Last night a few hours after the NFT sale sold out(fast 15~ mins) a snapshot and airdrop occurred! For each NFT held the address received 8 LP tokens!

Tx:https://polygonscan.com/tx/0x109f3ae84efbefcc56784b27421e575e8c6e31a298866bd393bfc4da9a2567fd

Now you might be asking what exactly are LP tokens and what use they have for you?

Well to start they are a huge boon to a projects growth and health. They help support Blazar Force as a whole, quite a lot really, this includes many of you! But lets get into some technical aspects.

LP Tokens, or Liquidity Provider Tokens, are a fundamental concept in decentralized finance (DeFi) ecosystems, particularly within Automated Market Makers (AMMs). AMMs are decentralized exchange protocols that facilitate the trading of cryptocurrencies without the need for traditional order books. Instead, they rely on liquidity pools, which are pools of tokens provided by users for trading.

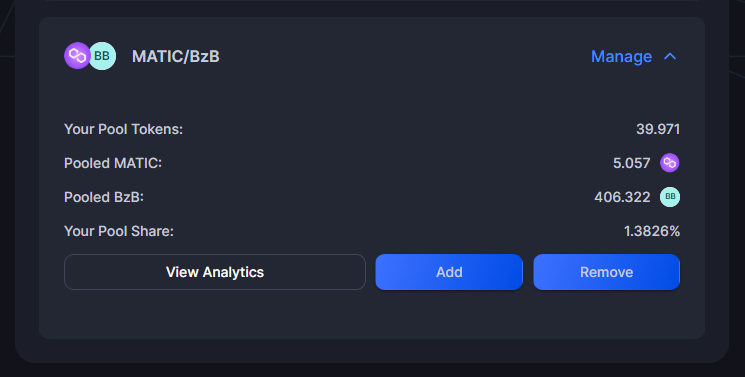

When a user provides liquidity to an AMM, they deposit an equal value of two different tokens (for example, ETH and DAI) into a specific liquidity pool. In return, they receive LP Tokens, which represent their share of the pool. These LP Tokens serve as a receipt and a claim to the deposited assets. They also represent the proportionate ownership of the liquidity provider in the pool.

Providing liquidity in an AMM is akin to becoming a market maker. By contributing assets to the liquidity pool, users help facilitate trades for other participants. In return for their service, they earn a portion of the trading fees generated on the platform. This is a crucial aspect of how decentralized exchanges operate.

Benefits of Providing Liquidity:

Earning Trading Fees: Liquidity providers earn a share of the fees charged on trades within the liquidity pool. This can be a lucrative source of passive income, especially for popular pools with high trading volumes.

Token Rewards: Some DeFi platforms incentivize liquidity provision by offering additional tokens as rewards. This is typically done through yield farming programs, where LPs are given native tokens from the platform.

Market Participation: By providing liquidity, users actively contribute to the liquidity and efficiency of the market. This helps to reduce slippage and increase the overall liquidity of the trading pairs.

Risks and Considerations:

Impermanent Loss: This is a key risk associated with providing liquidity. It occurs when the relative prices of the two tokens in a pool change. Liquidity providers may end up with fewer assets than they initially deposited when they withdraw from the pool.

Imbalance in the Pool: If one of the tokens in the pool experiences a significant price swing, it can lead to an imbalance in the pool. This can result in losses for liquidity providers.

Smart Contract Risks: Providing liquidity in DeFi protocols involves interacting with smart contracts, which can be vulnerable to bugs or exploits. Users should exercise caution and conduct due diligence before depositing assets.

Liquidity Lock-In: Once assets are provided to a liquidity pool, they are typically locked in until the user decides to withdraw. This means they might not be easily accessible for other purposes.

In summary, providing liquidity in an AMM can be a rewarding endeavor, offering opportunities for earning fees and additional tokens. However, it comes with inherent risks, including impermanent loss and exposure to smart contract vulnerabilities. It's important for users to carefully consider these factors and conduct thorough research before participating in liquidity provision.

thanks!

Congratulations @blazar-force! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 60 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts: