy (as prices tend to do at least a quick bounce off these levels).

One can “buy the dips” to sell quickly for a profit, to build a long term position, or to incrementally take gains.In all cases, the concept is the same, aiming to buy low and not high.

I think we're seeing signs of recovery and that we've currently got some fairly optimal conditions to pair up with the sound risk management you mention.

The closest thing to an ideal target price for buying Bitcoin is the dip (BTFD). The number of times we regret buying dips totals zero. If you don’t trust yourself to buy the dips, commit to a scheduled purchasing plan. Bitcoin is nothing if not volatile and largely unpredictable which is why most people know better than to try to time the market by trying to guess when the price has reached a top or bottom. Playing the price to find an ideal entry point burns more people than it benefits. And i, therefore, offer no opinions on when to buy (even during a dip). But a bad time to buy is generally not in a downward price trend. And holding Bitcoin long-term is the best compliment to a buy-the-dip strategy.

When the price is low, people hesitate to buy it, because they also expect the price for more dip or they fear to buy it. When the price is high they again assume it will rise and rise. Wise investment strategy and proper knowledge of it will definitely help to gain the decent amount of profits.

A winning strategy for a bull market but what about STFR!

I have to say I was a little perplexed if not outright confused when I heard the term BTFD the first time coming from a long stint with Forex trading, where we follow the paradigm of “Buy Low & Sell High”. So basically as most of you know in Stock market you are either a Bull or a Bear depending on which side of the trade you prefer. Bulls love the when the market is going up & Bears like to short sell.

For 9 long years we had a nice bullish on US equities market where it was really profitable to buy every dip in the market & keep progressing. Being a technical trader I know that market works in cycles & nothing stays forever. I would wait for a technical pattern to emerge before jumping in the trade — that means getting a confirmation from the technical indicators. Everybody knew that this longest bull run had gone too far,, it was over stretched etc. etc. but the bulls just didn’t want to cave in. After such a long stint of bull market I don’t really blame the traders who were just Buying the f***g dip (#BTFD)!

Know more about that https://medium.com/@tradealike/btfd-a-winning-strategy-for-a-bull-market-but-what-about-stfr-36c3e3db9d16

Hello @cryptographic,

BTC bounce in between $8,000 - $10,000 sense like a deep ocean before a huge storm. It's still unknown the new peak. But BTC is looking for a new peak around $50,000+

Incredible discussion & valuable for all crypto players of Steemit.

~@mywhale

the alpha of crypto world never go bearish for long time. therefore, buy at dip & ready to see it at the moon. impressive chart analysis @cryptographic

reteemed & upvoted@resteemia

Thanks for the post mate, always interesting to look at the graphs despite not being in the finance field. I'm slowly slowly accruing during these side way movements, and having some more significant amount fiat parked. Waiting for the next drop!

If it goes up, well I've got enough invested anyway. Win win eh? haha

Also of note- there's a picture going around with STEEM being rated #2 by the China's Ministry of Industry and IT. Bullish!

BTS and ADA on that list too!

This whole move up just feels a little forced, without any true demand. As we've seen how fast BTC collapsed from $9200 to $8200. It doesnt even bounce. No one bothered to buy the dip.

I was watching the charts yesterday at $8300, it was largely driven only by bitstamp.

Yeah, I'm really focusing more on the big picture and the influence it has on the short to intermediate term. The most recent very short term sell-off could be the last of the more intermediate term selling that gives way to longer term upside pressure.

I am just asking, is there is a way or a pattern to use these BTC trend to predict market prices of ALTs like STEEM, BTS, EOS, SYS, ADA and etc?

If that works I think (My crazy idea) it's better to stay with those currencies due to the dominance of BTC is dropping drastically! That means one or more ALT coins might take that place!

So, one or more from our best bets (best cryptos) can be there! If there is a pattern that we could understand by using BTC, then I think we can make more Return of Investment (RIO) from these coins!@cryptographic,

Cheers~

Even though all of the top cryptocurrencies are still in the red as of now, it seems the momentum is slowly turning in direction of those coins once more. Don't be incorrect in considering there shall be any predominant upward momentum for all of those coins within the coming hours, although. Right now, the Bitcoin cost is recovering and accomplishing $8,500 again is the first order of business now.

In the interim, we can have to wait and notice how the Bitcoin price evolves in the coming hours. Given the bearish stress on the cryptocurrency industry in the course of most of 2018, it's evident things don't seem all that excellent right now. Alternatively, the rebound will start any day now, and when it happens, it is evident the Bitcoin rate- along with most different cryptocurrencies will see some stable momentum.

I agree the rebound is gonna start any day but we shouldn't expect any predominant increase

it has been predicted that this is the only fall for BTC, if anyone wants to invest or buy BTC they should do it now coz from now on it will only rise for the rest, it will cross the barrier of 20,000 by the end of this year...

I think it is perfect time to but the dip,it is following the resistance for long now , i see this the golden opportunity to get enlisted....

I believe the predictions of future bitcoin touching 20K ....

I think bull's header is more deadly than bear scratch. That's why I choose Bull :)

Personally HOLD is still too cute to anticipate bad things. Because several times I do trading make me lose :)

I think the bull will run fast this year ...

Thank you always for helping friends with your amazing charts, sir! I keep following your graph every time you post. Regards!🙏

Now I am not saying BTC will never go back up, but buy the dip implies that the dip is temporary, it could be, but it isn’t certain as there are so many different factors at play. I counted 20 significant dips before it hit bottom. That is 20 times you can buy the dip and create 20 new losing positions. All coins will at some point experience dips, corrections, and a damn long extended bear run. Do not blindly buy the dip. Buy the correction. If you believe in BTC, then this is where to buy, in the correction, in the $7500 zone & it is ready for another price wave.

It is difficult to tell how deep it can be. My recomendation is that anyone who is thinking of investing, this is the right time to do so, but investment should be done with discretion. Patience is truly a virtue in this crypto market

It has something bullish, although BTC is low and has not given a very considerable rise, but has the price to buy and start holding, after all is the safest crypto.

according to the information one-sided, it may be more appropriate to buy at current prices because some coins have a very high decline.

mining and waiting for the right time to resell.

a very nice post @ cryptographic, in my opinion, BTC will be increasing for the future, because I've read from some other sites. And BTC will not be bullish, although now BTC prices are still low, but if I have the money, I will definitely buy BTC for me save, because I am sure that BTC will rise again, if have a lot of capital, surely we will get big profit. What do you think? Is this a good idea, if we buy BTC. thank you...

Thnxxx sir.😃I dnt think so sir @cryptoeagle.. can u tell me the answer of this question?? im in great confusion.

It's fun to enjoy your analysis Sir! I'm still holding on to the long run with the hope of repeating success last year.

Bitcoin is unstoppable, it is the decentralized engine, though transactions are public. But untraceable currencies such as Monero are poised to capture a decent part of the market share. Stay thirsty my friends.

cryptocurriencies are the future, thank goodness we are part of this..

Solutions to problems are like sunshine. really good one!!!!

I think after reading from some sources, bitcoin will keep moving, crawling toward the top, up to now bitcoin still holds high trust from its users ..

I hope it will go super bullish. But In reality it may go bullish for a little. It will go up and down within 10k for a long time. Cause some political reason I think.

It is always hard to tell what is the lowest possible dip and how high it can go. The best is to invest with spare cash at the low price for BTC that one is comfortable with it and hodl till it rises again. The problem with many new comers is panic selling when they see great drop in price. Patience is the key to getting the profit then.

it is likely that the past few days’ price appreciation is but short coverings. Noticing that there is a clear failure to march past $9000 since volumes are low and half below March 11 bear spike. I recommend shorts in lower time frames with targets at $6800 in the short term.

(Weekly)

If i have to simplify, then i would say btc is moving within a 6000 range defined by february 18 high and low. Now, after periods of consolidation between those two highs, what stands out for me is the week ending february 4 candle which asserts the bear trend and week ending april 1 stick confirming this assertion.

So,with this in mind and the fact that the general trend is bearish, selling on resistances or retests would be better to aligning trades with the trend.from this technical development, our first level of support is at 7800. any break below that means our 6000 target is likely to be hit. T

this would be case especially if there are high volumes accompanying a consolidation bear break out.

I would be very careful with shorting crypto, and especially BTC.

I would be even more careful recommending it to others without proper disclaimers and accompanying explanations about how dangerous shorting is to begin with.

From a strictly TA standpoint, I agree that 7800 is good support, and shorting at current levels looking for that as a target is like trying to pick up dimes in front of a steamroller. I certainly wouldn't say that a break of that means 6000 is likely either. I'd see a bear trap as being more likely if that were to happen. But that's what makes a market.

By the way, you got your charts mixed up (you can still edit your posts to fix that).

Cheers

And as for your Reply- First, it is just my own hunch about the market. So, I am not recommending to anyone to follow. I shared, just the possibilities. Nothing else. When, i looked at the chart, and was going through the previous data, I came up with this. because, without any question, everyone or atleast most of the trader will recommend for long move. But, market is also place of uncertaintities. So, people also have to consider this too. I have found several positive indication of the long, but i did not share them with you guys,because most of the comments are suggesting go for long. So, i just put the other alternatives on the table, for just in case, be careful.

Sorry, again for the messing up or if i could not clear my point of view. I corrected my wrong. It's always been pleasure to argue or have conversation about these, with someone likes you. It also clear my concepts too. Thanks, have a good day.@cryptographic, Sorry for mixed up. i added the charts later. So, messed up when selecting them. I did not check after that.

(daily)

like the weekly chart,btc prices are still trading inside a range but with a bearish skew.those lower lows and most importantly the reaction from 6000.that is important my attention is May 11 candle.trade volumes are high relative to previous days and there is a mid-range push below 10000-a region of minor support. follow through bull candlesticks have been short on volumes. On may15 we saw relatively high volumes confirming the bear pin bar at $9000.

aggressive traders can short now while aiming for 7800 and $6600.on the other hand conservatives can stay out of this trade and watch till prices are out of this consolidation.

I am putting both long term view on the table, it is up to you to decide.

there is now a dip within a dip too much confusion when to buy or when not too

The chart suggests that the price may slowly move higher towards $19.00. Once there is a proper close above the 100 hourly SMA, the price may accelerate gains towards the last swing high of $19.87. Above this, the next major hurdle for buyers is near $20.00.

Hourly MACD – The MACD for ETC/USD is slowly moving in the bullish zone.

Hourly RSI – The RSI for ETC/USD is currently place nicely above the 50 level.

Major Support Level – $17.00

Major Resistance Level – $18.40

Sign of huge Bull Trend... Sir everything set very well... My problem is when??? I still don't know the which one can be the correct dip...

Sir as a student of yours, I won't join BitCoin bull trend... You gave me more options & I'll stay with them Sir... Thank you...@cryptographic - Sir big whales of crypto market place are really cunning... Today red market is telling me a

+W+

That's a very difficult question. Shakespeare himself would have envied this question. It is much more urgent than to be or not to be. The more I spend time in the world of crypto currency, the more I'm convinced that the logic in it is no more than a blonde. Good luck to you and Love.

Majority of people love to buy crypto at dip time, but it's really difficult to percieve it's the biggest dip. New people remain reluctant to buy at high price as they don't familiar with the market so they have no idea how the market behave. how high it will go? If they buy during bullish trend. They easily get frustrated due to slight dip in crypto values. We believe the value of crypto will rise high but it's difficult to understand your heart and mind when you have invest high amount of fiat in crypto. In my 2 cent opinion greater the risk taker greater the winner @cryptographic

Fascinating how many Bitcoin traders want to "Buy the Dip".. not an optimal strategy on most timeframes