Despite my statements from the last post, I recently decided to take more profits.

Transactions below:

The end

It’s been a great couple of years, but everything must eventually come to an end. Because I already sold over half of my portfolio, I decided that tracking it doesn't make much more sense at this point, as I am not going to re-enter the market with already realized profits anytime soon. That’s why I consider this portfolio closed. Over time, it became more and more apparent to me that I do not feel comfortable holding almost my entire net worth in crypto. That said, I decided to relocate most of my crypto assets into a long-term stock portfolio.

I’d like to summarize the performance and reflect on the most important moments of this portfolio.

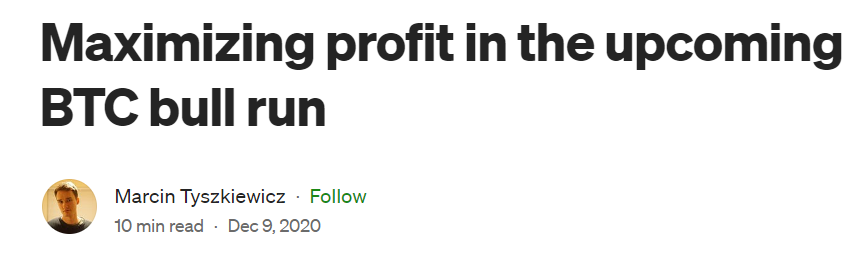

Going back to my first post and initial strategy, I have to say that I actually didn’t follow it at all. From today’s perspective, my initial plan and market analysis was pretty much.. childish. Going back to the post from Dec 2020, it strikes me how little did I know about the crypto market compared to now.

Going back to my first post and initial strategy, I have to say that I actually didn’t follow it at all. From today’s perspective, my initial plan and market analysis was pretty much.. childish. Going back to the post from Dec 2020, it strikes me how little did I know about the crypto market compared to now.

This journey started as an EOS maxi, with the majority of my wealth in a single altcoin. Today, I’m extremely happy about abandoning this shitcoin in time. In fact, EOS price today is around 70% lower than over 3 years ago, which is absolutely insane, and it’s a great proof that you should be open to changing your strategy and opinion on the go. Do not ever feel emotionally attached to your investments. Don’t ever join communities related to your investments, as you will most likely end up in a bubble of positive information and narratives.

Over the course of 2021, I also held a significant position in HT (Huobi Token), which I luckily also cashed for BTC on very decent HT/BTC profits.

Today, HT is also another dead shitcoin. Funny enough, at some point I also held the majority of my portfolio on FTX exchange. Luckily, when it came down I had only about $600 in BTC there.

Today, HT is also another dead shitcoin. Funny enough, at some point I also held the majority of my portfolio on FTX exchange. Luckily, when it came down I had only about $600 in BTC there.

Most importantly, I completely failed to take profits in 2021… kind of. I actually sold the very top of the last bull market, but I fully re-entered shortly after. I also re-entered fully into ETH, which underperformed compared to BTC at the time.

I definitely wasn’t experienced enough in interpreting on-chain data. I pretty much relied on “on-chain Twitter influencers” such as WIlly Woo, who sound very smart, but in fact turned out to be a bunch of complete retards. Today, I am very confident in my ability to read on-chain data, and I think that I managed to prove in the last 2 years.

When I re-entered the market, I did it by going all-in ETH and buying Ethereum node (32 ETH), worth $120k. I initially planned to hold it for another 9 years. But as I said before, I later realized that I do not feel comfortable holding 90% of my wealth in crypto, and this is not a good idea. Still, I am happy to look back at this in 7 years to see if it would have played out :)

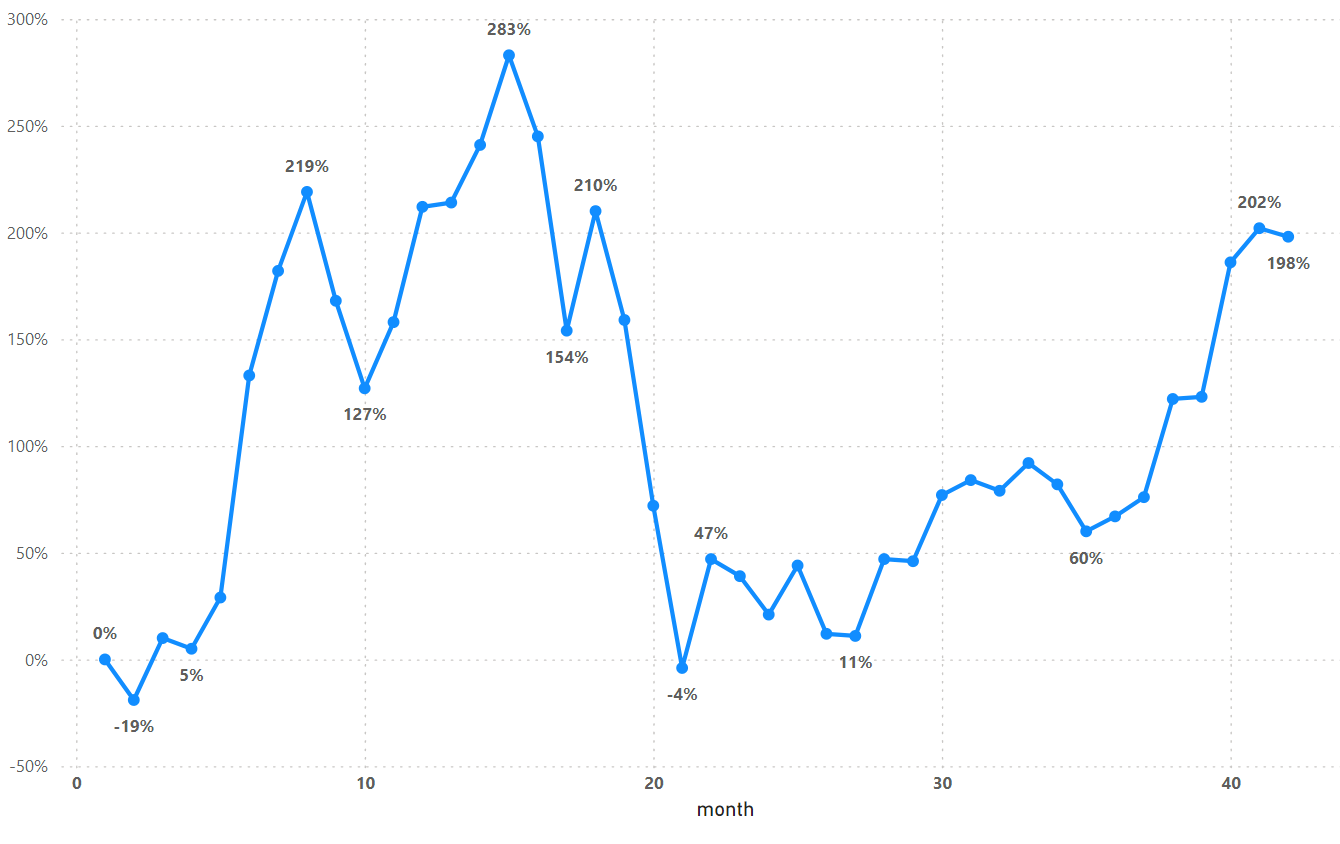

In the 22nd month, I pretty much started from 0, as my portfolio dropped to levels from the starting point. That was a really sad realization that I pretty much wasted almost 2 years and missed out on great profits. At the same time however, I felt more bullish than ever, and I knew that another bull run was just a matter of time. I also entered some smaller positions outside of this portfolio and made some extra short term gains.

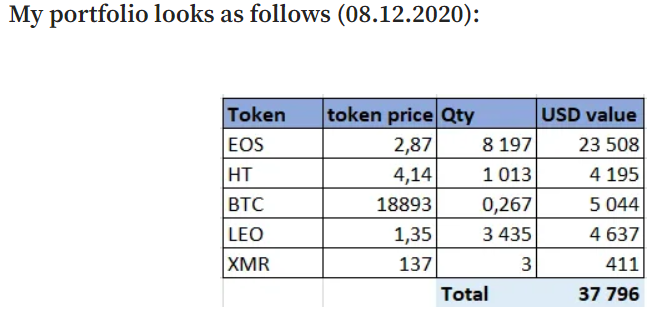

What I’m the most proud of is probably last year, as my market predictions were close to perfect.

Market right now

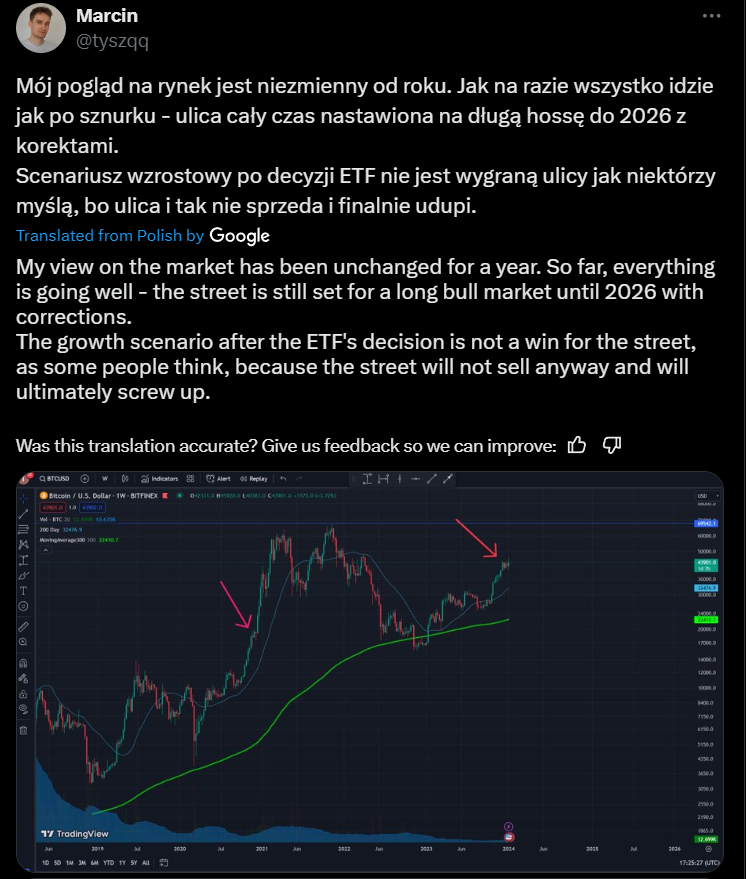

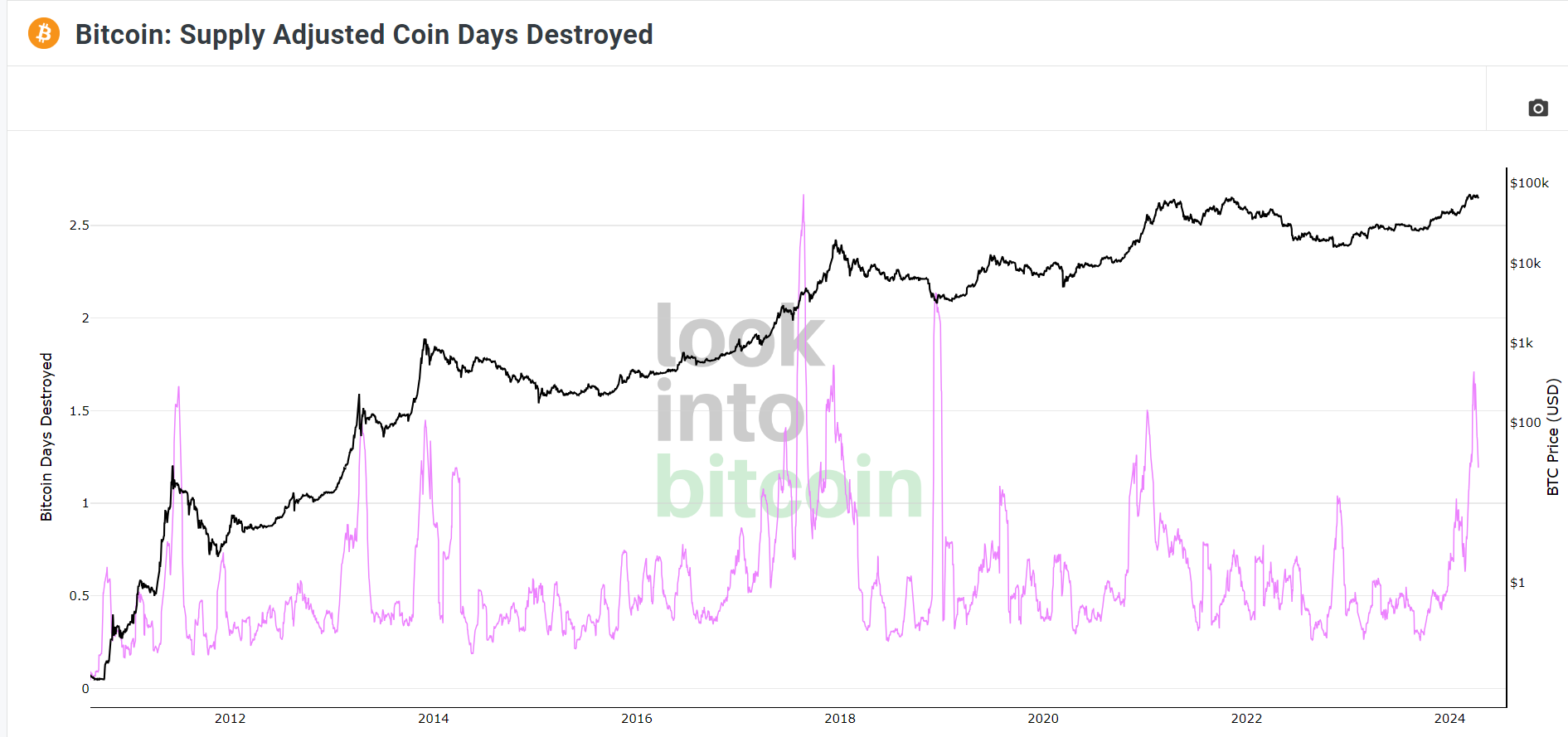

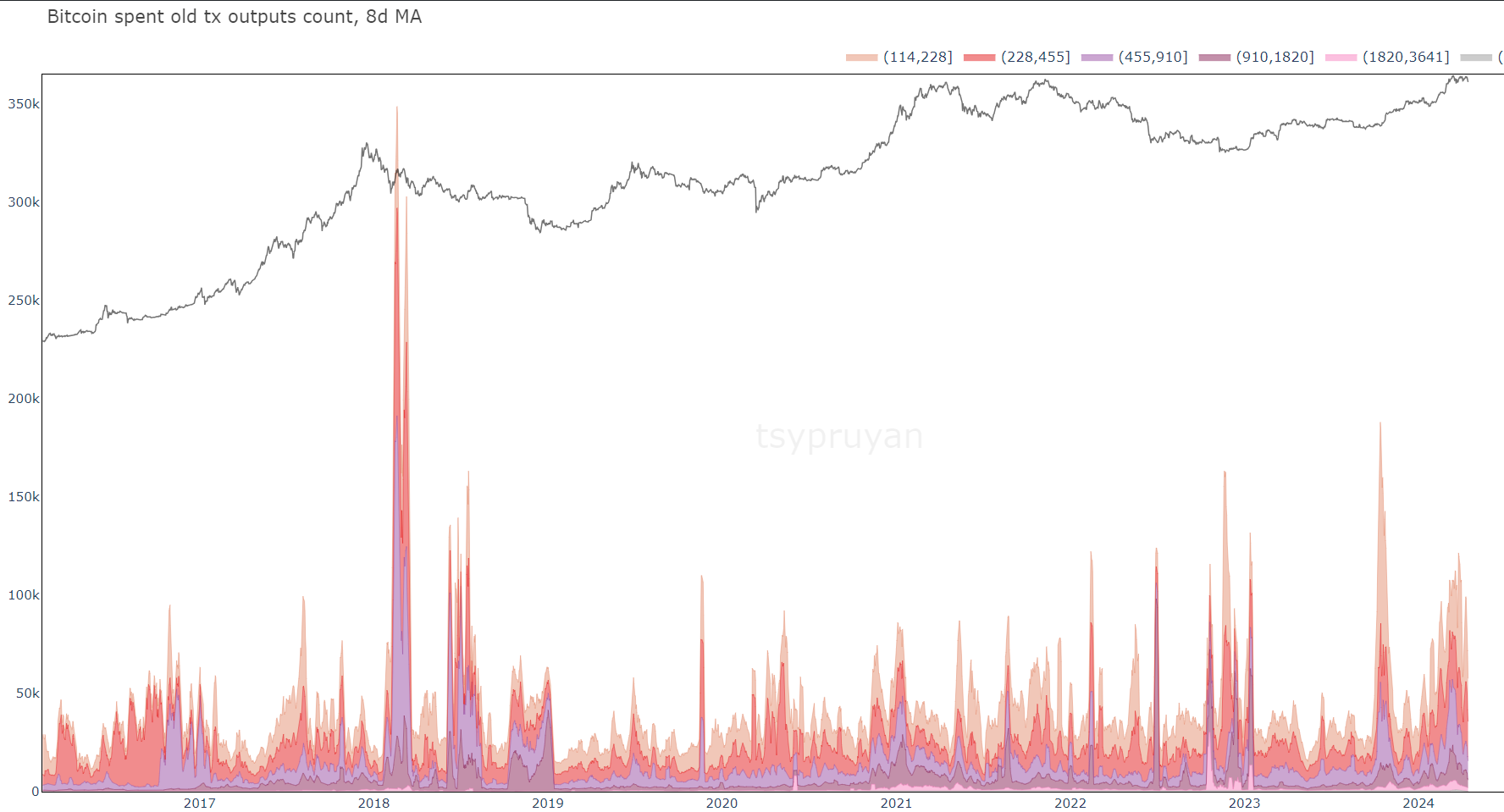

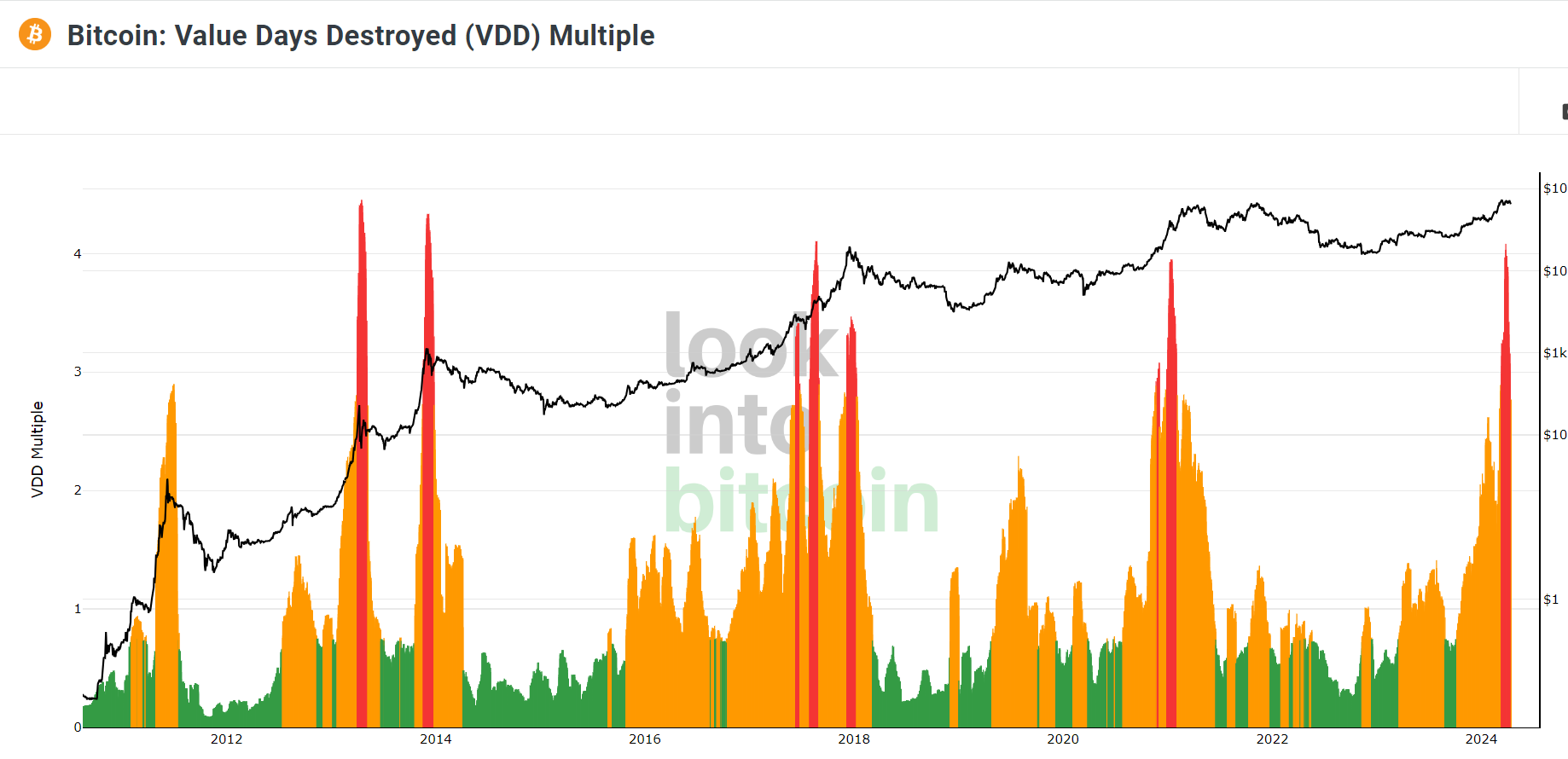

Today, the market is starting to become really overheated. We can clearly see highest profit taking from longterm holders since 2017, and on-chain indicators hitting levels last seen on 2021 top.

This is clearly the final stage of the bull market. Of course, the final stage of the bull market can also last for a long time, and no one knows where the top is. We may have already hit the top, as well as it could be 2x or 3x from here. One of the things that the last 7 years in crypto taught me, is that you shouldn’t try to hit the bulls eye, but rather look at pre-top distribution and sell along with longterm holders. The signs of the final bull market stage are easily recognizable. Some of retail falsely believes that they should wait for some exact levels of on-chain indicators before selling. “Oh, I’m not selling anything before MVRV hits 6.” - ok then, you will most likely never sell.

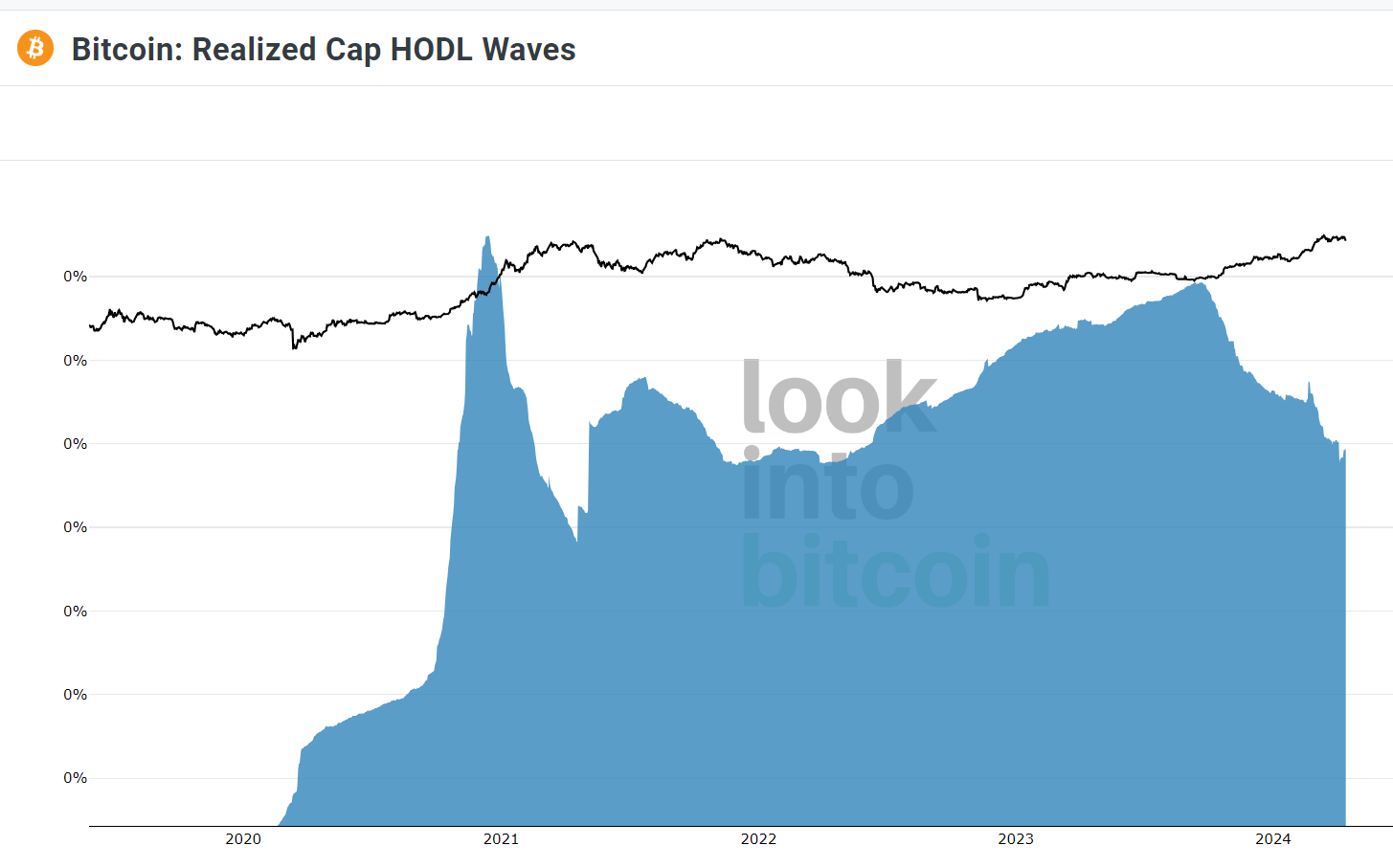

Longterm holders dumping like crazy

And lastly, dropping longterm supply in profit along with rising price, which held true for every final bull market rally in Bitcoin history.

Market sentiment

Another thing that you should also look at is market sentiment, which is not that easy to quantify. I spend a lot of time on X and Reddit, which helps me to understand general strategy of retail and their sentiment. I elaborated on this a lot in my previous posts - 90% of retail expected continuation of the bull market into Q4 2025, so this is just not gonna happen. Retail always loses. This makes me very confident that we will see the top much sooner than everyone expects. The high level of greed is there as well - lots of retail is considering taking ANY profits only past $100k per BTC.

Another thing is that retail time-target for the top has most recently shortened. From what I am seeing, lots of retail now expects the top at the end of 2024.

In fact, lots of retail even fails to acknowledge that we are already 16 months into a bull market, which to me is quite funny. I keep reading posts of people that are “preparing for the next bull market”, like this one has not even started yet.

“Be fearful when others are greedy”

Google Trends are also showing very high retail interest. The key phrase that I was always looking at is “crypto exchange”, which clearly shows an inflow of new investors that are looking for a place to buy crypto. No existing crypto-user would search for it. Again, retail completely fails to recognize that there is actually a huge further retail inflow happening right now. Also, existing retail fails to acknowledge that they are retail, lol.

That all said, I believe that the top is relatively near, and it’s a great time to be taking profits.

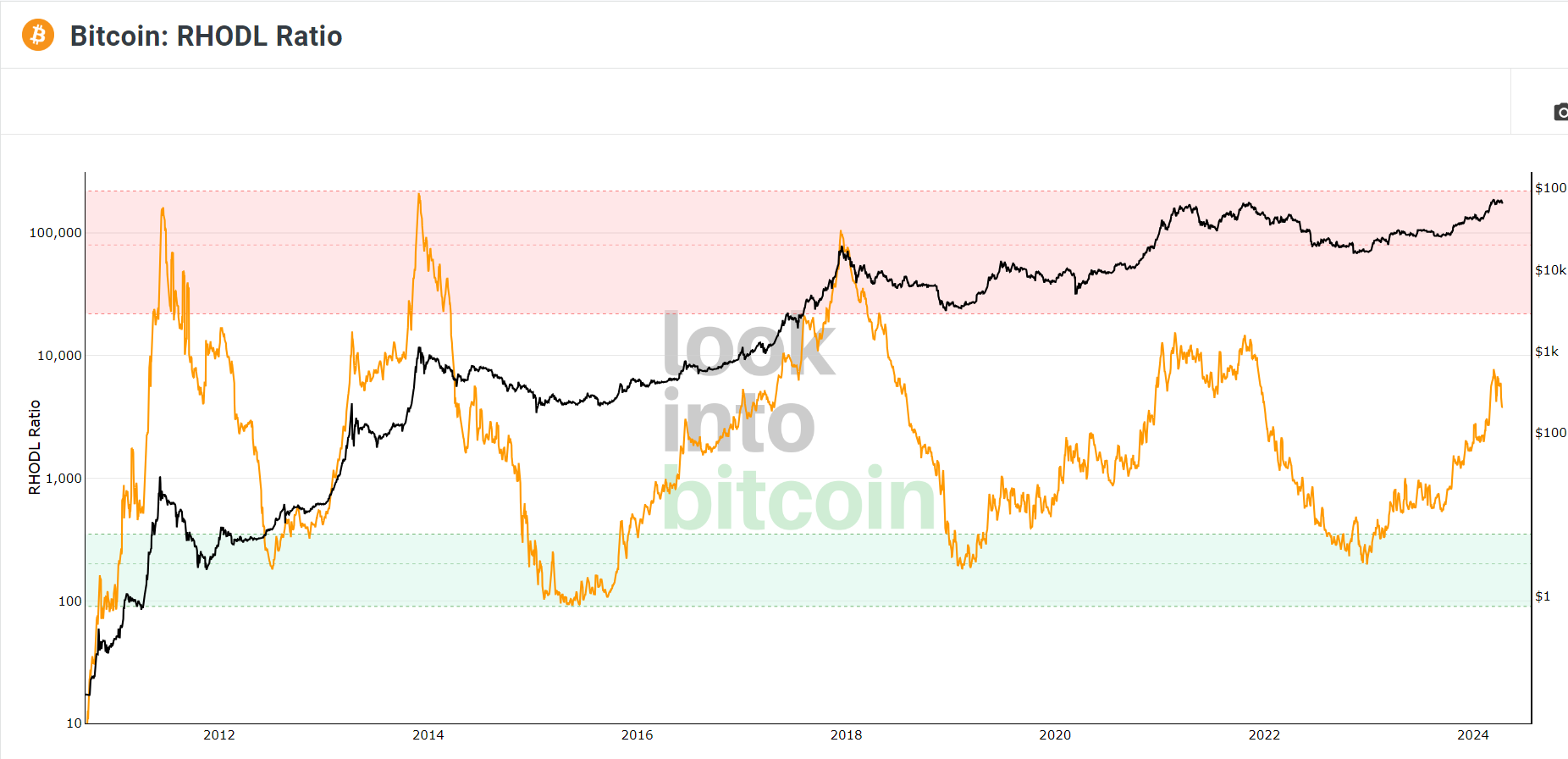

ETF's

Of course, we are still seeing tremendous institutional inflow that may lead to much higher prices. But in the end, it’s really just another narrative for retail to convince themselves that the bull market will last much longer, and “this time is different”. We’ve seen very similar narratives in the last 2 cycles, and I am not falling for it. It’s longterm Bitcoin holders (which I do not consider retail) dumping on them, and I believe that longterm BTC holders will be the biggest winners, as they always are.

There is a false belief of retail that those institutions buying Bitcoin ETFs cannot lose. Of course this is a huge misconception, and we’ve seen something similar in the previous cycle. “Of course such a great company as Tesla wouldn’t lose on BTC, it’s just the beginning of a super cycle mate.” etc.

Generally, the way I approached taking profits in this bull market is pretty much mimicking moves of big longterm holders on-chain. They are selling, so am I.

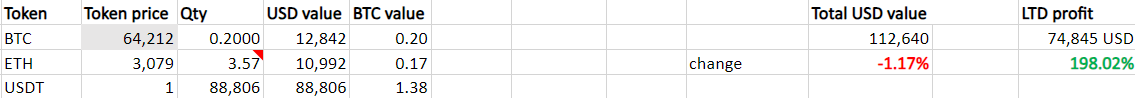

Final portfolio:

As you can see, USD is currently 80% of my portfolio. I’m not sure how exactly I will proceed with the rest of the crypto, but I will keep cashing in some of it as the price moves higher. I doubt that I will ever sell 100% of my crypto tho. I am also definitely not abandoning the crypto market for good, as I think there is still decent money to be made in coming years, or even decades.

Below is how the value of my portfolio changed over time.

The key takeaway is that I am definitely unsatisfied with portfolio performance, as the major objective of the portfolio was to beat the return of BTC, which I failed to do.

So running this portfolio compared to just holding spot BTC:

- increased risk

- gave less returns

- led to more stress

- required a lot more effort

This is a really important lesson for me that will have a big impact on how I approach investing moving forward.

ty