I am posting this on @buynburn account. I will use any HIVE or HBD I receive on this post to purchased failed coins on #hive-engine.

Now For the Post

I can't believe it!

We did it!

In the category of "Play Stupid Games, Win Stupid Prizes" the HIVE ecosystem can now jump up and down in celebration.

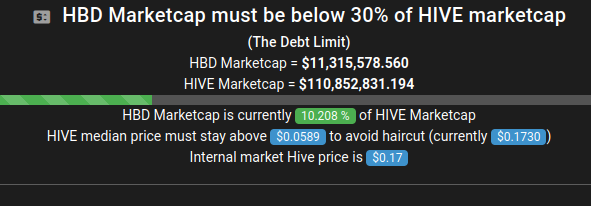

I checked into HBD Dollar Monitor to find that the HBD market cap is now over 10% of the HIVE market cap.

Financial collapse is the prize that people win when they play the game of debt.

To celebrate, I asked Nightcafe to create an image of insane people celebrating.

I was surprised that it took this long.

Of course, HBD really never gained the popularity of UST or the other failed stablecoins.

HBD is a derivative of HIVE. HBD derives its value from HIVE. The conversion operation will destroy the HBD and generate HIVE in its place.

When the witnesses raised the interest on HBD to 20%, I was expecting to see a large number of institutional investors jump in to take advantage of the high interest.

What happened is the investors is that investors looked at the HBD formula. They realized that the HBD/HIVE formula and realized that the 20% interest on HBD created an unstable structure.

Geek Girl produces monthly reports on this slow moving train wreck.

Her reports show that we paid $133,454 HBD interest in June. If converted at $0.172, this HBD would produce 775,000 HIVE.

The HBD dropped from 133,454 to 126,956 in July.

The @geekgirl report confirms something that I've noticed about HBD.

People save HBD when the price of HIVE rises. They dump HBD when the price of HIVE falls.

The interest on HBD costs the platform way more than 20%.

We are currently experiencing the high point of the HBD experiment.

The crossing of the 10% marcap is the great milestone of HBD.

The sad truth is that HIVE is likely to start experiencing the downside of massive debt in the future.

As mentioned, the market has to absorb 778,000 HIVE a month to cover the interest on HBD.

The scary mathematics happens when the price of HIVE drops to a dime.

Ausbit says that there's 11 million HBD. Much of this is held by smart people.

People are likely to panic as HIVE drops below a dime. I would not be surprised to see people convert 5 million HBD to HIVE. 5 million HBD at a dime would dump 50 million HIVE onto a depressed market.

Who is going to buy this 50 million HIVE?

HIVE holders would be reeling from the devaluation of their investment. HIVE authors will be reeling from the continued drop in their earnings.

The HIVE authors who were depending on HIVE to pay expenses will have to accelorate their selling of HIVE.

The investors in HIVE Engine have already been destroyed. We will simply see more and more things break as the system implodes.

Celebrating the Mile Mark

I wrote this post to celebrate the greatest milestone on HIVE.

The HBD marketcap is now over 10% of HIVE.

This milemark has been the primary focus of the witnesses since the decision to raise interest on HBD to 20%.

We should celebrate.

Buying and Burning HE coins

I feel bad for raining on the parade. I will use any rewards from this post to buy and burn some of the failed HE coins.

I admit, most of the HE projects were lame. I was hoping that there would be better development on HE.

The 20% on HBD created a dynamic where it is impossible for the HE coins to compete.

I will buy up some of the failed coins has it helps people recover from their failed dreams.

I think I will burn another 1,508 VYB as it has been dropping of late. I've burned 5412 VYB so far. This brings my total to 6,920 VYB . The VYB marcap has fallen to $498. It appears that i am the only buyer. VYB won't hold.

There is no way we can burn our way out of the hole dug by the HBD debt.

Play Stupid Games. Win Stupid Prizes

The 20% interest on HBD was a stupid game. The game creates down pressure on HIVE when the market is weak. The low price of HIVE is the prize for HBD debt.

At least we are getting to be entertained by watching a platform being destroyed by debt. I want to give all the witnesses who supported the 20% applause for their stupidity as it takes bold form of stupidity to support debt.

Buying and burning tokens doesn't help much. The right thing to do would be to buy BEE and create a pool in the VYB:SWAP.HIVE pairs (maybe ask @trostparadox, @scholaris, @calumam to use POB funds from an account like @x-1pob-1vyb to create the pool).

The problem with H-E tokens is that the majority of those who have the token will vote for those who only use the Tag, but are not participating in the community, so the community doesn't grow and those who use the Tag will see the token as an airdrop and will just sell the token and that's it. H-E will only have a future when they treat the token as a community and not a simple tag.

Other tokens are similar to PALnet, they left the DAO released on the tribaldex, the community doesn't even care, those who hold it don't care, so someone went there and stole with DAO proposal 50 million PAL tokens and destroyed the price.

That said, I tell you that the problem with H-E tokens is not HBD's APR, but how they are managed.

Ah, that is funny.

Karma is real.

HBD is the greatest thing in human history.

How dare you imply that debt is a bad thing. Why the political party I support increases the debt every time it is in office (this applies to both parties).

Debt must be a good thing if our leaders are so keen on pushing it on the masses.

Here is the Proof of Burn #pob. It is a pathetic 1508 VYB.

https://he.dtools.dev/tx/6812fd21db564db1e987defd3d67c4aa424553d1

The LOL tag should add some really humor to this thread.

#LOL

It’s true that I sell all of my HBD right now because it lands me a shit ton more hive that I use to power up! I don’t know if a lot of people do that but I know several dozen that do.

There may be issues with HBD but how could we hope to attract bigger fish if we only have 11 million HBD? We need hundreds of millions.

I converted my HBD to HIVE last month thinking that 0.22 would be the low price for HIVE.

I put the money in HIVE Engine. That is a place where money goes to disappear.

!WINE

I say we pass more proposals and print more HBDs.

I don't mind the proposal system. The proposals are supposed to fund the creation of things. There is a catch proposal that burns the HBD.

The 20% interest on HBD creates coins that don't do anything except push down the price of HIVE.

That is incorrect. One of the primary purposes of Hive is to enable investors to attain ROI. Prior to the increase in the return on HBD, almost the only overt way to attain to ROI was for holders of Hive to generate curation rewards. This created a financial purpose for curation that deprecated actual curative intent. Rather than upvote 'quality' posts - whatever quality standards consumers apply - investors upvoted posts to gain financial returns, which created incentive to form circlejerks, bot farms, to buy votes, to frontrun pandering, and for reasons related to curation reward metrics that have nothing to do with the quality of the content of the posts. A quick look at Trending, particularly during the heyday of bidbots, reveals that such financial incentives utterly derange curation and dramatically reduce the quality of content on Hive.

Implementing the 20% return on HBD enabled investors to achieve ROI without deranging curation, which has had a beneficial impact on content quality on the platform by reducing the use of staked Hive to curate only in order to gain curation rewards because that stake was instead parked in HBD. It also increased Hive's potential to attract investment by providing an ROI mechanism to investors other than dodgy curation rewards.

Social media has rapidly become the largest financial sector in global markets, and this shows that Hive's blog usecase has enormous potential for upside, far more potentially rewarding than any other use case.

The ratio of HBD to Hive is ~1/3 that at which the HBD 'haircut' is required to prevent debt from overwhelming the Hive currency value. We're nowhere close to that point today, and HBD continues to benefit free speech and content quality, which is arguably the platforms vastly greatest potential to raise token price, suppressed because attracting outside investment threatens extant control of governance, as Steem demonstrated (and BlackRock reveals is endemic to plutocracy).

@edicted has posted several times regarding stable coins and shown that HBD FUD is baseless. I recommend having a look at those posts and considering the analysis he has provided, as well as understanding how ROI is facilitated and curation rewards are mitigated by HBD interest. The quoted statement reveals you completely ignore those, and other, benefits of nominal HBD interest.

HBD savings, for example, increase funds available to invest in development. People take out loans for reasons, and without debt the world would be without one of the most powerful vehicles for commercial development. Hive could certainly invest better than it does, but that requires better use of funds, rather than reducing funds available for development.

To play devil's advocate, you could drop the interest rate on HBD as low as 12% and still exceed what you could get from hive interest+curation and provide a greater return than most traditional investments (on average).

Having said that, I don't see an immediate need to reduce interest. I guess a better discussion might be under what conditions should a reduction be considered?

Indeed, the ~9% premium over the historical ~11% return on stocks is intended to attract stake that would otherwise be invested elsewhere. I prefer to allow the current offer to continue to demonstrate reliable returns, because prudent management of funds will await historical demonstration of stability and security of the vehicle. It would be rash to now raise that rate, despite upside room to as much as 25% or more, and I see no reason other than FUD to lower it, presently. Slow and steady wins the race to financial security, and extreme hype would attract aggressive speculation, while reduction to marginally improved returns would not overcome FUD regarding Hive. 20% feels like a sweet spot to me, and I expect it came of substantial consideration prior to it's implementation.

The value of HBD comes from HIVE. This is easy to prove because HBD was holding its peg before the the raise in the interest rate.

Yes, the HBD price tends to be slightly lower than $1.00. The easiest way to raise the HBD price to $1 would be to change the conversion formula so that it generated $1.01 in HIVE.

Originally the haircut hit at 10%. So, we just crossed the original haircut.

That's what people thought would happen when they raised the rate.

The price of HIVE has been in steady decline since the decision.

HBD Interest Crashed HIVE-Engine

It is easy to prove that the 20% interest on HBD accelerated the decline of HIVE Engine.

If you look at the history of honey-swap; you would see that a large number of players pulled their funds from HE and put the funds into HBD. You will also see that 20% interest on HBD reduced the flow of funds into HE.

The 20% interest on HBD failed to bring in new investors. It managed to "derange" the curation of both HIVE and HE coins which is shown in the deep decline of the coins ever since.

!WINE

I'm not saying these things didn't happen. I point out that the oligarchy can only maintain it's plutocratic control of Hive as long as it doesn't incite outside financial interest from relatively small investors, like Sun Yuchen. Trying to maintain the oligarchy on Hive requires a delicate balancing act, because they need to maintain ROI without facing hostile takeover. That seems to require a shrinking userbase and declining token price, because sharks are circling, looking for ROI.

HBD's 20% return offers a way for sharks to invest in Hive without changing it's paradigm, to prevent Hive from suffering Steem's fate and the extant oligarchy from losing control of governance, IMHO. This is your real problem with 20% interest on HBD, that it works to attract that stake and dampens ambition, as it is implemented to do. The DHF transforms the Damoclean sword of the Founder's stake into a mechanism to redistribute that stake to the remaining oligarchy through proposals, such as HBD Stabilizer, Valuplan, HW, SPL, and etc, that may promote growth rhetorically, but do not threaten it in actuality.

Actual growth is no less an axe poised above Hive's neck than was the Founder's stake, as Steem shows.

Edit: I am confident that any mechanism that potentiates growth without facilitating the subsumation of Hive by BlackRock or lesser stakes would be eagerly adopted by extant stakeholders. What would you propose?

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.BEERHey @enforcer48, here is a little bit of from @isnochys for you. Enjoy it!HIVE .We love your support by voting @detlev.witness on

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.BEERHey @enforcer48, here is a little bit of from @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.BEERHey @enforcer48, here is a little bit of from @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Coinmarketcap has the price of HBD at $1.03. If people were dumping it, would the price not fall? I can't speak to what might happen but so far it doesn't look like there has been a big dump.

I usually follow Coin Gecko. It shows sharp fluctuations in the price of HBD during the recent dip.

This is the chart from Coin Gecko.

This is the chart from CoinMarket Cap:

They both show fluctuations.

Since one can convert between HBD and HIVE the charts really just reflect the the conversions.

To really figure out what is going on, I would need to figure out how to parse the blockchain and follow conversions.

What I usually do is just follow the reported market cap on the Ausbit page. The reported market cap of HBD has fallen about two million HBD during the last dip. Unfortunately, I don't know a chart that shows the market cap.

Neither one of you have bothered to check which markets Coinmarketcap and coingecko are actually aggregating. Both of them get their data from Korean exchanges that have zero liquidity, high spread, and zero access to the outside world. These numbers are completely disconnected from the actual value on the internal market. It's less than worthless misinformation. The actual peg is much much tighter than what's shown here (due to the stabilizer proposal).

Fluctuations compared to what? Here is the 1 year chart from coinmarketcap. I don't see anything that looks much out of the ordinary recently. $1 +/- 5% seems pretty normal:

Volume did heat up (or at least coinmarketcap says volume has dropped 90+% in the last 24 hours) but price seems to have remained about as stable as it typically is. You can argue the price has been more volatile but it thus far has stayed within a reasonably narrow (and typical) range.

I'm not arguing that too much debt isn't bad. Of course it is. I'm not sure that 10% is "too much" though. The fact that HBD has remained in its typical range would seem to back that up...for now.

Neither one of you have bothered to check which markets Coinmarketcap and coingecko are actually aggregating. Both of them get their data from Korean exchanges that have zero liquidity, high spread, and zero access to the outside world. These numbers are completely disconnected from the actual value on the internal market. It's less than worthless misinformation. The actual peg is much much tighter than what's shown here (due to the stabilizer proposal).

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.BEERHey @yintercept, here is a little bit of from @isnochys for you. Enjoy it!HIVE and on HIVE Engine.If you like BEER and want to support us please consider voting @louis.witness on

The negative effects of HBD are not just the interest payments, but the incentives. Who will stack Hive when the value is being extracted through HBD (plus the DHF)?

Congratulations @buynburn! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 700 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Burning tokens does not benefit existing token holders, or anyone else, imho.

Follow this link to read my thoughts about token burning:

To burn or not to burn ... I say don't burn crypto (or bridges or witches, maybe ducks are okay)

Also, HBD APY is not to blame for this bear market. Lowering the APY now runs the risk of making things even worse.

With that said, I and others have been discussing (for quite some time, now) the need for L1 HBD time vaults, so that those who are earning higher-than-traditional APYs are required to make long-term commitments in exchange for those additional earnings.

HBD transferable bonds are another important L1 feature that need to go hand-in-hand with L1 time vaults. I discussed this very briefly during my presentation at HiveFest last year.

!BBH

@eolianpariah2 likes your content! so I just sent 1 BBH(4/5)@buynburn! to your account on behalf of @eolianpariah2.

(html comment removed: )

)