Go out today, do you have a wallet?

What do you pay for without wallet?

I believe almost half of people will answer "Alipay."

Today, there are countless third-party trading platforms in China, such as TenPay, Baidu Wallet, Yibao, Quick Money. The highest utilization rate is the WeChat payment and Alipay.

In fact, China's first third-party trading platform is Alipay. Now as long as people who buy on Taobao, will register Alipay. Alipay in the hearts of people like a reference to the Tablet PC, the first thing that can be thought of is the iPad, but when it comes to talking about third-party trading platform is the first.

Alipay's past lives

October 18, 2003, Taobao launched the first Alipay service.

In 2004, Alipay spin-off independence from Taobao, and gradually to more partners to provide payment services, developed into China's largest third-party payment platform.

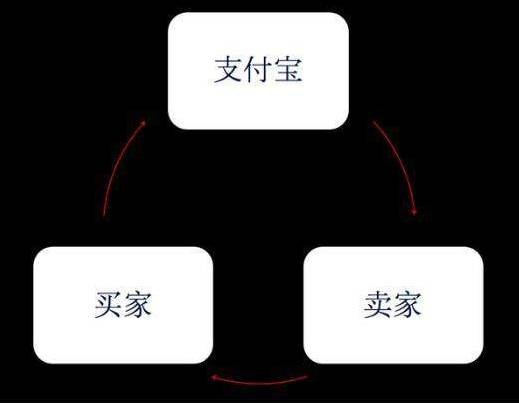

From the first day of Alipay's birth, Alipay is a guaranteed transaction. At a time when online trading in China was still in its brutal phase, Alipay as a payment intermediary reduced the risks for buyers and sellers, which of course were primarily buyer risks, which allowed Taobao to grow rapidly and even beyond eBay and eBay.

Alipay builds credit for our deal

At the time, when business integrity was not established, as the first cornerstone of honesty, Alipay had an important and fundamental role in the big Taobao system. It allows buyers do not have to worry about digging money, receive goods, or receive the goods are not satisfied with no way to deal with.

At that time in order to quickly open the market, in 2005 Alipay launched "full payment" payment, put forward "you dare to use, I dare to lose" commitment to promote Alipay.

Today's business environment has changed a lot compared with 2004. Now that we are shopping in WeChat or buying things through Taobao, we are less concerned with the issue of merchant shipping. I am afraid ordinary Internet users rarely know how the guarantee transaction is one thing.

Alipay development list

Have to say, Alipay every move, all affect China's economic change and changes in people's consumption patterns.

Book then text, continue to review Alipay more than 10 years of innovation step by step the road.

February 27, 2008, Alipay released mobile e-commerce strategy, launched mobile payment services.

October 25, 2008, Alipay public utility payment formally launched to support water, electricity, coal, communications and other payment.

December 23, 2010, Alipay and Bank of China, the first launch of quick payment by credit card.

On May 26, 2011, Alipay received the first "Payment Business License" (in the industry, also referred to as "payment license") issued by the Central Bank.

In June 2013, Alipay launched account surplus value-added service "Yu Bao Bao". With YuBao Bao, users can not only get higher returns but also pay for and transfer out anytime without any handling fee.

November 13, 2013, Alipay mobile payment users over 100 million, "Alipay wallet" users amounted to 100 million, Alipay wallet officially announced an independent brand.

November 30, 2013, 12306 website supports Alipay purchase train tickets.

December 31, 2013, Alipay real-name authentication users more than 300 million.

In 2013, Alipay Mobile Payment completed more than 2.78 billion transactions worth over 900 billion RMB and became the largest mobile payment company in the world.

According to data from iResearch, since the first quarter of 2013, Alipay has gradually raised its market share in mobile internet payment from 67.6% to 78.4%, ranking the first place.

As of the end of 2013, the number of Alipay real-name certified users exceeded 300 million. In 2013, the peak value of Alipay's single-day transactions reached 188 million. Among them, the single-day mobile payment transactions peaked 45.18 million, the peak daily mobile payment reached 11.3 billion yuan.

On February 28, 2014, the balance of Bao users exceeded 81 million.

March 20, 2014, Alipay daily mobile payment number of more than 25 million.

In 2015, Alipay Wallet 8.5 version, in wallet "exploration" second page, the more a "My Friends" tab, after entering the transfer interface, you can send text, voice, pictures and other information directly with each other.

May 27, 2015, Alipay large-scale failure. Response: Hangzhou fiber was cut off.

July 8, 2015, Alipay released the latest version of 9.0, joined the "business" and "friends" two new first-level entrance, respectively, "service window" and "exploration", which cut into the offline life services and Social field. In addition, also added a family account, IOU, group accounts and a series of functions.

September 25, 2015, Alipay and McDonald's big data cooperation, all in Shanghai, McDonald's will be able to use Alipay to pay, and will be further extended to the national stores.

January 12, 2016, Ant Financial released the 2015 annual Alipay bill.

May 20, 2016, Samsung Mobile Payments Service Samsung Pay and Alipay formally announced the cooperation, allowing users to quickly bring up their payment interface on Samsung mobile phones by sliding the screen up.

On May 31, 2016, Alipay and Shenzhen Municipal Bureau of Human Resources and Social Security co-operation of health insurance mobile payment platform, started in Shenzhen six hospitals landing test run.

In September 2016, Alipay announced that as of October 12, 2016, it will charge a service fee of 0.1% for individual users over the free limit. Individual subscribers will enjoy a total free cash allowance of RMB 20,000 per person.

November 1, 2016 Alipay settled in the Apple App Store, mainland China users have been able to see Alipay in the App Store payment methods and recharge two places, can be used to purchase applications, to recharge the account, or to Apple Music subscription Service payment and so on.

On the afternoon of November 27, 2016, Alipay launched the "White Collar Diary" and "Campus Diary" after its launch of "High-end Single Dating Circle." Alipay response, the function is still in the gray test stage.

On November 29, 2016, in response to a dispute over the recent Alipay campus diary and other circles, Peng Lei, chairman of Ant Financial Holding, a parent company of Alipay, released an internal letter today to apologize and post on the net. Never blame others!

December 23, 2016, Alipay launched the Alipay 10.0 version, bringing Alipay AR real red envelopes play.

January 5, 2017, Alipay launched 2016 annual bill, netizens fried pot. Many people read the last year's "chop hand" situation, have laments, "I do not know I am so rich!" "No wonder you are so poor!" Do not rush to scold their own prodigal, online bill does not mean "online shopping" concept , You do not really spend so much money online shopping. In addition to spending and spending, personal bills also record low carbon and environmental protection, charity and other public welfare, a comprehensive display of the modern concept of life and appearance.

On May 24, 2017, Alipay announced the launch of Hong Kong version of its e-wallet, Alipay HK, which formally provides cashless services to Hong Kong residents. Hong Kong version Alipay on the line, all Hong Kong residents can bind local banks in Hong Kong by credit card or recharge the use of Alipay, direct payment in Hong Kong dollars

This is Alipay's first overseas version of App. As early as 2007, Alipay started to serve the Hong Kong market. In August last year, the Hong Kong Monetary Authority released a third-party payment license and Alipay Hong Kong became the first payment licensee to provide digital financial services to local users. After six months of preparation, Hong Kong version Alipay finally on the line.

Functionally, the Hong Kong version of Alipay provides sweep code payment, business offers and set three printing services. Among them, the sweep code payment and the use of the Mainland experience exactly the same, just open the payment code, allow merchants to complete the payment scan.

In addition to the basic functions mentioned above, in the future, the Alipay Hong Kong version will gradually launch such functions as charging telephone charges, water and coal charges, transfer of funds, taxis and insurance to keep Hong Kong people's "cashless" life in line with the Mainland.

In June 2017, Monaco signed a strategic cooperation agreement (MOU) with Alipay, and merchants in Albania will access Alipay. This is the first time Ant Financial signed a strategic cooperation agreement with the government of a sovereign country and became the 12th European country to access Alipay.

On October 10, 2017, Alipay announced the launch of online credit lending platform, taking the lead in promoting credit leasing in eight cities of Shanghai, Beijing, Shenzhen, Hangzhou, Nanjing, Chengdu, Xi'an and Zhengzhou. Over 1 million apartments will be officially opened in Alipay. Rather than pay the three pillars of this rental the most common form of payment, sesame credit over 650 points through the Alipay APP rental apartment, you can save a deposit, rent can be paid on a monthly basis.

The future, look forward to Alipay brought a new surprise.

今天出门,你有带钱包吗?

不带钱包的你,都用什么支付?

相信几乎半数人都会回答“支付宝”。

如今中国的第三方交易平台数不胜数,如财付通、百度钱包、易付宝、快钱等。使用率最高的当属微信支付和支付宝。

其实中国最早的第三方交易平台就是支付宝。如今只要上淘宝网购的人,就会注册支付宝。支付宝在人们心中的地位就好比一提到平板电脑,首先能想到的就是iPad,而说起第三方交易平台首先想到就是它了。

腾讯CEO马化腾(左)与阿里巴巴CEO马云(右)

支付宝的前世今生

2003年10月18日,淘宝网首次推出支付宝服务。

2004年,支付宝从淘宝网分拆独立,逐渐向更多的合作方提供支付服务,发展成为中国最大的第三方支付平台。

从支付宝诞生的第一天起,支付宝就是一个担保交易的角色存在。当时在中国网络交易还处于蛮荒期的时候,支付宝作为一个支付中间者,降低了买家和卖家的风险,当然主要是买家风险,这让淘宝快速发展,甚至后面超越ebay和易趣。

支付宝为我们的交易建立起信用

在当时,在商业诚信还没建立的时候,作为诚信的第一个基石,支付宝在大淘宝体系里面有着重要的基础性作用。它让买家不用担心掏了钱,收不到货,或者收到货不满意没办法处理。

当时为了快速的打开市场,在2005年支付宝推出“全额赔付”支付,提出“你敢用,我敢赔”承诺来推广支付宝。

如今的商业环境与2004年比有了很大的变化,现在在微信里买东西或者淘宝买东西已经不太在乎商家不发货的问题。普通的网民恐怕很少知道担保交易是怎么一回事了。

支付宝发展一览

不得不说,支付宝的每一个举动,都牵动着中国经济的变革和国人消费方式的改变。

书接上文,继续回顾支付宝这十几年一步一个脚印的创新之路。

2008年2月27日,支付宝发布移动电子商务战略,推出手机支付业务。

2008年10月25日,支付宝公共事业缴费正式上线,支持水、电、煤、通讯等缴费。

2010年12月23日,支付宝与中国银行合作,首次推出信用卡快捷支付。

2011年5月26日,支付宝获得央行颁发的国内第一张《支付业务许可证》(业内又称“支付牌照”)。

2013年6月,支付宝推出账户余额增值服务“余额宝”,通过余额宝,用户不仅能够得到较高的收益,还能随时消费支付和转出,无任何手续费。

2013年11月13日,支付宝手机支付用户超1亿,“支付宝钱包”用户数达1亿,支付宝钱包正式宣布成为独立品牌。

2013年11月30日,12306网站支持支付宝购买火车票。

2013年12月31日,支付宝实名认证用户超过3亿。

2013年,支付宝手机支付完成超过27.8亿笔、金额超过9000亿元,成为全球最大的移动支付公司。

来自艾瑞咨询的数据显示,自2013年第一季度以来,支付宝在移动互联网支付市场份额从67.6%逐步提升至78.4%,居第一。

截至2013年底,支付宝实名认证的用户数超过3亿。2013年,支付宝单日交易笔数的峰值达到1.88亿笔。其中,移动支付单日交易笔数峰值达到4518万笔,移动支付单日交易额峰值达到113亿元人民币。

2014年2月28日,余额宝用户数突破8100万。

2014年3月20日,支付宝每天的移动支付笔数超过2500万笔。

2015年,支付宝钱包8.5版,在钱包“探索”二级页面下,多了一个“我的朋友”选项卡,在进入转账界面后,就可以和对方直接发送文字、语音、图片等信息。

2015年5月27日,支付宝出现大规模故障。回应:杭州光纤被挖断 。

2015年7月8日,支付宝发布最新9.0版本,加入了“商家”和“朋友”两个新的一级入口,分别替代“服务窗”与“探索”,由此切入了线下生活服务与社交领域。此外,还增加了亲情账户、借条、群账户等一系列功能。

2015年9月25日起,支付宝和麦当劳进行大数据合作,全上海地区的麦当劳将可使用支付宝支付,并将进一步推广至全国门店。

2016年1月12日,蚂蚁金服对外发布2015年支付宝年账单。

2016年5月20日,三星移动支付服务Samsung Pay和支付宝正式宣布合作,用户可以在三星手机上通过上滑屏幕的方式快速调出支付宝的支付界面。

2016年5月31日,支付宝与深圳人社局合作上线的医保移动支付平台,开始在深圳 6 家医院落地试运行。

2016年9月,宣布支付宝自2016年10月12日起,将对个人用户超出免费额度的提现收取0.1%的服务费,个人用户每人累计享有2万元基础免费提现额度。

2016年11月1日支付宝入驻苹果App Store,中国大陆用户已经能在App Store的付款方式和充值两个地方看到支付宝的加入,可以用于购买应用,给账户充值,或给Apple Music等订阅服务付费等。

2016年11月27日下午,继“高端单身交友圈”之后,支付宝又小范围推出了“白领日记”和“校园日记”。支付宝回应,目前该功能尚处于灰度测试阶段。

2016年11月29日,针对近期支付宝“校园日记”等圈子引发的争议,支付宝母公司蚂蚁金服的董事长彭蕾今天发布了内部信予以道歉并在内网发帖:自己做错的事,永远不要怪别人!

2016年12月23日,支付宝推出了支付宝10.0版本,带来支付宝AR实景红包的玩法。

2017年1月5日,支付宝推出2016年个人年账单,网友们炸了锅。许多人看了去年“剁手”情况后,纷纷感叹“我都不知道我这么有钱!”“难怪自己那么穷!”先别急着骂自己败家,线上账单并不等于“网购”概念,你也没有真正网购花出那么多钱。除了支出和消费状况,个人账单还记录了低碳环保、爱心公益等情况,全面展示了现代人的生活观念和面貌。

2017年5月24日,支付宝宣布推出香港版电子钱包——支付宝HK,正式为香港居民提供无现金服务。港版支付宝上线后,所有香港居民都可以通过绑定香港当地银行信用卡或余额充值使用支付宝,直接用港币付款。

这是支付宝第一次发布境外版App。支付宝最早2007年开始服务香港市场,去年8月,香港金融管理局发布第三方支付牌照,支付宝香港公司成为首批支付牌照获得者,可以为当地用户提供数字金融服务。经过大半年的准备,香港版支付宝终于上线。

功能上,港版支付宝提供了扫码付、商家优惠和集印花三大服务。其中,扫码付与内地的使用体验完全一样,只要打开付款码,让商户扫一下即可完成付款。

除了上述基础功能外,未来,港版支付宝将陆续开通充话费、水电煤缴费、转账、打车、保险等功能,让香港人的“无现金”生活与内地接轨。

2017年6月,摩纳哥与支付宝签订战略合作协议(MOU),举国商户将接入支付宝。这是蚂蚁金服第一次与主权国家政府签订战略合作协议,成为第12个接入支付宝的欧洲国家。

2017年10月10日,支付宝宣布上线信用租房平台,在上海、北京、深圳、杭州、南京、成都、西安、郑州这8个城市率先推广信用租房,有超过100万间公寓将正式入驻支付宝。不同于付三押一这种租房时最常见的付款方式,芝麻信用分超过650分通过支付宝APP租公寓,可以免押金、房租可以月付。

未来,期待支付宝带来的新惊喜。