Source: http://moslereconomics.com/2017/07/07/credit-check-30/

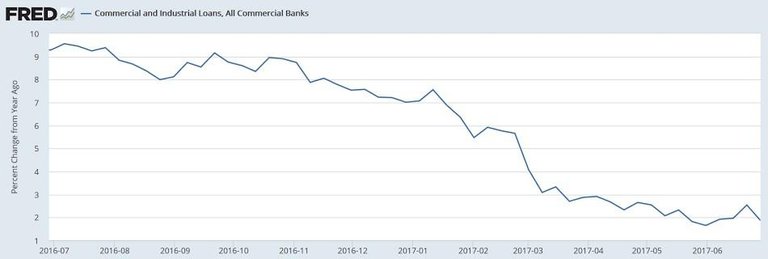

Let's look at commercial and industrial loan growth over the past 12 months -- 9.5% to 2% drop in one year

Next, what about real estate loans. We here that is going great. The past 12 months growth has dropped from 7 to 4% grwoth

Next Commercial Bank -- ALL consumer loans -- lets remember that consumer drive 70% of economy.

We see that consumer loan growth rate is cut in half -- from 8% to 4%

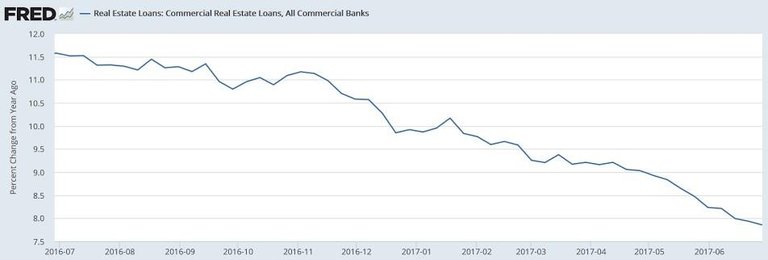

So we now look to the Commercial Real Estate Market-- how is that holding up the past 12 months. Not as bad -- only a drop from 11.5 to 7% growth.

What do these charts tell us. They show us that the consumer is "tapped out" growth is slowing dramatically. The charts source is the Fed Reserve Board, so the data is presented without prejudice. Maybe it takes time for the markets to react. Mike Maloney does a great job in going through these charts on his latest YouTube.

What are your thoughts...? Do you see the same...do you see a market and business cycle slow down?

More success to you.

Thank you...just try to help us all see the "fog of media".

Well all they did is reward the people that ruined the economy with more money. That really cant fix anything.

Good point...the money went to the banks. It did not bring back manufacturing jobs. It helped those that "took risks, gambled or committed commercial fraud" and bailed them out. It just created another opportunity to begin the money printing again fro the past 8 years....this is where we are...they were able to prop things up again quite well. Much of that money of course flowing into stocks to support the country. if not for the market recovering if would have been quite bad for many reasons.

The wall street recovery hasn't done much for main street. The work force participation rate is similar to what it was in the great depression.

Very true...they like to fudge the numbers ...help creative a certain positive narrative so people keep spending

These drops all seem reasonable to me. In an economy growing 2 to 2 1/2 percent a year, having loan growth in high single or double digits is unsustainable. That's how we got into trouble before the last crisis. I'd focus on employment growth, which looks pretty good and business investment, which was crappy in 2016, but was very strong in the first part of this year.

June numbers were seasonal....2nd largest I believe was in govt growth ....not sure if these numbers will hold up...let see.

"Next, what about real estate loans. We here that is going great. The past 12 months growth has dropped from 7 to 4% grwoth?" Seriously?! Can you edit your post? Also, you are using FRED charts and FRED charts are the most fake charts. FRED charts are so fake that ZeroHedge uses their charts. That, alone, should tell you the truthful legitimacy of their charts.

I don't think anything is going great at all. The fact that I am using fake Fed charts even proves the point more because it's worse. Thanks for your comments.

You must be a bear

I am more a realist that comes from experience.....there are cycles to see.

Do you ever feel that markets will stay irrational? Do you think the market will go up tomorrow?

I think the markets are a matter of national security and are propped up until they are not....which those same people will make money on the downside. We stopped having "markets some time ago" ...there is no fair price discovery....markets are now rigged....look at silver and gold at the comes being rigged with paper contracts which say what the price of these metals are.

I understand your frustration. Have you heard of decay, contango, tracking errors, or standard deviation? When the so called people try to make money on the downside, they will have a much harder time because of these four hindrances. This is one of the reasons that the markets are rigged to the upside. The main reason that the markets are rigged to the upside is because the government receives more tax dollars from the good economy compared to a down economy.