BTC has well consolidated into the second phase of it's bear season by continuing the sell off this week. There's been virtually no signs of bulls and prices just kept crashing and crashing. In this post I will attempt to give a view on a short term time frame to play out in the next week or two, then I will consider options for longer time frames.

In my last post on BTC I was analysing the direction of price action and the anticipated levels of support: https://steemit.com/cryptocurrency/@digitalisbetter/the-big-reveal. As it turned out BTC had hit those levels dead on and as we speak, we sit on the $3,700 support region (55 Monthly EMA yellow line).

Shorter Time Frame

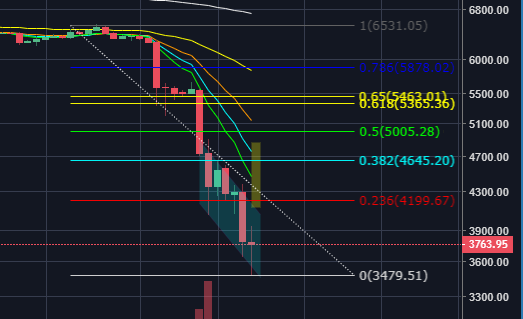

From shorter time frame perspective, 1 to 4 weeks, I think we're due for a rally. We're sitting on significant level of support that will need a few re-tests before being broken. Equally, we show signs of exhaustion on momentum indicators. Daily RSI has been oversold for nearly two weeks now and at its lowest it hit value around 9, which is the lowest historic daily RSI level recorded for BTC.

The daily histogram on MACD has levelled out and we can expect it to reverse at any point now.

When zoomed in to 4hr we can see strong signs of bullish divergence, with 3 peak forming now.

Price actions has formed a descending channel, which is also a bullish formation.

All these signs are pointing at an upcoming rally, so let's consider what levels can be considered as targets.

The target from price action pattern falls around $4,800.

If you overlay it on top of fibonacci extension tool, you can see that it aligns well to 0.382 fib level. Taking both factors into consideration, i think that a retracement to $4,800 level is a very conservative projection and can has high probability of playing out.

I think that there is a possibility that we will see a test of previous support around the $6,000k level, but it is difficult to say without seeing the price action behaviour over the next few weeks.

Longer Time Frame

From the longer time frame perspective, one thing that got my attention is how strong and decisive the move to the downside was. There was virtually no moves to the upside with just continuous sell off. What this makes me think is that

we're probably more bearish then we were hoping to. The force of this move implies even more downside to come, which as I have indicated in my previous post, will mean breaking of weekly and monthly supports. This is a very bleak picture for BTC.

I'm not an expert, but from what my technical knowledge tells me is that if we won't hold the level we're at now, then the next level of support that we can count on starts at $1,200.

Upvote if you like this post!

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice. I do not take any responsibility for how you choose to apply this information.![]

Congratulations @digitalisbetter! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!