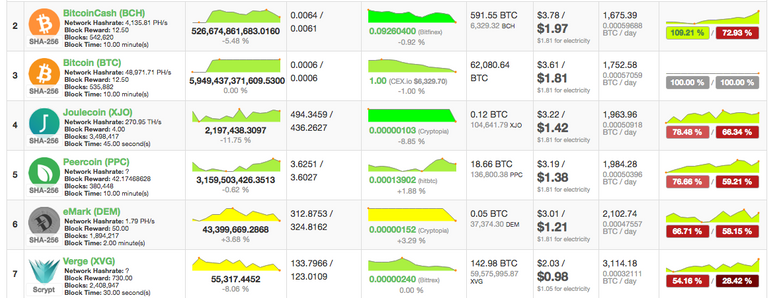

I took this photo off of coinwarz.com which does a good job of showing mining profitability. As you can see, right now, mining is not very profitable at all. BUT... Mining profitability can give us some insight into where the bottom is.

Technical analysis ignores the fact that this market is not just based on buyers and sellers. The miners are the ones that are introducing all of the new coins into the market. In fact, miners may be the key sellers at this point. Who would sell right now when everything is looking like it is close to bottoming out? Miners.

Miners have bills to pay and need to sell coins to pay the bills. The column close to the right shows the cost and profit of running a machine. Look at BTC. It costs $1.81 / day electricity and an s9 would mine around $3.61 of BTC, leaving about $1.81 profit. In order to run the machines and pay for the electricity, a miner should be selling off half of what they mine at the moment. Not, ideal, but, you are making some BTC. Not too shabby.

How much lower does BTC need to go before miners are making nothing? Let's calculate!

48,971 Petahash = 48,971,000 TH / 14 Th (per s9) = 3.497 million s9's. These are rough numbers. If all miners are running 14TH s9's, there are around 3.5 million s9's online mining BTC at the moment.

At $6329 / BTC. 12.5 are released every 10 minutes. ---> 1800 BTC / day are mined. $11.4 million.

At 11.4 million - that leaves each s9 mining about $3.25 / day. The $1.81 is a static price. so... at the current price, mining profitability looks more like $1.44 to me.

Let's move a bit further. $1.81 times 3.497 million =$6.329 million / 1800 = $3516

$3516 is the terminal point for BTC (if all of the miners stay mining BTC, there are more factors that I won't get into at this point). At $3516, all 3.5 million s9's mining BTC will be mining for the cost of power and no more. Some miners will be fine with that as they are buying cheap BTC, but those miners will not be selling at that price. Any miner selling coins to finance their operation will not be selling at this point. They will either shut off their machines or hold the coins.

Holding the coins would add upward pressure to the market. Shutting off the machines would make the terminal price go down, thus driving the price further down. These things I cannot predict. What I can say somewhat confidently is that BTC will have a very tough time getting below $3500. That is an absolute bottom support. If it tests that line too many times, all bets are off... but that is the lowest I could see it going.

I think it won't come near there... but I figured I would put the miners perspective into the mix to help you gauge the situation.

Cool! I will see what I can come up with in the following days on this topic. Thanks for reading!