We did a thorough review of CEX, a cryptocurrency exchange which claim it can send funds onto your credit card, but we found their fees are high.

Updated 12 March 2018. v1.0.

Disclaimer: We are not affiliated in any way to these Companies, this article is 100% our findings. There is no affiliate marketing in place through the links provided below, they’re for your convenience.

Contents of this article:

- What is CEX?

- Registering.

- Trading.

- Fees and charges.

- Types of accounts and limits.

- Pros and cons.

- Conclusion.

1- What is CEX?

In the beginning, CEX was known as Ghash.io when it launched in 2013 in London, as a Bitcoin cloud mining provider with a market share of about 42% of the total mining power of the Bitcoin Network. It has since closed down its mining services since January 2015. It is now an online currency exchanger where you can purchase the cryptocurrency on offer (Bitcoin, Ether, Ripple, Bitcoin Gold etc.) for fiat money like US dollars “$”, Pounds “£”, Euros “€” and Russian Rubble “₽” all with your debit card in a secure environment.

2-Registering.

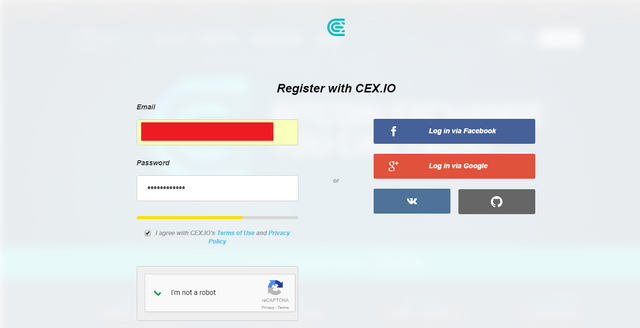

Step 1: Registering.

· Enter the URL cex.io into your browser.

· Click on register.

· Enter your details, you can register with either your email address, Facebook or Gmail. We advise to use a secure email provider, read our article Tutanota vs Protonmail We also suggest you use a dedicated alias for CEX, read our article It’s time to get rid of your email.

· A confirmation email will be sent to your email address to confirm your account.

Step 2: Setting up security.

· After registration and confirmation of your email address, you will need to set your account security. We strongly recommend using 2FA to protect your account.

Step 3: Add your debit or credit card to your account.

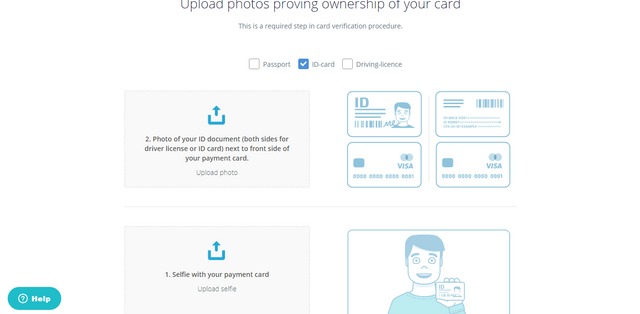

· You need to verify your identity before you can carry out any transaction on CEX. Credit card verification usually takes about 48 hours or less. Once completed you can purchase any cryptocurrency of your choice into your account instantly.

· To do this click on deposit, choose your payment method and add a new card.

· CEX requires you to upload photos proving ownership of your card, you can either upload a passport, an ID-card or a driver’s license. You will be required to upload a picture of yourself holding your debit or credit card.

Note: if the quality of the picture isn’t up to standard, you may be required to take another by a CEX compliance officer.

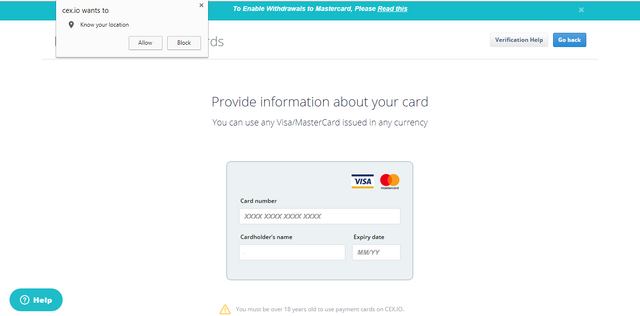

Step 4: Provide information about your card.

· Enter the details on your credit or debit card.

· CEX requests for a small verification charge in order to verify the card, you will be required to enter the exact amount that will be charged to the card, it is usually in USD. Once the verification is complete, the charge is refunded to the users automatically.

· You can add more than one credit card.

3-Trading.

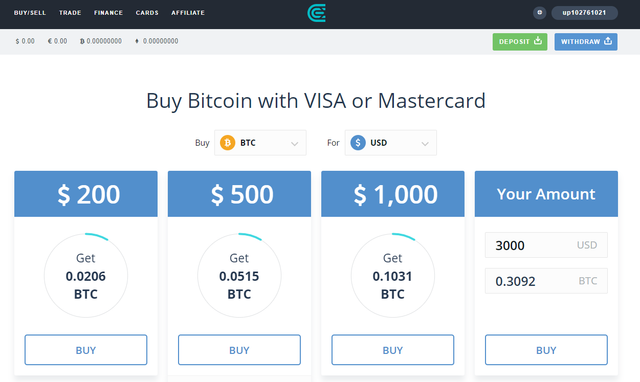

· The first thing is to follow the above steps and fund your account with fiat money (USD, EUR and RUB). Once that is done, you can trade successfully.

· Once you enter a trade, CEX automatically calculates the price and freezes it for approximately 2 minutes.

· Enter the amount of money you wish to spend and you see its Bitcoin equivalent that you’ll get.

· Pressing the Buy/Sell button, the system verifies that you have adequate funds for the trade.

· If the conditions you agreed on in the market is the same, favorable or not worse, your order is filled. But, if there is a sudden increase in the exchange rate, you order will not be executed but you’ll be properly notified.

· After the trade is confirmed, your order is matched to other orders on CEX and your balance is duly rectified.

4-Fees and charges.

· CEX charges a fee of 7% as service charge on every amount you pay using fiat currency. What this means is that if you buy Bitcoins of a $100 worth, your account is credited with $93. This is applicable only when you buy directly from CEX.

· Different fees apply when you use CEX’s trading services, first you fund your CEX account with a credit card and pay 3.5% + $0.25 / £0.20 as commission or with a bank account with no commission. Once your card is verified, credit card purchases are processed almost instantly.

· Per trade you enter, you pay %0.02 as commission per transaction, this depends on what part you play in the trade.

· CEX operates a Fill-or-Kill orders meaning that they fulfill all their orders at the rate they offer without exception. Users who enter a trade are assured that it is what was agreed upon that they’ll get.

5-Types of accounts and limits.

CEX offers three types of accounts which have various transaction limits on them. Having a verified account makes it easier to upgrade without which processing may take a while. The minimum amount of Bitcoin that can be bought is 0.01 BTC, while the maximum amount is pegged at 10 BTC. Here are the different accounts available on CEX;

· Basic: the trade limit on this account is set at $500 per day and a maximum of $2,000 per month for Bitcoin and Ether. A government issued ID is the only requirement for having a Basic account.

· Verified: the trade limit for verified account holders is $10,000 per day and $100,000 per month for both Bitcoin and Ether. A government issued ID and a proof of residency are the requirements to get verified.

· Verified Plus & Corporate: there is no limit to the amount of Bitcoin or Ether for users of this account to trade with.

Withdrawal limits are set to €2,000 per day and a maximum of €50,000 per month or its corresponding value in other currencies. With CEX users can withdraw their funds directly on their debit or credit card with ease.

For credit card withdrawals, CEX charges a fixed rate of $3.80 / £2.90 and an extra 1.2% if the user is using a MasterCard credit card. Bank withdrawals are the most expensive, for every transfer CEX charges a fixed rate of $50. Verified users are given a reprieve by using Crypto Capital for their withdrawals. They’re a private banking fiat capital service based on the Blockchain platform, and they charge 1% per withdrawal.

6-Pros and Cons.

Pros:

- It is one of the oldest and most trusted Bitcoin exchanges in the market.

- Their security is quite solid especially with 2FA.

- The only security breach which was immediately patched happened when the company was still young in 2013 and none has been reported after that.

- It supports 4 fiat currencies: USD, EUR, RUB, and GBP whereas most exchanges support one or two currencies.

- The support team responds quite fast to tickets and customer complaints.

Cons:

- The 7% service charge per amount paid with fiat currency is on the high side.

- A lot of users complain of other hidden charges.

- As at the time of writing, the site had a bug on its credit card verification page which had not been fixed.

- There are a lot of restricted countries on CEX’s list making their services not available to everyone.

7-Conclusion.

The fees are too high for purchasing cryptocurrency regularly or for trading. The Unique Selling Point lies in the ability to withdraw directly on your verified credit cards, especially Visa cards as Mastercards attract additional fees. Instead of waiting for dedicated cryptocurrency debit cards to be widely available, like TenX or BitPay, you can immediately start spending your earned cryptocurrency right from your usual credit card, which will help mainstream people adopt cryptocurrency for day to day payments, that could be valuable for international consultants for example.

General effort put into review. I don't know why an exchange would put in a 7% fee, but hey, it's for simplicity's sake.

Thanks, the high service charge is the main reason we consider it a con...

I don't disagree.

Hi, great post, have followed you. What do you think of the current state of the Bitcoin market?

Thanks for following, my take on the bitcoin market is; it's time to start buying... This new lows won't last forever