Bear Trend

In my previous post, I was analysing the cryptocurrency market in terms of the media's influence over the people investing. To summarise in a few words :

There is an unprecedented correlation between media's exposure and Bitcoin's price.

This is not news to most people investing, but it raises questions about the current state of the market. Since Bitcoin reached 20K all we have been seeing is bad news. People coming into the market trying to make "a quick buck" have been scared off. Bitcoin's price found support two days ago around the 8K price mark, only to be moved to a lower low of 7,8K. This downwards tend is leading me to believe that we are in a bearish market. Heading to lower and lower price points until we find possible support around 5K.

A bear market is when the price of an investment falls over time. As investors anticipate losses in a bear market and selling continues, pessimism only grows.

Parabolic Trend

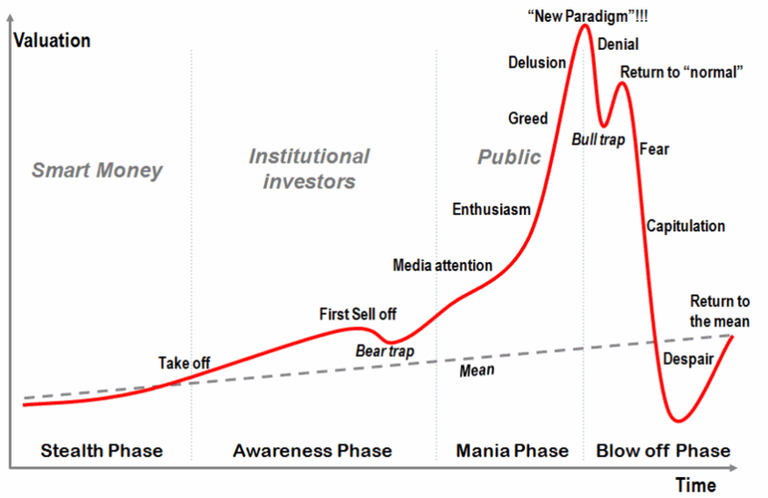

The red line represents the price while the grey dashed line represents the mean value of a given asset. We are currently facing the Blow Off phase where more and more people will be selling trying to save themselves from massive looses. The next couple of months will be detrimental to the cryptocurrency market as the selling continues. The bearish trend is necessary in order for Bitcoin to grow over time and reach new All Time Highs (ATH). One thing is for sure...It will be scary. For me, you and everybody else.

Conclusion

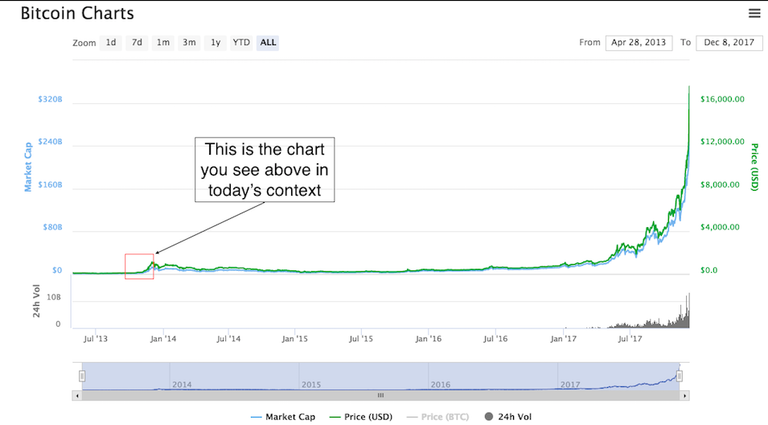

History tends to repeat itself. Looking at bitcoin's chart from the 2013 perspective. Bitcoin's price plummets to $70 after hitting a new ATH for the period of $145. There was fear back then when the market was on a bearish pattern...I suppose you would love to have bought Bitcoin at the $145 mark, wouldn't you? Think about the future of bitcoin. I think it will do to finance what the internet did to communication. I will leave you to decide for yourself.

Let me know what you think in the comments down below!