When in college, I sold cars and what it taught me will forever remain valuable.

Basically, wether you buy a car new or used it's a terrible investment in the long haul. Lets start with new cars. You and your family or girlfriend/boyfriend go out to the dealership and pick out a beautiful new car. It has everything you want in a vehicle and all you can think about is getting it home. You sign the finance papers unless you have the luxury of purchasing outright and drive off the lot. BAM! Your $60,000 investment just became worth $42,000 or less 30%. Now, if you put no money down and got 0% interest for 5 years($1,000/month) that means you're automatically negative $18,000! Over time the vehicle will continue to depreciate and when you're ready to get something new you may owe more than its worth. This is what they call being "upside down" in the industry. If you repeat this process and purchase a brand new car every few years you'll always be upside down and always raising your payments due to your inequity. This is something I feel a majority of people do not understand. To simplify it lets say after 3 years of driving the car you initially purchased for $60,000 you decide to trade. Your payment is $1,000 and if you've paid on time every month you would've paid down $36,000 from the loan, leaving a balance of $24,000. The dealership looks over the vehicle and is only willing to offer $19,000 leaving you $5,000 upside down. This can be mitigated by down payment or having equity in the vehicle. Now you can negotiate with the dealer but its important to still keep this information in mind.

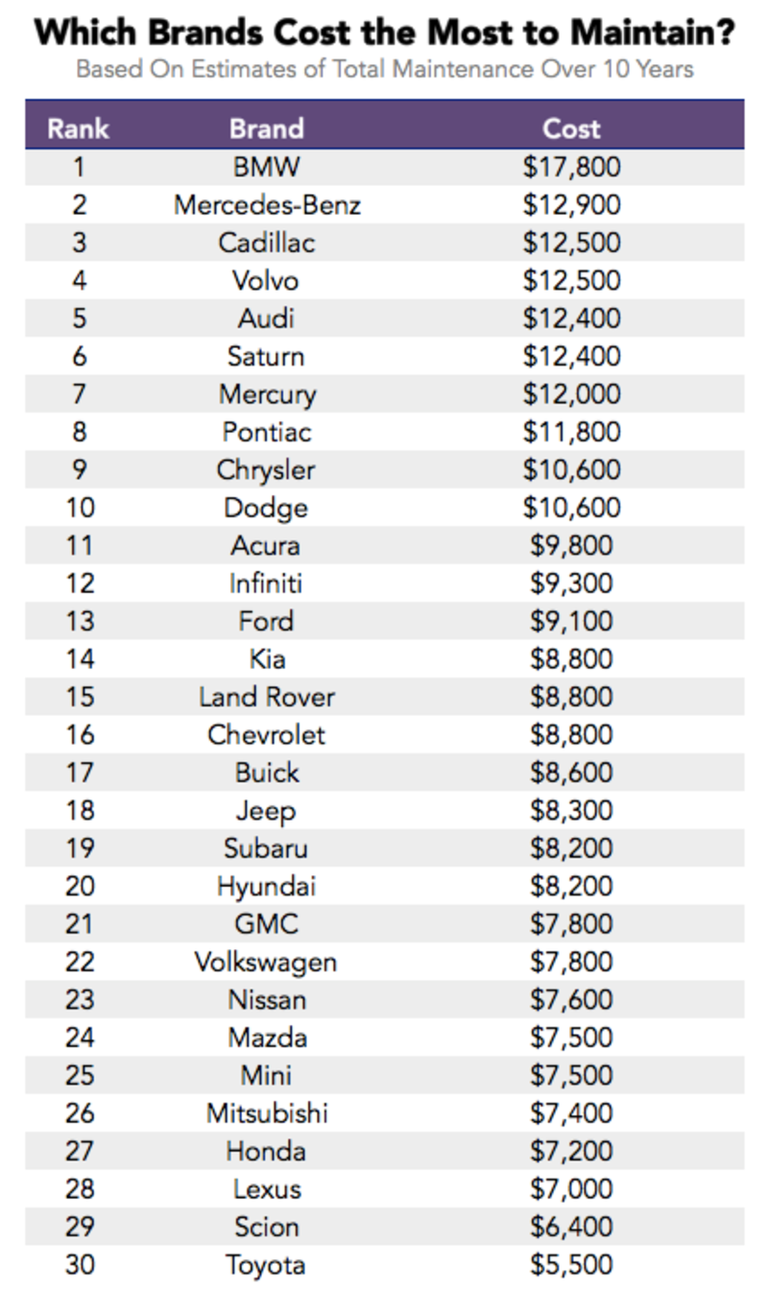

Moving on to used vehicles. They can be at a great discount because you are not taking the initial hit in depreciation(30% if its 6 months old) like the person who bought it new. There is still a problem to making this work in your favor. Pre owned vehicles tend to come with higher interest rates which means that you will end up owing more in interest at the end of the loan than a new car loan. It's stupid I know. You also have to consider that a majority of pre owned vehicles do not come with any kind of warranty. This means repair costs will fall on you and you must account for this in the overall investment. Every vehicle will require at least some kind of maintenance over time and things are always bound to break or malfunction. Brands also vary in maintenance costs so this is essential in making a decision. Its always the unexpected repair costs that gets you. Like a $600 transfer case censor on a BMW I once owned. Ouch.

With all this said, do you still see that shiny new or pre owned car as a good investment? I used to until I worked in the industry and learned the ins and outs. Many people will jump at and buy the car despite knowing this information and if you have the money than go for it. I personally will stick to driving my 2010 Jeep Grand Cherokee which I have a positive stake in when I go to sell. But that is not typical.

At the end of the day everyones financial decisions are for them to make! I hope this article helps!