Deciding to expand our business is no easy task and going into dept to do so is a risky undertaking. It is wise to asses the risks carefully and thoroughly before taking on new debt for productive assets.

All of us probably want to improve our business but the wisest and most successful will make certain they can afford it before taking the steps or making the changes.

That is where our daily record keeping comes in handy again.

Using these records we can create a cash flow statement which we can then use to predict our future income based on past performance. We should also be very careful to factor in any foreseeable challenges or changes to our cash flow in our equations and calculations. Some room should also be left for contingencies.

There are three main steps to creating a cash flow statement:

- we need to look at past performance

- we need to look at future costs and expences

- we can then analyse and predict the cash we will have available in the future

Based on this analysis, then we can figure out the best way to grow our business.

Do we add to our product selection? do we need to focus on decreasing or expenses first? do we need to focus on increasing profitability of what we already have? and can we afford to start evaluating possible loans?

Thanks you for this information!

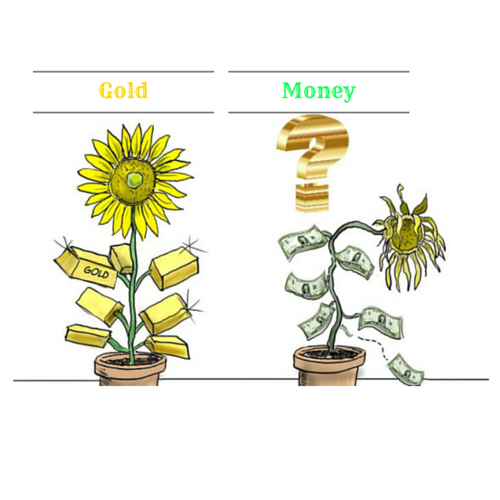

Assets can create future value so holding assets that appreciate can help generate more in the future =)

Mantap

Luar biasa salam kenal by @maulidin-alasyi

Saya suka dengan gambar ilustrasi diatas. Secara tidak langsung gambar tersebut memberi arti bahwa nilai uang akan turun dibandingkan dengan nilai emas. Terimakasih atas postingan bagusnya

I love this guide because it's very informative and at the same time simple and digestible. Thanks for sharing☺️!

An important note for the government in 2017 is how to maintain overall price stability, especially the basic needs so as not to burden the public.To deal with the possibility of bad or concerning economic problems that will occur, especially in 2017, forcing people from now must think more intelligent and careful, especially how to manage finances become more productive. So when the bad possibilities happen to the Indonesian economy, for example the rise in the price of basic commodities, people can anticipate with assets or finances that are managed productively. Therefore, the alternative that can be done by society is by investing in capital market.@sme

Good article. As for the future, we must also consider whether the industry in which our business operates will grow or fall into recessions in the future.

One has to carefully access the field of business he or she going into.Those are some fantastic points you mentioned @sme.

One of the worst things that can happen to you, is going into debt for the wrong reasons.

Thanks for sharing information this is very important

Good article. Steady planned growth is the way to go.

we need to look at past performance

we need to look at future costs and expences

we can then analyse and predict the cash we will have available in the future

This is indeed true.

Thanks for sharing this lovely and educating article.

Steem On

BOS Team

This is a really good tip for start-ups and those interested in business expansion.

Thanks