What is Taking Advantage of the Trend?

Taking advantage of the trend means moving in the same direction as the trend follows its own rules. However, they aren’t 100% accurate, there’s always the possibility of mistakes. Risk control must be done right to achieve long-term profits.

How to Follow the Trend?

Following the trend requires mastering the exponential moving average, the most common of which are EMA8 and EMA34.

EMA: Exponential Moving Average

The two exponential moving averages mentioned above can be used to determine the trend with EMA8 having a length of 8 period, while EMA34 has a length of 34 periods. If one consistently operates according to the trend, the success rate will be approximately somewhere between 50–60%. EMA34 represents an exponential moving average consisting of 34 candlesticks as the unit of calculation. Switching to the daily candlestick, 34 daily lines are used to make the EMA, the average daily index of 34 daily lines, drawn by the moving average chart. If set to 8, then it is the exponential average movement of 8 K-line based components. It’s typically recommended to use candlesticks of over an hour, to get trends of a longer duration.

EMA and the Fibonacci Sequence

This principle is derived from Fibonacci’s sequence, which is a system of progressive addition.

0+1=1

1+2=3

2+3=5

3+5=8

5+8=13

8+13=21

13+21=34

Above is the logic of the EMA principle. At the same time, EMA8 and EMA34 form what are called a golden cross and death cross, explained in the case below.

Golden Cross

When EMA8 (red) surpasses EMA34 (blue), the golden cross that appears indicates bull-market sentimentality. At this time, choose follow the trend and buy long.

In the diagram, EMA8 (red) surpasses EMA34 (blue), resulting in a golden cross. A back step then occurs, continuing until it breaks through the former high (7031.88). During the body of the candlestick chart, you can try to buy long for single transactions, setting the stop loss low in front. The trader can usually set the risk-to-profit ratio to 1:1 or 1:2, or according to the trader’s own judgment.

If it continues to break through the previous high (7021.88), then consider raising the price, adjusting the stop loss to the lowest point after the transition. If you didn’t follow the high entry, first observe the market and wait for it to return, then enter.

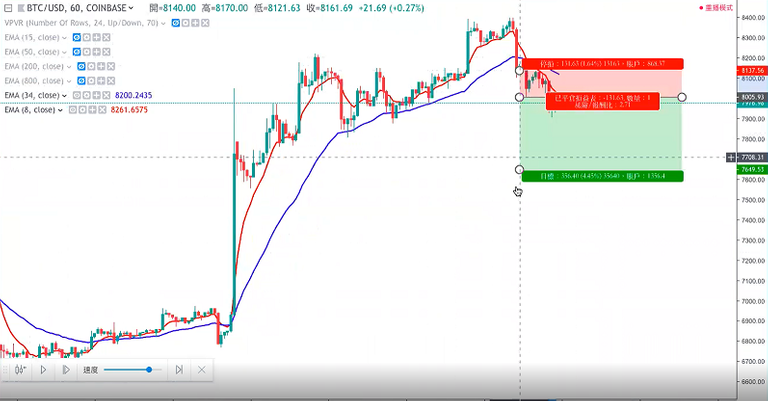

Death Cross

When EMA8 falls below EMA34, a death cross appears. This indicates an increase in bear-market sentimentality. Choose to follow the trend and sell short in this case.

In the above diagram, the price continues to go downward. When EMA8 (red) goes below EMA34 (blue), a death cross appears, indicating an increase in bear market sentimentality. At this time, follow the trend and sell short when entering the market. Set the stop-loss at 8137.56 and the take-profit at 7649.53, setting the risk-reward ratio at either 1:2 or 1:3.

How to increase the chance of success?

When fiddling with the golden cross and death cross methods, stop loss can easily be triggered. Remain patient and remember that the win rate when following the trend is usually at 50–60% so it is very probable to trigger a stop loss once every two to three trades. The rate at which a trade can give a high profit or loss is called risk ratio.

This article was written and shared by Gabriel Yeh. The views and opinions expressed in this article are those of the author, do not necessarily reflect the official policy or position of Bybit, and comes from his many years trading in both traditional and cryptocurrency markets.

We hope you learned a lot in this article about How to use the exponential moving average (EMA) to take advantage of the trend; enjoyed the read; and stay tuned for more great content.

Where to Find Us:

Website: https://www.bybit.com

Twitter: https://www.twitter.com/Bybit_Official

Reddit: https://www.reddit.com/r/Bybit/

Youtube: https://bit.ly/2Cmuibg

Medium: https://medium.com/bybit

Facebook: https://bit.ly/2S1cyrf

Linkedin: https://bit.ly/2CxHGcz

Instagram: https://www.instagram.com/bybit_official/

Telegram: https://t.me/BybitTradingChat