The cryptocurrency markets have been crazy to say the least. In late November BTC made first contact with the $10,000 USD price. December 1st was the true beginning of the BTC bull market madness with out a doubt and the bull run continued until December 17th hitting a few hundred shy the $20,000 resistance level and a five day correction down to the $11,000 dollar level. In the last couple weeks we have seen a sideways BTC market that is nothing to phone home about. So now lets just talk about where the BTC price is.

Now, as we can see from the above chart BTC is at a short-midterm support level, but on top of that it has just broken past a major trendline(which might be kind of hard to see, but i did draw it.), and it is also below the 9-day moving average on the daily chart.(Which means BTC could correct further down to $8000-$10000. With that being said I think there will be a relatively quick rebound back to these prices we have gotten used to in the past few weeks and we will see these prices as the new true support levels. We might see something like this...

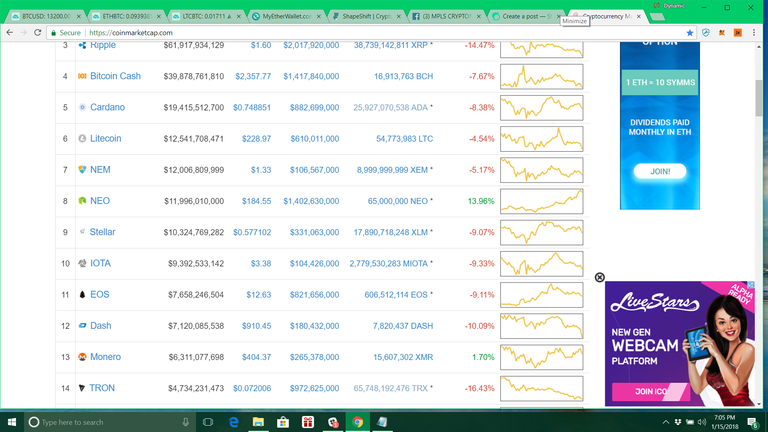

But, we are talking about BTC after all so we could be at the support level and BTC will continue it's bull run. No matter what happens I just want to make sure my cryptocurrency portfolio is well balanced. While BTC has been losing steam(no pun) I have been repositioning my portfolio. We have been seeing a new wave of cryptocurrency adopters and with that an increase of interest into new cryptocurrencies many of us probably never heard of or care about for that matter. But, because we like to make money and know the power of psychology and the power of the bandwagon we take a look at those anyway.

I don't like FOMO so I had to look into some of these altcoins. I did some research on some of them and bought into some of them such as...

(TRX) Tron

https://tron.network/en.html

(XLM) Stellar

https://www.stellar.org/

(EOS) EOS

https://eos.io/

One thing I've learned in the last few weeks is that even someone experienced in the cryptomarkets could fall victim to over speculation and excessive optimism. When new people get into cryptocurrencies they will generally pay more attention to the newer projects because of the cheap prices. What they soon find out and what we are all reminded of is the fact that these newer projects have yet to prove themselves and although they are cheaper than the legacy altcoins such as (ETH), (LTC), (DASH), and (XMR) they are more risky. Sure, you can make quick gains with many of the newer alts but you can lose those gains just as quickly and who knows when they will return. With that being said I will be holding many of the newer alts for the long term gains, if any. Obviously I do not need the funds right away or I would not be investing especially in newer risky projects. Also, it's questionable to participate in some when they are trying to solve a problem that another legacy altcoin solves. With Verge(XVG) and Monero(XMR) as a comparison... why would I need Verge when I have Monero? Just a thought.

With all that being said I have fully re-positioned my portfolio as I'm quite excited about the ETH chart. If you pay attention to the rectangles the current ETH price is at a historic point of support, it is resting at 50% fibonacci retracement levels, while also staying above the moving average. So I went ahead and transfer a good chunk of BTC for ETH and I'm excited to see if my theory is correct.

What do you guys think? Let me know in the comments below if you would like me to do more thorough technical analysis for trading ideas and portfolio management. Keep in mind, I am not and investment advisor and am not qualified to give investment advice, all I have are educated guesses and continuous learning. Happy trading!

You stopped following me too? What in the world happened to you? I got you back into steemit, and now you act like nothing happened 3 months ago. Money changed you man.