You can revisit my previous posts about cryptos, Bitcoin, and the US Dollar, here (What Are Blockchains?) and here (What's Bitcoin?).

I understand fiat currencies are only based on confidence, so I'll move my money to a non-fiat alternative - forget cryptocurrency.

Cool idea, but not real. The last currency even kind of sort of similar to the gold standard was the Swiss Franc, which kept 40% of the value of their currency in gold in their reserves at all times. They broke with this structure by way of a referendum passed in the year 2000. Find me a non-fiat physical currency, and I'll show you a commodity.

What is important to take note of is that every fiat currency throughout history has declined in value until being worthless. Though it may sound ridiculous, the value of the US Dollar has decreased slowly but surely since 1913. Don't expect it to be around forever. I'm not stirring panic, or trying to get the public to abandon the Dollar - simply stating a historical fact.

I still trust paper money more than digital cash.

There are further problems with paper currency, still.

- Criminals (and some countries) make fortunes counterfeiting bills, and most of us would be hard-pressed to see the difference between reals and fakes. This devalues and delegitimizes actual bills.

(on first glance, it'd be nearly impossible to see the differences)

- Next, people or governments can do whatever they want with dollar bills (though it’s claimed there are repercussions if you defame or destroy them). Lock it up, burn it, hoard it, overcirculate it. This makes proper valuation almost impossible to accomplish.

The Joker burns huge piles of cash - cause he can.

- And then there’s transfer times. Want to send $1000 to your friend? They’re gonna have to wait 3-5 days. Or, you can write them a check that they can deposit, in which case they’ll be waiting for 1-3 days for the balance to settle. Don’t want to wait? You can send the money through PayPal or Venmo, but you better believe they’re taking some cream off the top.

You’re saying we already base our currency on confidence, but how does cryptocurrency and blockchain fix any of the issues you’ve described with paper money?

You can’t forge blockchains. Due to the fact that they’re decentralized, linked, and locked with a personal key, you’d have to counterfeit an entire network, which would cost billions of dollars in computing power, energy, and time. There is no such thing as a duplicate blockchain: Mining is a record-keeping service done through the use of computer processing power. Miners keep the blockchain consistent, complete, and unalterable by repeatedly verifying and collecting newly broadcast transactions into a new group of transactions called a block.

The decentralized nature of Bitcoin and cryptos (though not all are actually decentralized – do your homework before buying) means no government, corporate entity, or person can single-handedly determine the price. The market won’t get flooded with Bitcoin because the Fed decides to print more, you can’t take existing Bitcoin and burn them, and the number of blockchains on the ledger is countable – the supply and demand is able to constantly be monitored.

Transfer times are faster, and, on a good day, transaction fees are lower. This is where you start to get into the nitty-gritty. In relation to the dollar and banks, Bitcoin transfer times are significantly faster – think anywhere between a few minutes to a day. This is easily outpaced by credit card transaction speeds, and is no longer considered speedy in the world of cryptocurrencies - one of the many reasons Bitcoin has become a value holder rather than a means of currency distribution (the difference between currency and value holder being: no one goes to the supermarket and pays for their groceries with gold nuggets, you keep gold in a safe deposit box for emergencies, or peak price times).

You said “on a good day” transaction fees are lower. What does that mean?

The cost and speed of a transfer (a buy or sell order) is determined by a multitude of factors.

- How many people are on the network?

- How big are the datasets contained on each blockchain?

- What is the volume of trading at any given time period?

- Is the network designed for low-cost, fast transfers, or for tighter security and more stringent privacy?

Using Bitcoin as an example: when the process began, mining fees were low, transfer fees were low, volume of Bitcoin holders was low, and the currency itself was nearly worthless. Unfortunately, as Bitcoin has continued to scale up, it’s run into numerous problems that weren’t understood thoroughly when it was created. One of these major issues is that Bitcoin blockchains are limited in size to one megabyte.

Here’s a summary of why that's important:

Bitcoin blocks carry the transactions on the bitcoin network since the last block has been created. In contrast to Visa's peak of 47,000 transactions per second, the bitcoin network's theoretical maximum capacity sits between 3.3 to 7 transactions per second. The one-megabyte limit has created a bottleneck in bitcoin, resulting in increasing transaction fees and delayed processing of transactions that cannot be fit into a block. (Wikipedia)

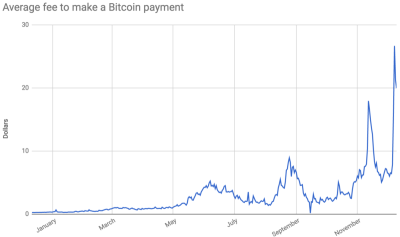

On one particularly high volume-trading day, any transaction, be it .0001 Bitcoin or 1,000 Bitcoin, would’ve cost the user an equivalent of at least $50. This is a major problem, and there’s been a tug-of-war regarding how to resolve it since July 2017. If you want read up on the way programmers have decided to take it on, search for: Bitcoin scalability problem, Segregated Witness, and Bitcoin Cash.

Bitcoin wasn’t designed with fees in mind, but fees have become essential – basically, if you want to have your Bitcoin exchanged, you have to pay a large transaction fee to entice a computer to validate your command, because everyone else is willing to pay a large fee for that computer’s time and energy, as well. With a cap of 3-7 transactions a second, and more users wanting to buy and sell everyday... you, uh, see the issue. But we won’t delve any further into that. Interested in how programmers are attempting to solve this (and it is a very solvable problem)? Many of Bitcoin's competitors have made low fees and fast transactions their selling point, but this doesn't mean they're better or more trustworthy than Bitcoin.

Next time, we'll be exploring risk vs. reward in the crypto-sphere. Please follow to see further updates!

help to understand the issue

https://steemit.com/cryptocurrency/@coinbizpro/attention-the-kucoin-carnival-is-about-to-begin-discussion