Good day and week Steemit friends,

I gave a speech this morning on: "Why you should invest in China". The subject was mainly concentrated on bonds (Fixed Income).

I thought to share my analysis with you. Let me know if you have any question.

Please note that this is just my opinion, hence you should not consider it as an investment recommendation

Why should you invest in China based bonds denominated in USD?

The main reason is: strong fundamentals!

China has a very strong political system, no opposition and no politicians lies. The enact reforms with ease, and that's my second point for rationale, reforms. The country enacts 30 years forward reforms such as:

- The Belt & Road Initiative

- Strategically transitioning its economy that produces high-value added products (this is quite a huge shift, brace dear European artisans...), and also they are working towards an important improvement in Corporate Governance which will increase transparency and therefore attract more capital from abroad.

Convinced yet?

Hold on. The best is about to come

Not only USD bonds are interesting, but also the once denominated in Yuan.

Why then, should you invest in China based bonds denominated in CNH/CNY (Chinese Yuan)?

The reasons are multiple, structural, cyclical and technical. All stars seem to be aligned here

- Chinese Yuan is becoming a World Reserve Currency, Chinese Yuan bonds are likely going to be included in Worlds Bonds' indexed, both of those structural factors should drive inflows in the country north of 300bn$, according to my estimates.

- Supply of bonds this year should be easily absorbed (techincal)

- Banks liquidity conditions should remain stable, despite their deleveraging, the central bank will soon lower the Reserve Rate Ratio by 200bps!!

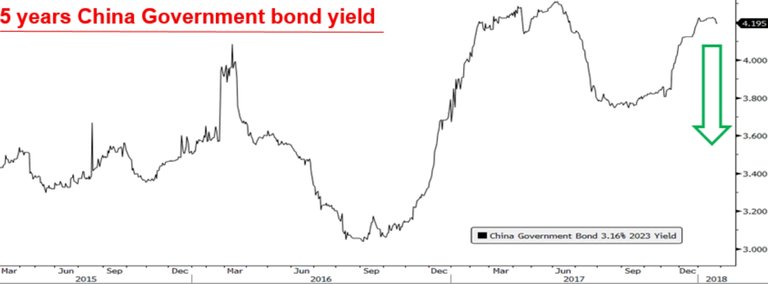

I believe that yields on Chinese Yuan bonds are going to fall (prices to increase) see the chart below (that I took from Bloomberg terminal). Yields have risen too much.

Great post!

Sounds interesting. I need to look at this in more detail. Thanks!

Let me know if I can help in giving tips

Nice post!!!

Thanks for the comment and feedback

Interesting analysis - If I could wish for something than I would love to read about how someone can take advantage out of this. What should someone buy?

XS1555076162 its China Huarong 4.5% Coupon Perpetual with sure call date in 2023 (given that on call date there is a huge coupon reset (5years Treasury yield +7.7% hence a huge incentive to call) : 4.2% yield for A- rated, its one the biggest AssetManagers in China and it's Government owned. Only issue is that its min 200k$

In Chinese Yuan there are some solutions but with no or very limited credit risk (or spread) there i'd play the Chinese Sovereign.

Thanks for your comment and feedbcak @famunger. In USD i really like China is also very playable on equities I've written a post on this https://steemit.com/finance/@fedescolari/investimenti-in-azioni-di-mercati-emergenti even though it's in Italian..there i talk about the trade of the decade and that is Emerging market stocka, especially Asian equities, despite the amazing 2017 performace, next years they will outperform everything. I see you're a crypto trader as well. You trade actively or play long term only? Long term I like Eos, dash, eth, neo. Dash for the scalability and ease of use/speed and eos because i just love @dan. You which do you like longer term?

China is awesome..

Indeed

You got a 1.35% upvote from @postpromoter courtesy of @fedescolari!

Want to promote your posts too? Check out the Steem Bot Tracker websitevote for @yabapmatt for witness! for more info. If you would like to support the development of @postpromoter and the bot tracker please