What are futures & options?

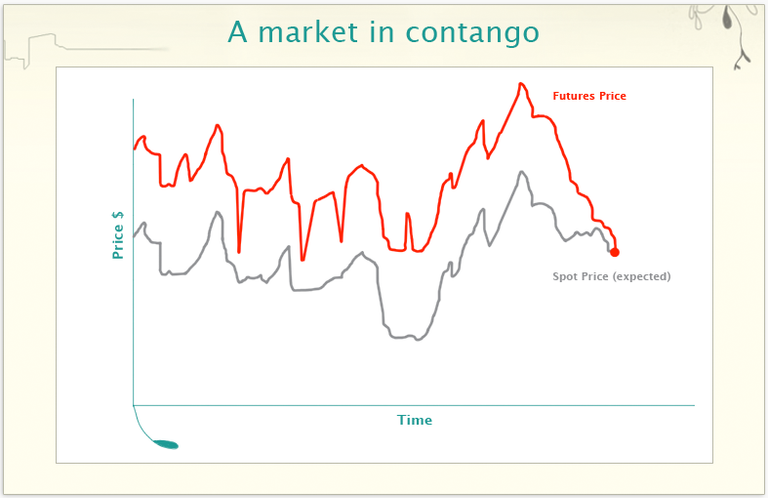

For a normal market or a market in contango it is cheaper to buy a commodity at the spot market than buy at a future date using futures contracts.

In normal markets the spot and futures prices are related by the principle of Cost-of-Carry. These markets are called normal, as one can consider futures markets equivalent to buying the physical commodity and holding it (in storage) for the future. The additional cost of holding it, imply a higher future price.

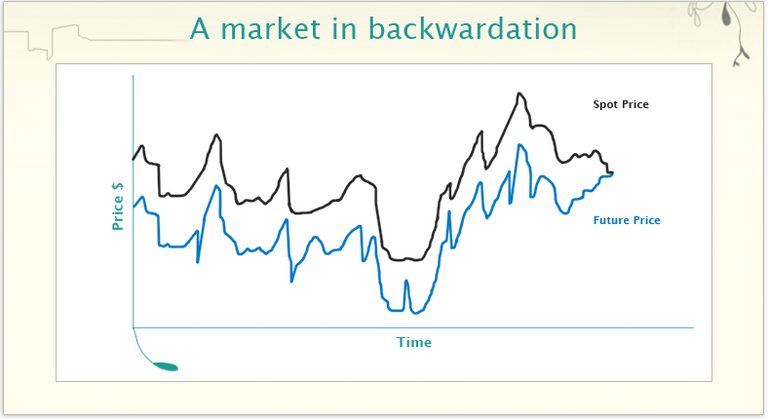

In an inverse market or a market in backwardation, the price of a commodity on the physical market is higher than the price of the commodity on the futures markets .

Inverse markets imply a significant Convenience Yield.

Images from AroundCommodities.com

Very curious to see how #blockChain might affect the #commodities #futures markets ?!