Managing finances as a couple can be challenging. Whether you’re newlyweds or have been together for decades, financial transparency and joint budgeting are essential for a healthy relationship. Luckily, technology can make this easier by offering various apps designed to simplify shared finances. In this article, we’ll cover the top 3 budgeting apps for couples in 2024 that are feature-rich, affordable, and ideal for syncing with your partner’s financial goals.

Budgeting as a couple goes beyond keeping track of expenses. It builds transparency, promotes better communication, and ensures that both partners are aligned on their financial goals. Without a clear plan, couples can easily fall into money misunderstandings, leading to stress and even relationship tension. A budgeting app streamlines the process, allowing both partners to see where their money is going, set savings goals, and track their financial progress together.

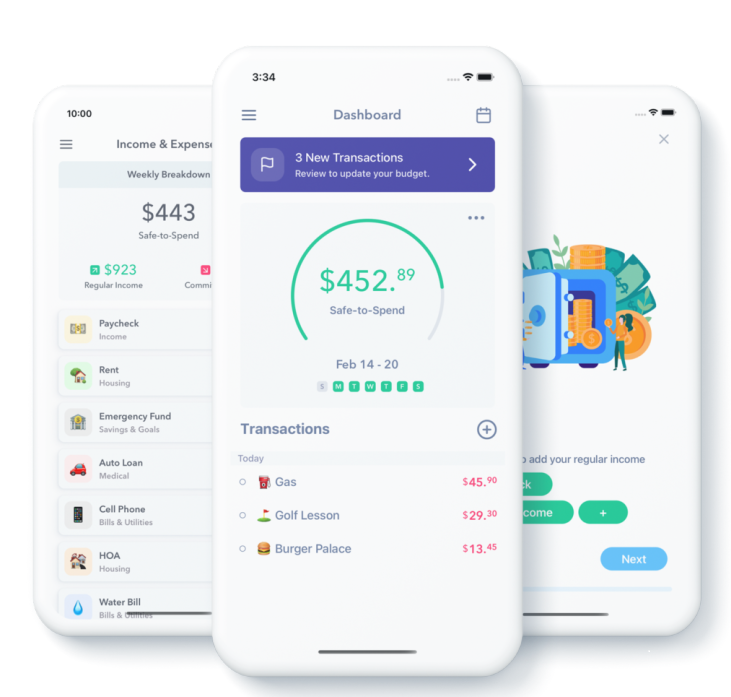

**Top 3 Budgeting Apps for Couples in 2024

**As we dive into the top budgeting apps, we’ve selected the following based on ease of use, features specific to couples, pricing, and customer reviews.

**1. Honeydue: Best Free Budgeting App for Couples

**Overview and Key Features

Honeydue is one of the best free budgeting apps specifically designed for couples. It allows partners to link bank accounts, track spending, set bill reminders, and chat about finances all in one platform. The beauty of Honeydue lies in its simplicity and flexibility. You can choose which accounts and expenses you want to share with your partner, so if you want to keep some purchases private, that’s entirely possible.

**Related Post: How Couples Can Start Saving for Their First Home

**Why It’s Great for Couples

Honeydue offers unique features like customizable alerts for upcoming bills and the ability to split expenses easily. The app also syncs with most major banks and financial institutions, making it easier to track shared expenses, like rent or utility bills. Plus, you can open a joint cash account with a Visa card through Honeydue, allowing for seamless financial integration.

Pros:

Free to use

Allows selective sharing of accounts

Offers a joint cash account

Cons:

Some users report occasional syncing issues

Limited financial goal-setting tools compared to paid apps

Pricing

Honeydue is free, making it an excellent choice for budget-conscious couples.

**2. YNAB (You Need a Budget): Best for Zero-Based Budgeting

**Overview and Key Features

YNAB (You Need a Budget) is one of the most popular and robust budgeting apps on the market. Designed around the concept of zero-based budgeting, YNAB encourages users to give every dollar a job, ensuring that you are more intentional with your spending. It’s ideal for couples who want to manage every penny while working toward financial goals like paying off debt or saving for a vacation.

Why Couples Love YNAB

YNAB offers shared budget access, making it simple for couples to manage money together. Its syncing capabilities allow real-time updates, so both partners are always aware of their financial standing. YNAB also features educational content and workshops on budgeting, making it a great choice for couples looking to improve their financial literacy together.

Pros:

Real-time syncing between partners

Highly customizable and educational

Excellent for goal-oriented couples

Cons:

Paid subscription model

Steep learning curve for beginners

Pricing

YNAB offers a 34-day free trial, after which it costs $14.99 per month or $99 per year.

READ MORE HERE: https://viztadaily.com/top-3-budgeting-apps-for-couples-in-2024-a-comprehensive-guide/

financial goals for couples