This week saw an update on a couple of projects that will have an impact on the world of tokenization.

Source

Real estate is projected to be one of the major markets that are enhanced by tokens. One of the biggest challenges with real estate is that it is a rather non-liquid market. This means that property transactions are slow and costly.

Tokens seek to remedy this by providing the frictionless transaction ability that we are seeing in other crypto segments.

One of the biggest impacts is that it should instantly raise the value of properties. There is a cost in value when an asset is not liquid. In other words, liquid assets tend to trade at a premium over their non-liquid counterparts.

For a market like real estate, that becomes a very large number. It is estimated the liquidity cost is a reduction of between 5%-10% on the value of the property.

With the global real estate industry estimated to be valued at over $200 trillion, even 5% is a lot of money.

Using security tokens, real estate is about to be transformed. Since we are dealing with high-value assets, the total amount in this market is expected to grow quickly.

One project sees the partnering of tZero and Tezos. They agreed to tokenize over $600 million for a real estate development. It will tokenize portion of properties financed by a U.K. company.

This is what the CIO of the company, Alliance Investments, had to say:

“Raising funds through an STO is more efficient, cost-effective, autonomous and democratic than traditional financing. We believe that we are at the forefront of a technological change that can disrupt the current funding paradigm.”

The first project will kick off in Q1 2020. It is a $20 million waterfront project.

https://www.coindesk.com/tzero-tezos-foundation-to-tokenize-500-million-in-uk-real-estate

Another project that took a major step forward this week is Harbor, a security token startup. The company received its broker-dealer license last month from FINRA. This week, it got another license which ensures interest and dividend payments to investors.

This is vital in the world of real estate investment. The idea of tokenization of this industry is to enable fractional ownership. We will see people all over the world having stakes in many different projects. Since tokens are traded the same regardless of the asset it represents, people will end up with very small shares.

Getting the licensing was important for Harbor. The firm already completed a $100 million real estate offering using tokens on 4 different projects. This took place on the Ethereum blockchain.

Harbor hopes to become a one-stop-shop for this kind of financing in the future.

https://www.coindesk.com/harbor-now-has-both-broker-dealer-and-transfer-agent-licenses-in-the-us

These are just two projects in what is expected a blockbuster industry. The projects from just these two companies amount to close to 3/4 of a billion of dollars. A few hundred projects will easily reach into trillions of dollars.

Security tokens are going to offer a great many opportunities to investors over the next few years. The real estate market is just getting started. Within a decade, the way we buy and sell real estate today will seem archaic.

|  |

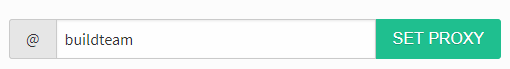

( Want an easier way? Use our SteemConnect proxy link! )

Disclaimer: This is a @steemvoter subscription payment post. Thank you to Steemvoter customers for allowing us to use your Steem accounts to upvote this post by virtue of your free subscription to the Steemvoter.com curation automation service. @steemvoter is proudly a @buildteam subsidiary and sister project to @dlease, @tokenbb, @ginabot, @steemsports, @btuniverse, @steemsports-es and @minnowbooster.

Beneficiary Declaration: 10% @null BURNPOST! 10% to @steem.dao proposal fund.

This incision tokens into Real Estate can have a huge upworth potential. Although, I think it is highly unlikely to happen. RE is a very traditional industry and it's foudntaions are intimately concrete. Changes here would be very slow i think.

Verry good the week project

thats nice hoping to see some growth in this

Sounds good in theory, but fiat is fiat. It devalues slowly over time.

A crypto can shed 100% of its value in under a minute.

shrug

Posted using Partiko Android

This is looking Great ....where this is place ?

Potential but also huge possibilities for scams

Wooow 😍

Posted using Partiko Android

Woooow. Your post is so cool! Can you vote for me in my last post? The venezuelan economic social class...

Posted using Partiko Android

Hi @btuniverse

My dear friend @lanzjoseg shared with me link to this publication just now. A bit to old to upvote, but I still would like to thank you for interesting read.

Personally I'm not sure if it's a reason to be happy or depresed. Our cost of living are steadily growing mostly because of two factors:

After all if prices of real estate goes up, then rentals goes up too and that is forcing businesses to find ways to survive and they always push costs of their products and services on final customers.

Tokenizing real estate is an amazing idea and I love it. However I can easily imagine that some cities will attract huge attention of international investors and that will cause rapid increase in cost of housing in some areas. Pushing local population of of those cities or forcing to live like rats (mumbai is an excellent example of such a market).

Yours, Piotr