As we all know, running a store or business requires a range of management, administrative and marketing skills. From making sure that there is ample inventory to assembling monthly reports, these skills are essential to ensure that the business runs smoothly. Further, having a competent point of sale (POS) machines can go a long way to make sure that the operations run placidly and efficiently.

What is a POS System?

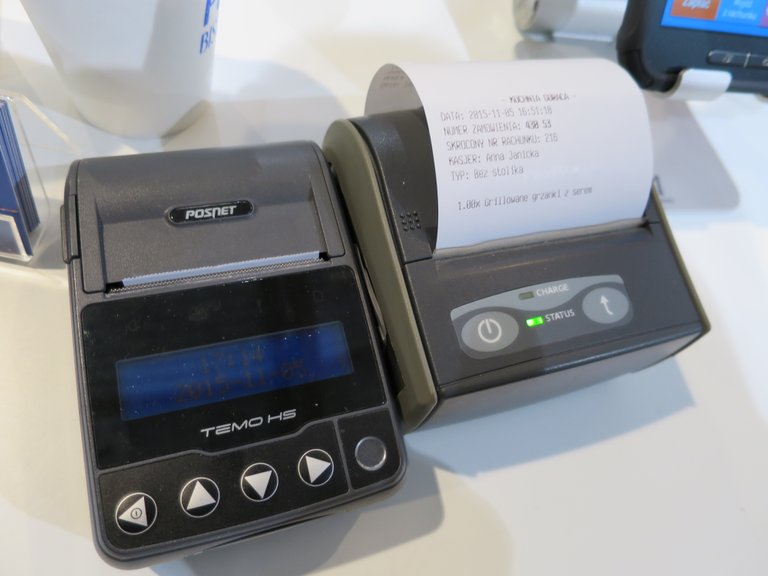

Point of sale systems serve as a tool to handle purchases, automatically calculate discounts, keep a check on inventory and track payroll. It combines several business utilities into a single integrated solution. A POS machine is a terminal that sits beside the traditional cash register to process debit, credit and gift cards that are accepted at the store or business. Apart from streamlining transactions, increasing payment security and connecting several business functions, POS systems offer a lot to the business of varying magnitudes across industries.

Additionally, the increase in the volume of swipes has created opportunities for a merchant cash advance to businesses and entrepreneurs with funds to run and grow the business. Further, several lenders have also extended merchant cash advance loans including NBFCs, and one such name is Clix Capital that provides risk-free loans, customised repayment method, and flexible loan amount.

Moreover, Clix Capital provides quick funding for POS loans to scale up a business and lends a helping hand to solve all the short term hurdles to sustain and stay ahead in the competition curve. The best aspect is that the entire process is based on the history of transactions of a business’s card swipes.

Features of Loan Against POS Machine from Clix Capital

Collateral Free Loan- Risk is the last thing one would want while thinking about working capital loans. There is no collateral required to secure a Loan Against Electronic Payments from Clix.

Swipe Based Loan - One can pay the EMIs daily with every swipe to not worry about paying the installments at the end of the month.

Customized Repayment - It comes with an opportunity to choose a repayment period from 6 to 18 months.

Flexible Loan Amount - The loan amounts range from Rs 2 to 50 lakhs to ensure that the business faces no issues when it comes to expansion.

No Bulky EMIs - Clix Capital takes the responsibility of contacting the POS for a flexible repayment plan whether it be for a product on daily EMIs or a flexi repayment plan or anything else along the same lines.

Eligibility Criteria for Loan Against Electronic Payments from Clix Capital

If the business:

- is an Indian business entity (Partnership/Proprietorship/Private Limited Company/Closely-Held Public Limited Company)

- has a minimum business vintage of 24 months

- has been using a PoS machine for at least 12 months

- has a minimum card sales volume of at least Rs 2 lakhs per month

- has proof of ownership in the name of the applicant & the applicant’s spouse/parents of either the residence or business premises

If the answer to the above-mentioned statements is a yes, then the business is eligible to secure a loan on swipe machine from the leading digital NBFC, Clix Capital.

Running a business that accepts electronic payments (mostly via swipe machines) has become imperative in modern times. And Clix Capital has got the perfect solution for it in the form of working capital loans or loan against electronic payments to help businesses grow with every swipe.