WHY DO YOU NEED A BUSINESS PLAN?

If you want to start a new business, improve or expand an existing business, or buy a business — you need a business plan.

A good business plan helps you to focus on markets and customers for your product or service, identify the financial and human resources you’ll need to succeed and develop methods for monitoring and managing your business effectively.

If you need to raise money from investors or financial institutions they will not even consider providing money to your business unless you have a business plan that convinces them that you are prepared and have a creditable road map for success.

Whether you have written a business plan before or not, you need to be your own objective partner and guide in the analysis of the strengths and weaknesses of your business proposal. You need to develop your business plan so that you will have a useful tool for running your business and raising capital.

THE BUSINESS PLANNING PROCESS

I begin with a Feasibility Plan Section 1. It’s a step by step process that will enable you to quickly make an informed assessment of your business proposition. The feasibility plan is designed to discover whether your business proposition is likely to achieve your objectives. In short does your business proposition warrant further investment of your time, effort and money, or is it a non starter.

Most businesses that require money from banks or other financial institutions or agencies move directly to the development of an abbreviated Business Plan that is most often sufficient to secure loan guarantees from the SBA or the USDA. Section 2 is a simplified planning framework that permits you to expeditiously complete the additional information that is required.

The Management Plan is a critical component in the planning process. Section 3 explains the management practices I recommend to assure that you identify the critical operating risks of the business; review the business’s operating performance periodically; establish an exit strategy based on benchmarks; and revise and update the business plan when it's appropriate.

Section 1 – Feasibility Plan

The Feasibility Plan is designed to discover whether your business proposition is likely to achieve your stated objectives. It is a tactically focused study and answers the question does your business proposition warrant further investment of your time, effort and money or is it a non-starter.

A] BUSINESS DESCRIPTION

The business description is an overview of what your business is and what it does.

Start-up Business Example - The Deep Dish Bistro will be a new restaurant that caters to people who know and love Chicago style pizza. Located on West Avenue in Saratoga Springs, it will provide eat in, takeout and home delivery services. It will also sell beer and wine for on premise consumption.

Operating Business Example - ABC Enterprises is a LLC that manufactures and sells unique and patented bird feeders. It is located in a 2,500 sq. ft. facility in Malta, NY and sells through a distributor network to pet stores throughout the United States.

In a concise (~100 words) and direct manner describe your business.

B] OBJECTIVES

Objectives are statements of what you want to achieve, and why you want to achieve it.

For Start-up Businesses -

- You must begin with the amount of pretax income you expect to earn from the business (e.g. $48,000 which would be $4,000 per month).

- You should also include other objectives (e.g. I want earn and save enough money to provide my children with a college education, I want to start a home based business so I can care for my pre school children or I want to be my own boss)

An Operating Business Example - Because of increased customer demand, ABC Enterprises is seeking financing to expand its manufacturing capacity with newer faster production equipment and relocate to a larger facility in Northern Saratoga County with better access to I-87.

In a concise and direct manner describe what you want to achieve and why.

C] TIME LINE

A timeline is a calendar of events and critical milestones that answer the question when.

1] Start-up Target Date - The first timeline starts on the day of your write you business plan and ends the day you open the doors and begin selling your products or services to customers / clients.

Establish the target date that you plan to commence operations and identify the critical events that must be completed before you can open for business.

2] Pretax Income (not sales) Target Date - The second time line starts on the day you open for business and ends during the first month that you expect to or must earn the monthly pretax income that you identified in your objectives.

Explicitly establish your financial objective target date.

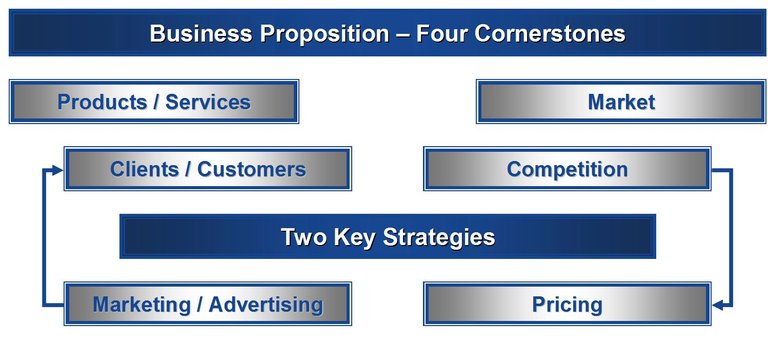

D] BUSINESS PROPOSITION

There are 6 questions that you must answer to develop your business proposition. Individual answers can take from a few sentences to 1/3 of a page (note: most people take 2-3 pages for this topic)

1] What products or services are you going to sell?

- Begin by identifying the industry (e.g. landscape services), and the industry sector(s) (e.g. residential and light commercial).

- Then identify the two to five product or service categories that will generate 80% or more of your sales. For example:

• Design and installation of stone driveways, walkways, and patios

• Design and installation of foundation plants and shrubbery

• Annual contracts - fertilization and maintenance of lawns

• Spring and fall yard cleanup

2] Who are your targeted customers / clients (i.e. the people most likely to purchase your products or services)?

Briefly describe and characterize them using the following example as a guide.

The target clients for our landscape services are homeowners of single family residences with a market value greater than $300,000. They may be retired, value their leisure time and would rather spend time on activities other than maintaining their property.

3] Where will you market and sell your products / services?

Think about geography and identify where you will operate. Businesses with multiple channels of distribution often operate in more than one geographic market.

For example a company that manufactures and sells wooden toys might answer.

• We will operate a retail factory store in Cambridge, NY. We will have manufacture’s representatives in the northeastern states who’ll sell to retail boutiques. We will have an internet site and will ship orders directly to retail and wholesale customers outside the northeastern states.

4] Who are the primary competitors in each market that you identified in question #3 above?

Think about products and services that are similar to yours that other companies offer in the market place. They may not be identical to yours but they provide customers an alternative.

For example a company that manufactures and sells wooden toys might answer.

• Our direct competitors are US manufacturers of hand made wooden games and toys. They include Maple Landmark (VT), Guillow (MA) and Wild Apples (NY).

• Our indirect competitors are companies from around the world, who sell similar but machine made products at Wall-Mart, Target and Toys-R-Us.

5] How will you attract your target customers /clients?

You’ll need to develop a marketing strategy that allows the business to concentrate its limited resources on the greatest opportunities to increase sales, build customer loyalty and achieve a sustainable competitive advantage.

There are three key objectives to consider.

A) How will you increase the number of new and existing customers who purchase your product/services?

• Usually some combination of the following works the best: media advertising, public relations, networking & face to face meetings, Internet – web site & social media and printed materials - business cards, tri-fold brochures, etc. The appropriate mix is often determined by your business.

B) How will you increase the average $’s per transaction?

• Often businesses use couponing, promotions and in-store special sales to achieve this objective.

C) How will you increase the frequency of customer repurchases?

• The simple answer is self evident. Build customer loyalty and thus create a sustainable competitive advantage. The more difficult question is how will you do it?

6] How will you price your products /services?

You’ll need to develop a pricing strategy. It is an iterative process that requires businesses consider many factors that influence a customers’ / clients’ perception of value.

• One of the most commonly used techniques is to collect and evaluate the pricing practices and prices of direct competitors for their most similar products. The average price calculated from your research is the “initial base price” that you should use in your financial projections.

The process is iterative because until you analyze the results of your financial projections you won’t know if the initial base price for your products / services will produce an operating profit.

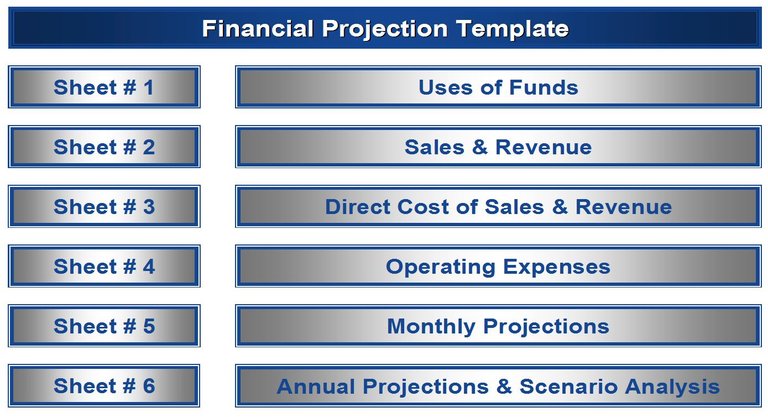

E] FINANCIAL ASSUMPTIONS AND PROJECTIONS

The Financial Projection Template that is used in developing your Feasibility Study is an Excel model that has six spreadsheets. It’s color coded and has proven to be a tool that even the most mathematically challenged people are able to master once it has been explained.

The following comments will be explained in more detail once you’ve completed and refined topics A through D.

Sheet # 1 – Uses of Funds

This is the worksheet to record the money you will have to spend before you can open your doors for business or launch a new initiative to expand the business. The investments and expenditures are summarized and automatically entered on sheet #5.

• Investments – money spent to purchase non-current fixed assets with a useful life expectancy of more than one year and current assets (e.g. inventory, prepaid insurance, deposits)

• Expenditures – startup expenses that expended before you can open your business to customers and clients to (e.g. LLC filing fees, web site development, pre opening newspaper advertising,)

Sheet #2 – Sales / Revenue

This sheet is used to forecast the monthly sales/revenue that your business will generate over the first 12 calendar months you are in operation using the two to five product / service categories you identified in section #1 of your business proposition.

Sheet #3 – Direct Cost of Sales / Revenue

This sheet is used to forecast the direct cost of sales that your business will generate over the first 12 calendar months you are in operation. Direct costs are those costs that are directly attributed to the sale of a product/service. Direct costs are not allocated operating expenses, interest on loans or an owner’s draw/salary.

Sheet # 4 – Operating Expenses

The operating expenses of the business are projected using this sheet. There are three major operating expense categories.

• Fixed expenses – you’ll incur them even if you have no sales or revenue (e.g. rent).

• Variable expenses – these expenses tend to fluctuate with sales (e.g. repair and maintenance of equipment and vehicles, fuel for delivery vehicles, office supplies).

• Discretionary expenses – you have more control over these expenses (e.g. travel and tradeshows, entertainment, advertising, promotion).

Sheet # 5 – Monthly Projections

This sheet puts everything together and answers the critical question of whether your plan will meet your stated objectives.

Sources and Uses of Funds

Where the money comes from are the sources of funds (e.g. you, investors, loans). They need to be estimated and entered on this sheet.

The Investment and expenditure that you projected on worksheet # 1, uses of funds, are automatically enter on this sheet.

Operating Cash Flow Projection

The information from sheets 2, 3, and 4 is automatically transferred to this sheet and the total operating cash flow is determined. Based on the result, the remainder of the sheet is completed.

Financial Expense Projection

If you require a loan from a bank or investor you will need to enter the monthly principal and interest payments. If you lease new equipment or vehicles enter the monthly payments.

Sheet # 6 – Annual Projections and Scenario Analysis

Once sheet #5 is finalized, you will use this sheet to make rough projections for the 2nd and 3rd years and evaluate how the business would perform if sales in the 1st year were better or worse than your plan.

Comment: All projections and forecasts of future events will probably be wrong. Consider the professional weather forecasters or renowned handicappers who predict the winner of the Travers or Kentucky Derby. Your challenge is to get the financial projections for your business as correct as possible so you can make informed decisions.

Section 2 – Management Plan

The Management Plan’s primary objective is to increase the likelihood that your business will succeed. It requires that you consider and address four important questions and in doing so develop management practices that will help you avoid a business or financial crisis.

In the following Management Plan Cliff Notes, it defines and elaborates the issues that underlie the questions that are posed below.

A] Operating Risks

Identify the three to five most critical operating risks that the business might face in the next year.

• What actions would you take to minimize the negative impact of each on the business?

B] Operating Performance

Identify the management practices you will adopt to monitor the business’s operating performance.

• How often will you formally evaluate the business operating performance and financial health?

• What are the three to five metrics / measures that indicate that the business is performing well?

C] Stakeholder Communications

Identify the management practices you will adopt to communicate with your business’s key stakeholders.

• Who are the most important stakeholders in your business?

• How often will you update them on the business’s progress and performance?

D] Exit Strategy

Exit strategies are important because they focus attention on how you’ll maximize the value of your business and when you should act.

• What three to five benchmarks will you use to evaluate whether you should sell or merge your business?

• What three to five benchmarks will you use to evaluate when its time to quit or liquidate your business?

Management Plan - Cliff Notes

Business Risks – there are two types that all businesses face.

1. Those you can not anticipate control or mitigate (e.g. the financial market collapse in 2008, the BP oil well failure in the Gulf of Mexico in 2009, collapse of the coal mine in Chile in 2010).

2. Those that are probable (i.e. any risk is possible) and thus you can develop contingency plans to mitigate them (i.e. minimize the negative impact on your business).

Business Operating Risks (type 2) tend to fall into broad categories

• Technology (e.g. new products or equipment that makes your business non-competitive on a cost basis)

• Marketing (e.g. new entrants that increase competition and decrease your market share)

• Human Resources (e.g. the availability of skilled workers, the loss of a key employee)

• Financial (e.g. the inability to refinance maturing loans, secure additional working capital for growth, inability to stem operating losses)

• Production (e.g. mechanical failure of a critical machine, important raw materials become scarce or double in price)

• Logistics (e.g. weather conditions create delays in scheduled delivery to important customers, gasoline & diesel fuel prices increase by 35% in 30 days)

Monitor Operating Performance

Managing the performance of a business and its operating risks is a critical process that all owners and key participants must do periodically. What they monitor and how often will vary by industry, but every experienced manager focuses on the actual vs. planned operating performance as a key indicator of the businesses health. The primary reason for this, whether the actual performance is better or worse than plan, is so they can take corrective actions. For instance, do more of the things that are working or do less of the things that aren’t working. Timely informed decisions are critical success factors in the ever-changing competitive business arena of today.

Communicating with Stakeholders

All businesses have stakeholders (i.e. investors, employees, customers, suppliers, etc.). It is very important that you develop management practices for communicating information regarding the progress and performance of the business to them on a timely / periodic basis. It is equally important that the information, both good and bad news, is communicated in a manner that is tailored to the audience and reinforces their perception that you are truly managing the business and understand their perspective.

Section 3 – BUSINESS PLAN

The business plan is, above all else, a sales document that is targeted at a specific audience (e.g. bank, financial agency, private investor) with the objective of securing the funds required to start, expand or acquire a business. It is seldom more than 12 pages in length (excluding appendix exhibits). If you have completed a Feasibility Study you have already developed a significant amount of the material that you’ll be presenting to the audience.

1] THE PLANS PURPOSE AND TABLE of CONTENTS

The opening page of the plan has two components.

The first component explains why you are presenting your business plan to the recipient (e.g. a bank, a financial institution or a private investor) and why they should invest their money in you and your business.

For example:

The following business plan for the XYZ LLC is being submitted to the ABC National Bank in support of our application for a commercial loan of $125.000. We believe that our equity capital contribution of $45,000 (~26% of the $170,000 total start-up capitalization), our current FICO scores (Brad 720 and Ann 750) and our experience in the industry are strong indicators of our credit worthiness and qualification for the loan requested. We look forward to working with you in the future as we grow the business.

The second component, the table of contents, details what follows.

2] EXECUTIVE SUMMARY

The executive summary is a brief (i.e. no more than one page) overview of your business plan.

It is the most important section of your business plan and the first thing that the audience will read. You should write it after completing the topics, numbers 3-10, that follow.

The executive summary highlights the key factors that will contribute to your business’s success and helps the reader understand why your business merits the financial investment you have requested.

3] BUSINESS DESCRIPTION

The business description is an overview of what your business is and what it does.

• This is a repeat of what you wrote in the Feasibility Study

4] PRODUCT OR SERVICE

In a concise manner describe what products or services you are going to sell.

Briefly explain why customers will want to purchase it. Consider and address:

• What makes your product unique (e.g. a patent, trademark or copy right)?

• What are the features or benefits that differentiate your product or service from the competition (e.g. better quality, healthier, cheaper, more stylish, faster…)?

• What need does your product meet and how does it satisfy those needs?

5] MARKET AND CUSTOMERS

Describe the market for your product or service.

Think total market then focus down to your target market (the geographic area and market segment in which you will compete). Consider and address:

• How large is the total market (i.e. total revenue from sales and/ or units sold)?

• What are the past, current and future trends of the total market?

• Is the market segmented and, if so, in what segment will you compete?

• How large is the market segment currently? Will it grow at a slower or faster rate than the total market? Why?

• What geographic area of the market will you target (i.e. where will you sell your product or service)

Describe who the customers are or will be in your target market. Are they individuals or businesses? Consider and address:

• If individuals, what are their demographic characteristics (i.e. age, household income, and other common traits)?

• If businesses, how can they be characterized (e.g. by industry, by size, etc.)?

• How many customers are there in your target market?

6] COMPETITION

Identify the top 3 to 6 companies that provide the same or alternative products or services in your target market. Be sure not to overlook internet competitors if relevant.

• Briefly describe these competitors in terms of size, location, distribution /sales channel, strengths and other relevant characteristics.

• Briefly explain what differentiates you from your competitors (e.g. what is your competitive advantage).

7] MARKETING STRATEGY

In a concise manner describe how you will reach your customers and attain our sales goals.

If your product or service is not sold directly to the consumer (e.g. your distribution channel includes wholesalers and retail stores) consider and address:

• How will you create awareness of your product or service in your target market?

• How you will price the product or service at each level in your distribution channel?

If your product or service is sold directly to the consumer consider and address:

• How will you create awareness of your product or service in your target market?

In either case, consider and address

• How do service, warranty and other policies support your marketing initiatives?

8] OPERATIONS

Briefly describe where your business will be located and what facilities and equipment you’ll require.

The size (square ft), spaces (e.g. offices, production, warehouse, loading docks, ceiling height, etc.), special conditions or services (e.g. electrical, water, rail, etc.), zoning and regulatory permits that will be needed.

• The type of equipment that you’ll need and whether the equipment required will be custom made or readily available from multiple sources

Briefly explain how you will make or obtain your products or provide your services.

Identify the human resources, excluding owners and key managers. How many will be needed to operate the business and when will they be needed (i.e. how many will be employed initially and how many by the end of the first year of operation).

• Briefly explain the positions they will fill and any special skills that will be required.

9] MANAGEMENT

The management section is a brief description of who will be the key participants in the business (e.g. you, other owners, and key managers).

• Identify key participants, their position in the business, what experience they bring to the business and how their background relates to their role and responsibilities.

• Identify outside professionals (e.g. accountants, attorneys, advisors) whose services will be needed in the business.

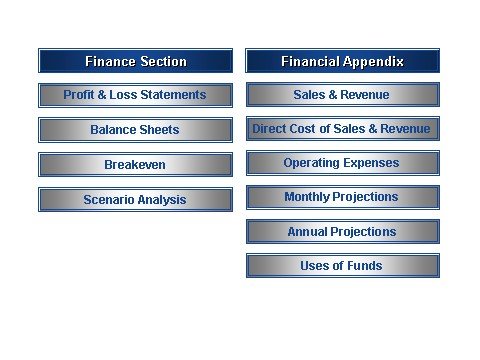

10] FINANCE

The finance section of your business plan is the second most important (the executive summary is #1). Because your audience (i.e. bankers and investors) are primarily numbers oriented they invariably turn to it to evaluate how their loan will be paid back.

The content of this section and the supporting Appendix exhibits are dictated by the industry in which you compete and whether your business is an operating (i.e. two or more years of operation), early stage (i.e. less than two years of operation) or start up company.

Much of the financial information that will be required by bankers and investors was developed in the Feasibility Study and will be included as supporting exhibits in the financial section of the Appendix.

There are two new and important financial exhibits that will be included in topic #10 that you’ll need to develop. Because they are on an accrual vs. cash basis they are a challenge for clients who are not accountants or financial wizards. SCORE counselors will assist you in their preparation.

• Three fiscal year end Profit & Loss Statements

• The opening and 3 fiscal year end closing Balance Sheets

You should also include comments regarding the analysis you undertook in the feasibility study that answered the questions:

• When will the business breakeven on a cash basis (i.e. break-even point is the month in which the sales/revenue equals or exceeds the sum of the direct costs, operating & financial expenses, and owner’s health & life insurance expenses)?

• What are your optimistic and pessimistic expectations for year one (i.e. the scenario analysis you performed in the Feasibility Study)?

11] APPENDIX -

There are no hard or fast rules of what you should included as supporting exhibits in a business plan other than the financial information sited in topic #9 and the resumes of key participants in the business identified in topic #8. The primary objective of the appendix is to provide the reader with additional data and information that supports your loan application and demonstrates further that you are prepared to succeed.

Thanks for the good article

Congratulations @saratoga-12866! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!