The crypto market is rising faster than anyone could reasonably expect. My strategy remains the same:

Keep the majority of holdings in BTC and ETH. I'm marginally more bullish on ETH than BTC, but believe any investment in ETH should be hedged with ETC

Buy 20% or greater dips in both

Continue to diversify (I currently hold 35 cryptoassets). There is no formula to my approach but factors I consider meaningful include community strength & quality, existing & prospective use cases, technological differentiation, and liquidity

If/when BTC hits $3000 USD, I'll take more money off the table. Other times I sold meaningful chunks: ~$1200 and $2000.

May's monthly performance versus benchmarks is coming in the next newsletter.

These assets are more than 1% of my portfolio. In descending order:

- BTC

- ETH

- XEM

- DASH

- XMR

- PEPECASH

- BTS

- XRP

- XCP

- ETC

Some charts:

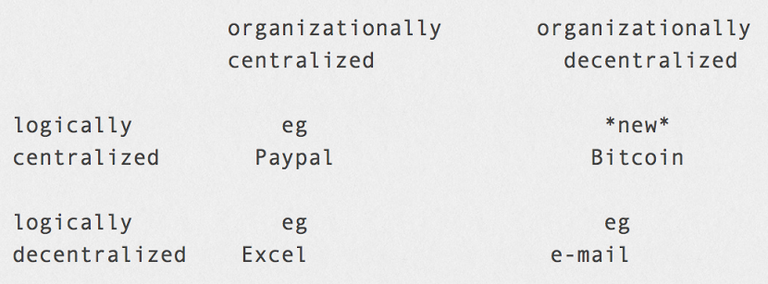

Great conceptual frame for Bitcoin: logically centralized (a single shared ledger) and organizationally decentralized (independent-ish miners and nodes). Source:

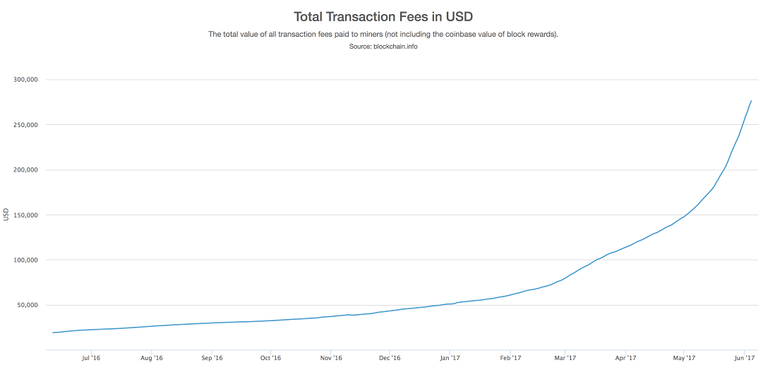

From a Trace Mayer podcast, the best predictor of Bitcoin's price is the 200-day moving average of transaction fees. If still true, seems bullish. Chart source:

Crypto Twitter is great. Some of my favorite pundits:

- https://twitter.com/cnLedger - Bitcoin in China, Mandarin sources

- https://twitter.com/CollinCrypto - respected day trader's commentary

- https://twitter.com/jimmysong - insider who is balanced and thoughtful about ecosystem

- https://twitter.com/AriDavidPaul - UChicago endowment PM who's very active in crypto

Thanks for reading. Hit reply if you wanna chat. Happy investing!

-Kevin (@kgao)

Congratulations @breakingbitcoin! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!