Many countries reacted negatively to the US Senate passing the tax reform. France, for example, saw in the new legislation a threat to EU subsidiaries in the United States.

France was seriously concerned by that part of the reform “that would give the U.S. government a broader scope to tax European subsidiaries on goods they sell in the United States. This would be very different system from what we have now.”

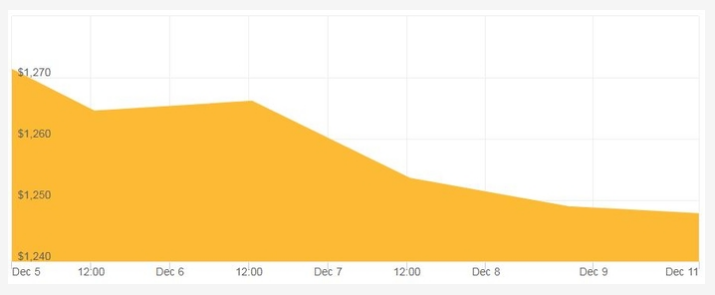

The adoption of the tax reform enhanced the dollar significantly, while gold was worth $1,276.

On Tuesday 5th, Brexit was widely discussed in the market. This topic has been a number one issue for investors. So far, certainty has not yet been achieved. The timing when the UK will leave the EU during the talks between European Commission President Jean-Claude Juncker and British Prime Minister Theresa May has not been identified.

Jean-Claude Juncker:

“We now have a common understanding on most relative issues – with just two or three open for discussion which require further consultation, further negotiation and further discussion.”

On Wednesday 6th, the head of the Federal Reserve Bank of Chicago, Charles Evans, urged not to rush rate hike in December. He suggested observing inflation for at least another six months. In the event of inflation increase, the Fed's rates could also be increased accordingly.

President and CEO of the FRB of Chicago Charles Evans:

“Maybe it's time to stop and see whether inflation expectations are going to move in line with our objective.”

Analysts at the international agency Moody's Investors Service spoke about the acceleration of economic growth in the next year. They forecast a three-fold increase in rates.

A gold ounce was worth $1,263.

!

!

On Thursday 7th, the dollar rose rapidly. This is due to investors' optimism about the tax reform, the publication of data on employment in the US and the possibility of adopting the final version of the draft law on taxes in the US.

The yellow metal that day cost $1,257 per ounce.

On Friday 8th, data on employment in the US reassured investors. In November 2017, economists noted the healthy growth of the US economy and the excellent shape of the labor market. Disclosed materials go against the efforts of Donald Trump and his actions on tax reform. Analysts confirm that America does not need financial incentives and tax cuts.

Analysts at CIBC Research:

"Without stronger wage growth, higher inflation remains in doubt, and that takes away one reason for the Fed being more aggressive in hiking rates."

At the end of the week, gold was worth $1,248.

On Monday 11th, economists at the Bloomberg agency announced the upcoming rate hikes in 2018. According to their forecasts, these will be in March, September and December.

More than half of the economists surveyed by Bloomberg believe that higher rates will cause increased risks and trigger a financial crisis.

Gold reached $1,249 at the beginning of the week.

George Gero, RBC Wealth Management managing director described factors that could lead to accelerated gold buying. This phenomenon embraces such “basics” as ongoing geopolitical upheavals “everywhere, from Brexit to North Korea to Venezuela to the Middle East”.

This year, gold bars prices have increased by 10%. Experts predict a moderate increase in the cost of the precious metal in 2018. Bart Melek, Global Head of Commodity Strategy at TD Securities Inc. in Canada believes that gold will grow by another 4%. In his opinion, an ounce of gold might cost $1,313.

Keep an eye on experts’ forecasts . Enhance your financial security.

To register for free or learn more about Global Intergold click http://maxmartgold.myintergold.com

kindly like and follow me on facebook https://www.facebook.com/maxmartgold/