Hi! @techblogger here, bringing you an exciting report on the developments with BuildTeam's organizational token referred to as BUILDTEAM available for purchase on the Bitshares DEX.

In this report I'm going to go over the purpose of the token and provide some clearly laid out metrics to give supporters a clearer picture of past ROI in early 2018.

What is the purpose of BuildTeam's token (BUILDTEAM)?

BuildTeam generates revenue from its various services including MinnowBooster, Steemvoter and @steemsports. The organization has been structured in a way in which profits are collected and amassed into the BuildTeam General Fund. The profits of BuildTeam are retained in the form of Steem cryptocurrency.

The BUILDTEAM token operates on something called 'Proof of Stake' which allows a token holder to vest their tokens in exchange for rewards. The more tokens you stake, the larger the percentage of staking payouts you will receive.

The amount of Steem paid is proportional to the number of tokens you stake in relation to all other users who have staked tokens and the overall quantity of Steem distributed.

The more BT you stake, the more Steem you will receive!

How Does Staking Work?

Staking payouts are made twice per month. They occur on the 1st and 16th of each month. Payouts are done from a fund of BuildTeam profits that have accumulated over the previous 2 week period. The size of this fund is never announced before distribution.

Since most of our projects are based around the Steem blockchain, payouts are made in Steem, and are sent to the Steem account you nominated when initiating the Stake.

When BuildTeam branches out to build on other blockchains, income in those currencies will also be paid out to Stakeholders.

Once you have staked your BUILDTEAM tokens, they are essentially frozen as long as they remain staked. Staked BT cannot be transferred or traded on the Bitshares market.

These tokens are effectively taken out of circulation.

This is the powerdown process by which you can unstake your tokens to make them liquid & tradeable once again:

The Power Down process takes 13 weeks to complete (Just like Steem Power).

You will get a portion of your BUILDTEAM back once per week.

At the end of 13 weeks, all of your BUILDTEAM will have been returned and your stake will be Zero.

While powering down, you will still earn staking payouts for the portion of your BUILDTEAM that remains staked.

Powerdown can be stopped at any time, in the event you change your mind and decide to leave some tokens staked.

BUILDTEAM tokens are distributed at a maximum rate of 2500 tokens, twice per month, to builders who do work for BuildTeam on a "Proof-of-Productivity" basis. The only way the tokens can be obtained by the public is when the builders decide to sell off a portion of their earnings for immediate expenditure needs.

Most builders however choose to stake a major portion of their tokens to remain vested in the future of the projects which takes further tokens out of circulation and increases scarcity.

BUILDTEAM tokens can be bought and sold using the following link :

https://bitshares.openledger.info/market/BUILDTEAM_BTS

BUILDTEAM Metrics 2018

BuildTeam was founded with builders in mind, the primary purpose of the BUILDTEAM token is to reward builders for contributions to BuildTeam's overall ecosystem and support their efforts to create a new and better world powered by blockchain. BuildTeam itself does not sell BUILDTEAM into the market but rather allows builders the opportunity to either stake or sell their tokens and gives the free market a chance to determine their overall value as the token is publicly traded.

BuildTeam was founded with builders in mind, the primary purpose of the BUILDTEAM token is to reward builders for contributions to BuildTeam's overall ecosystem and support their efforts to create a new and better world powered by blockchain. BuildTeam iteself does not sell BUILDTEAM into the market but rather allows builders the opportunity to either stake or sell their tokens and gives the free market a chance to determine their overall value as the token is publicly traded.

This year BUILDTEAM has offered an outstanding ROI to both inside and outside parties and would like to highlight that ROI in the chart below:

What does it all mean for BuildTeam?

As you can see from looking at the chart above payments / ROI declined over March and April which also tracked a major correction of the overall cryptospace in which every major cryptocurrency faced a massive decline of 20-80pct.

Another apparent observation is that payments / ROI has a new trend increasing significantly at the end of April 2018 and mid May 2018.

BuildTeam has an incredibly ambitious roadmap for 2018 which involves major updates to some of our flagship services and a possibility of getting involved with brand new projects involving the new EOS mainchain due to release on June 1, 2018.

Stay tuned for some exciting news! Thanks for supporting BuildTeam!

Join our Discord chat

Get support and connect with us and other BuildTeam fans!

We are always looking to improve @buildteam and try to keep you up-to-date whenever something changes. If you have any suggestions about what we should change or add to @buildteam, then please drop by and let us know!

Missed the BuildTeam announcement? Here's all the juicy details.

Visit our flashy new website BuildTeam.io!

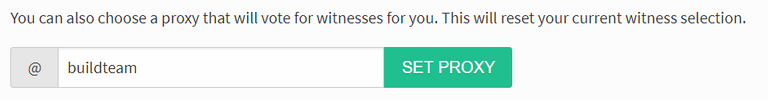

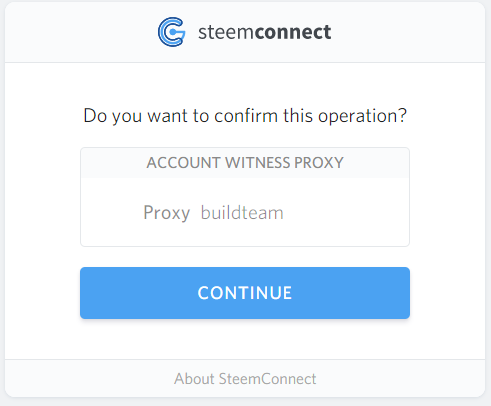

witness proxy today and contribute to building a better tomorrow!Set @buildteam as your

Want an easier way? Use our SteemConnect proxy link!

Steemvoter.comThis is a @steemvoter subscription payment post. Thank you to Steemvoter customers for allowing us to use your Steem accounts to upvote this post by virtue of your free subscription to the bot service. @steemvoter is proudly a @buildteam subsidiary and sister project to @steemsports and @minnowbooster.

Is the ROI considering the biweekly payouts only or does it also incorporate share price appreciation? If the biweekly payout is annualizing 50-100% then I gotta get some!

I would like to see the aggregate amount paid out vs the aggregate circulating supply from Jan 1 2018 till the last payout. I'm interested in 'yield.' That helps quiet some of the noise of the share price moving up and down.

That's live data from each month, it accounts for BT token price swings as well, if that's what you are asking. But we will have an explanation post on how we calculated this, up soon ™

How about an extra bar in the graph stating the ROI with BT token price swings per relevant time period EXCLUDED

How will you exclude them, we'd have to fix the BT token price on some value to do this?

You should follow @icowatchdog. ICO Watchdog is your comprehensive solution to following the cryptocurrency market. Follow the market with 100% Free and Real-time cryptocurrency alerts for all your favorite messaging applications today. Follow @icowatchdog Steemit account for news updates and token sales/air drops.

On how to use these tokens to get you Steem:

https://steemit.com/buildteam/@buildteam/buildteam-announcement-proof-of-stake-has-arrived-stake-your-tokens-now

Thanks for sharing. I've smashed the upvote button for you and i'll check out the token.

Also, if you are looking to get some tokens without investing or mining check out Crowdholding (https://www.crowdholding.com). They are a co-creation platform were you get rewarded for giving feedback to crypto startups on the platform. You can earn Crowdholding's token as well as DeepOnion, ITT, Smartcash and many other ERC-20 tokens.

Here is the prove

I've read every word in the post. It's very informative but since I'm a bit new in this platform, don't understand some of the terms. I'm already on the minnow booster discord. I'll check for more clarification

Who raised you? They deserve a medal for a job well done.You're great at figuring stuff out

Stay with us by this kind of post,

you are great...

will steem hit 10$ in one month.

Yes. All in and sell your house NOW.. BUY BUY BUY

/s

i think that building team is very good step to achieve this goal.

how many profit can i receive per month?

The past performance data is literally in the post.. please study it.

wow..

I would like to see the aggregate aggregate amounts of the highest circulated supply from January 1, 2018 to the end. I'm interested in 'yield'. It moves some of the speed of the stock forward and moves downwards..

Your post was mentioned in the Steemit Hit Parade in the following category:Congratulations @buildteam!

The article is very interesting! If you are interested in ico subscribe to me, I will also be mutually subscribed.

Cool. By the way, Please don't forget to follow our blogs and vote. Thank you.

Hi can you give me a upvote .i can give you 5 up vote .

if you want more up votes

please contact me Fb Id: 100008564616592

Gmail: [email protected]

Instagram: albart_olo

twitter : @Albart65486300

We can be more benefit By becomimg friends and keep upvote each other.

If you get this messge please contact me.