##Week 39 - Sept 27 Investment Moves

- Current US market

- Sept 27 - Option Trades for today

- Stock PURCHASE in 2024 (So far)

- Bitcoin/Ether moves

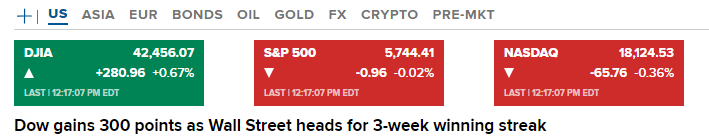

Current US market - 12:17 pm (EST).

Here is how the US market are trending right now:

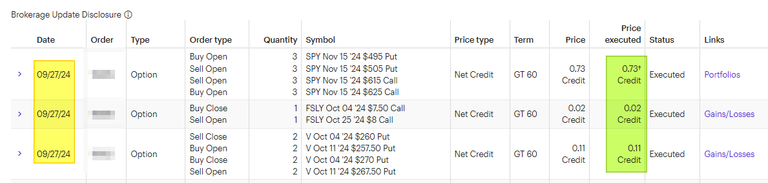

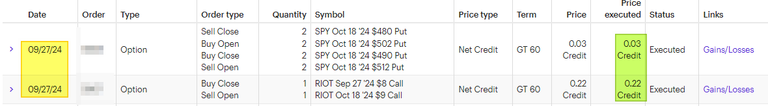

Sept 27 - Option Trades for today

Here are my trades for today.

Summary:

- Open new Iron Condor on SPY for Nov 15 for $73 in premium.

- Rolled FSLY covered call for $2.

- Rolled V put create spread for $11 each by moving out one week and down one strike price.

- Rolled SPY Iron Condor (PUT side) for $3 (Adding risk back into the trade on the PUT side.

- Rolled RIOT covered call out 3 weeks and up $1 in strike price for $22.

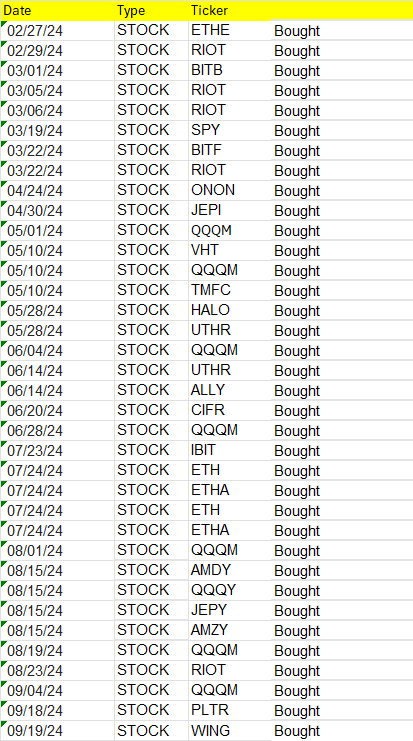

Stock PURCHASE in 2024 (So far)

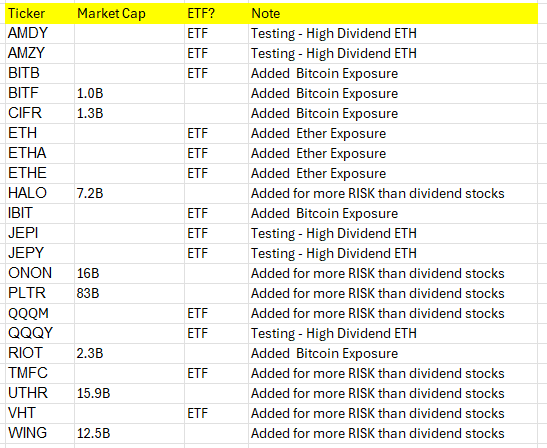

What stock have I purchased so far in 2024? Several months ago, I posted what I'm doing to remove boring DIVIDEND stock and how I'm using the DIVIDEND payment to buy other holdings. This means I'm not using CASH from a paycheck to fund these purchases.

This week GILD paid a dividend on Sept 27. I sold off like $400 (5 shares @ $82.75) and purchased 20 shares of BYRN. Why do all this? I own lots of boring "stable" dividend stock. However, I still working and I don't need income-type investment, so I have been moving out of that and adding more SMALL CAP or higher-risk stock. Most of my new investments are under 20B in market cap (except for Palantir).

Bitcoin/Ether moves

This week has been a good week for digital assets:

I am glad that I did most of my Bitcoin/Ether moves earlier this year and last year. History has suggested that it can take between 12-18 after the halving to hit new highs before downtrending. Since I have a small percentage allocated to Bitcoin/Ether (less than 2%), this asset class will not change my life even if it goes up 5x, 10x, or 20x.

Have a profitable day!

Posted Using InLeo Alpha