You want to hand an 18 year old born in the year 2000 a paper cheque? Then you want to complain about high employee turn over? Stop complaining, start adapting.

Implementing direct deposit can increase employee retention and reduce fees associated with cheques and banking fees. The problem businesses face with direct deposit is that they only consider large companies like ADP or TelPay. These companies will take care of as much or as little as you like but it adds a monthly fee to your business that is difficult to reduce. I suggest going with a cloud based accounting software with features that you only pay for when you use them.

We use waveapps.com for all our book keeping. We have an accountant that does our tax returns otherwise it's all us. You'll probably see more posts from me about using Wave but for now let's just stick with Direct Deposit.

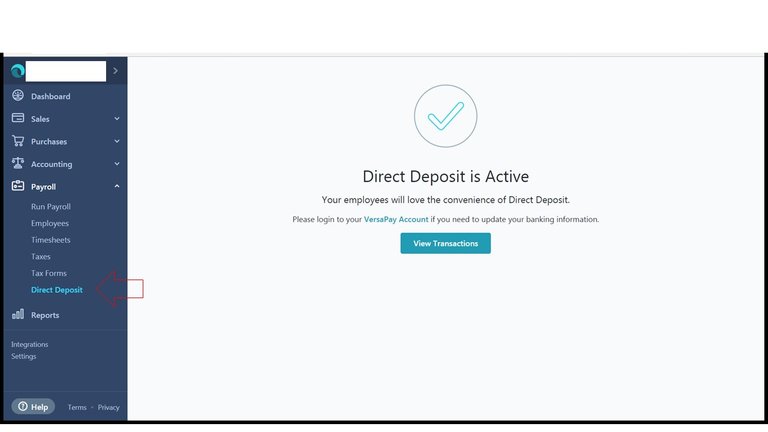

You'll need to start by setting up your direct deposit details which mostly includes bank accounts. Wave takes you through this in a comfortable and inviting way. Don't worry about having experience in order to be successful.

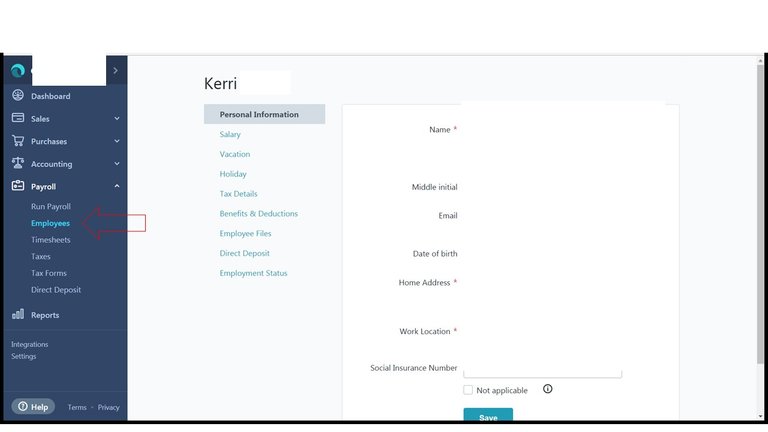

Next you need to put in your employee details. This is really helpful to have all your employee information in one place. You can issue ROE's and T4's from Wave so no need to fear tax time. Yipi!

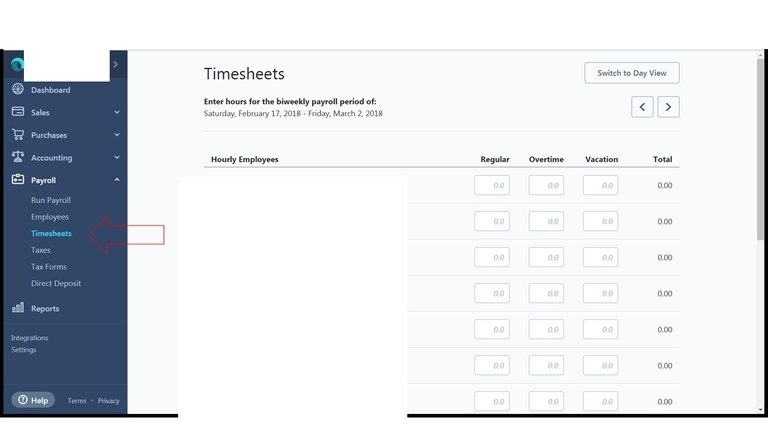

Next all you need to do is input the hours for each employee. You would have put in the wage under Employee so Wave already has this info. I blanked out the names but you can get the gist.

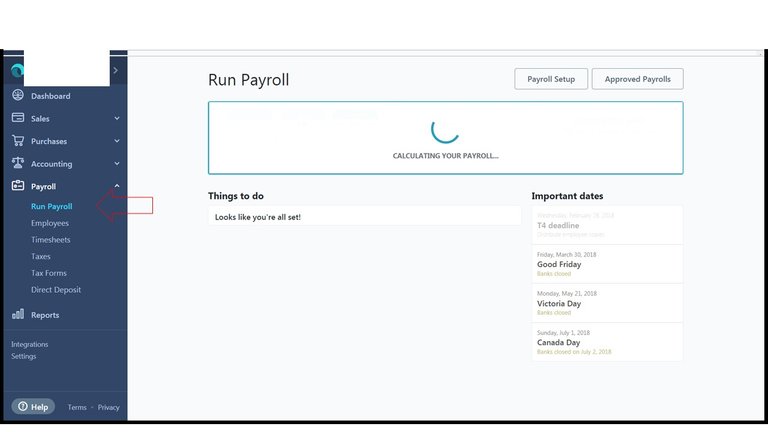

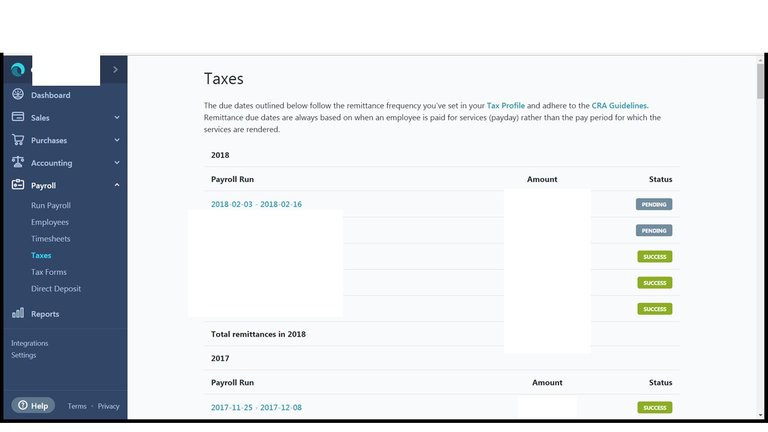

Wave will submit the Employee Deductions for you and submit them to your tax account. This is the part that accountants and big payroll companies make sound hard. With Wave you set it up once and it's automatic with each payroll.

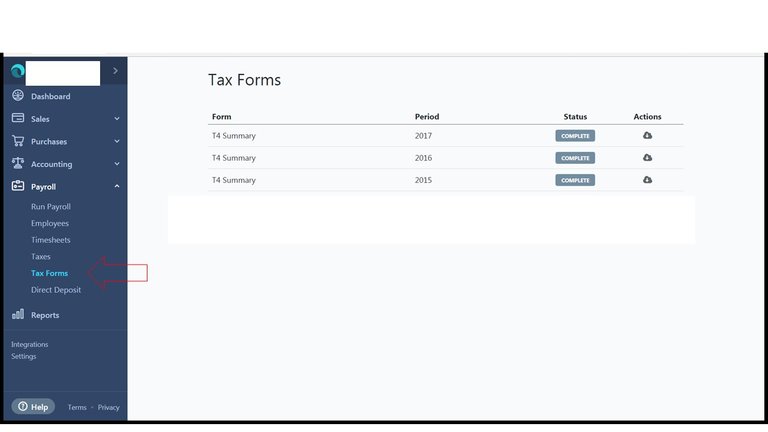

The next link is where you download and email the T4's out.

Overall Wave is a great inexpensive way to run direct deposit for a small team. If you don't have direct deposit at your business and you are still not convinced of it. Ask your team what they think. Employee retention starts with what employees want so you'll know if it's important to them :)

Banking in North America is so broken.

I got my first job in 2000, at the age of 18, and they paid direct into my bank account.

Have run 4 businesses and worked for 4-5 other employers since then and received cheques maybe.... 5 times?

Say what? Our banks have this available as a default option in Internet banking... unlimited transaction accounts start from like $5/mo, and you can just upload a spreadsheet with the payee's information in it.

I find it mind-boggling how far behind the US is on this stuff (and I know you're in Canada).

I was working with a US manufacturer a while back for one of my products and when I asked for their account details so I could wire their payment, they acted like I was asking for the pin number on their credit card...

Wait, I just remembered - they don't have pins on their credit cards yet yet either lol

Anything that is Government regulated is usually broken and a way to hose money from us regular folk. Death to the regulated!!

Heck yeah. I heard it gets expensive, it's great there are innovations like this that can help. Then again if you were handing out the kid born in 2000 a graduation gift what about this? steemgrad

Ohhh I love the steemgrad post! Thanks for mentioning it ^^

Thank you for sharing this valuable information. sharing your thoughts and commenting can help

Nice stuff! Just implementing the payroll system into your business can do wonder for your business. Don't you believe? Try by yourself. https://goo.gl/datsAv