금일 현재

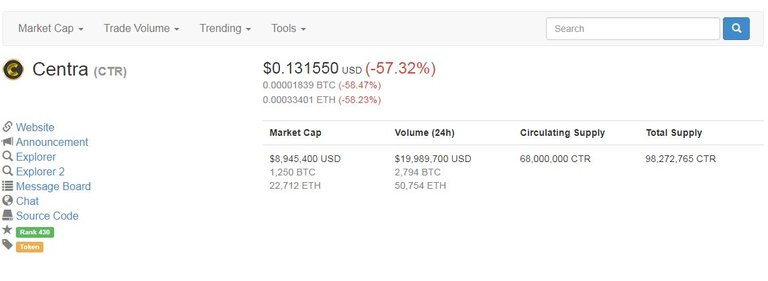

센트라 대표 사기협의로 체포 소식으로 인하여 센트라는 -57%가 넘는 손실이 발생하였습니다

거래량의 상당수는 바이낸스에서 이루어지고 있으며 scam코인으로 인하여 선량한 투자자들이

피해를 입게 되었다

기사내용에서 발췌

2018년 4월 2일 워싱턴 DC

증권 거래 위원회는 오늘 지난 해 수천명의 투자자들로부터 3천 2백만달러 이상을 모금한 최초의 위조 지폐 발행과 관련하여 소위 금융 서비스 개시를 주도한 두명을 기소했습니다. 형사 당국은 두 피고인을 별도로 기소하고 구속했습니다.

SEC의 불만 사항에 따르면 Sohrab"Sam"Sharma와 CentraTech의 공동 설립자인 RobertFarkas는 비난 받고 있습니다. 주식 회사는 Centra가 "CTR토큰"을 통해 미등록 투자를 제공하고 판매하는 사기성 ICO를 관리했다. 예를 들어, 그들은 사용자들이 쉽게 말할 수 없는 암호문을 미국 달러나 다른 법적 입찰가로 즉시 변환할 수 있도록 비자와 마스터 카드가 지원하는 직불 카드를 제공하겠다고 주장했다. 실제로 센트라는 비자나 마스터 카드와 아무 관련이 없다고 주장한다. SEC는 또한 ICO를 홍보하기 위해 샤르마와 파카스가 인상적인 전기를 가진 가상의 경영진을 만들어 센트라의 웹 사이트에 거짓 또는 오해의 소지가 있는 마케팅 자료를 게시하고, 그리고 소셜 미디어에 ICO를 홍보하기 위해 돈을 지불했다고 주장한다.

고소장에 따르면 파카스 씨는 출국 예약을 했으나 탑승하기 전 체포되었다고 한다. 범죄 당국은 샤르마를 체포했다.

SEC Halts Fraudulent Scheme Involving Unregistered ICO

FOR IMMEDIATE RELEASE

2018-53

Washington D.C., April 2, 2018 —

The Securities and Exchange Commission today charged two co-founders of a purported financial services start-up with orchestrating a fraudulent initial coin offering (ICO) that raised more than $32 million from thousands of investors last year. Criminal authorities separately charged and arrested both defendants.

The SEC's complaint alleges that Sohrab “Sam” Sharma and Robert Farkas, co-founders of Centra Tech. Inc., masterminded a fraudulent ICO in which Centra offered and sold unregistered investments through a "CTR Token." Sharma and Farkas allegedly claimed that funds raised in the ICO would help build a suite of financial products. They claimed, for example, to offer a debit card backed by Visa and MasterCard that would allow users to instantly convert hard-to-spend cryptocurrencies into U.S. dollars or other legal tender. In reality, the SEC alleges, Centra had no relationships with Visa or MasterCard. The SEC also alleges that to promote the ICO, Sharma and Farkas created fictional executives with impressive biographies, posted false or misleading marketing materials to Centra’s website, and paid celebrities to tout the ICO on social media.

According to the complaint, Farkas made flight reservations to leave the country, but was arrested before he was able to board his flight. Criminal authorities also arrested Sharma.

"We allege that Centra sold investors on the promise of new digital technologies by using a sophisticated marketing campaign to spin a web of lies about their supposed partnerships with legitimate businesses,” said Stephanie Avakian, Co-Director of the SEC's Division of Enforcement. “As the complaint alleges, these and other claims were simply false."

"As we allege, the defendants relied heavily on celebrity endorsements and social media to market their scheme,” said Steve Peikin, Co-Director of the SEC's Division of Enforcement. “Endorsements and glossy marketing materials are no substitute for the SEC’s registration and disclosure requirements as well as diligence by investors.”

The SEC’s complaint, filed in federal court in the Southern District of New York, charges Sharma and Farkas with violating the anti-fraud and registration provisions of the federal securities laws. The complaint seeks permanent injunctions, return of allegedly ill-gotten gains plus interest and penalties, as well as bars against Sharma and Farkas serving as public company officers or directors and from participating in any offering of digital or other securities. In a parallel action, the U.S. Attorney’s Office for the Southern District of New York today announced criminal charges against Sharma and Farkas.

The SEC's investigation, which is continuing, is being conducted by Jon A. Daniels, Luke M. Fitzgerald, and Alison R. Levine of the SEC's Cyber Unit and New York Regional Office, and supervised by Valerie A. Szczepanik and Robert A. Cohen. The litigation is being conducted by Mr. Daniels, Mr. Fitzgerald, and Ms. Levine, and supervised by Ms. Szczepanik. The SEC appreciates the assistance of the U.S. Attorney’s Office for the Southern District of New York, the Federal Bureau of Investigation, and the Financial Industry Regulatory Authority.

Investors in the Centra ICO who believe they may be a victim should contact www.SEC.gov/tcr. The SEC's Office of Investor Education and Advocacy has issued an Investor Bulletin on initial coin offerings and additional information is available on Investor.gov and SEC.gov.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.sec.gov/news/press-release/2018-53