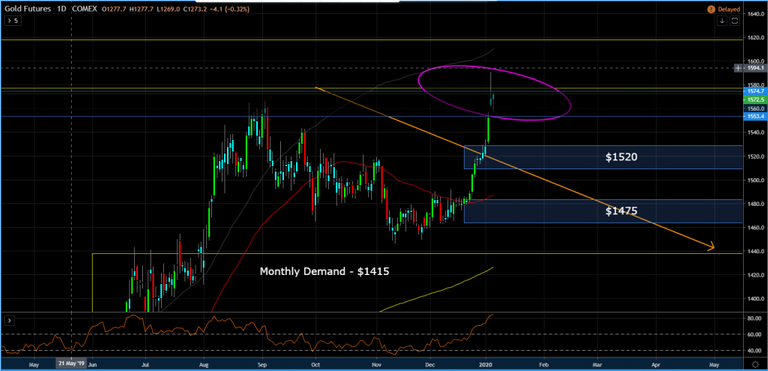

Lat month, gold fell below the psychological whole number of $1500 and was 5% down from the 6-year-peak reached in September due to profit taking and investors wanting to take on more risks. But the charts told you where the sellers were going to step before hand and for that matter where the buyers were going to step in before hand as well based on the monthly supply and demand zones.

Gold never did hit the monthly demand, missed the zone by $5 and has since rallied. The US air strike in Baghdad ordered by President Donald Trump that killed Qassem Soleimani, has been the catalyst not only for gold, but all the other precious metals as well.

But if you missed the rally in gold, don't worry, according to one article I read this morning, gold is due for a pull back.

Gold is almost guaranteed to record losses in the next two weeks, if history is any guide.

The 14-day Relative Strength Index for the yellow metal soared to 86 on Monday, well above the level of 70 that typically suggests securities are overbought. Previously, there have been only three times since 2000 when the RSI rose above 85, and in each instance bullion fell over the next 10 trading days. The loss averaged 1% compared with a gain of 7% over the previous 10 session.

To be sure, in all three occasions -- October 2010, February 2016 and June 2019 -- gold eventually resumed its rally. But the momentum had slowed. Gold performs best when interest rates fall and the dollar weakens. Without a further escalation of Middle East tensions, the bulk of the moves in rates and the dollar may be over for now. And the same is probably true for the bounce in gold, at least in the short term.

From my perspective, there is only one reason why gold will pull back and that's because price are in a monthly supply zone.

Supply and demand zones can often indicate institutional buying and selling. The big market participants cannot just enter one trade at once, they need to slowly build their position over time. And often their positions are so large that they will absorb most unfilled orders before price make big and explosive moves on price charts.

Take for instance the daily supply at $1560. Price entered the daily supply and two days later shot down, but when price returned to the zone several months later, well there weren't any unfilled orders remaining at that level.

On Sunday, price gapped up into a monthly supply zone and has sense formed a shooting star candle, which is is a bearish and signals a reversal.

But again, the shooting star only formed because the Smart Money was able to fill, unfilled orders at that level. Ideally, what I would like to see is price breach the monthly supply at $1600, pull back, then move higher to the monthly supply at $1700. But this may or may not happen in that order. So if you missed the rally and want to get long, two level to consider are the daily demand at $1520, but I think the better level to go long is at $1475.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

To buy on the highest level is never a good idea but the waiting time for a dip is sometimes so painful :-)

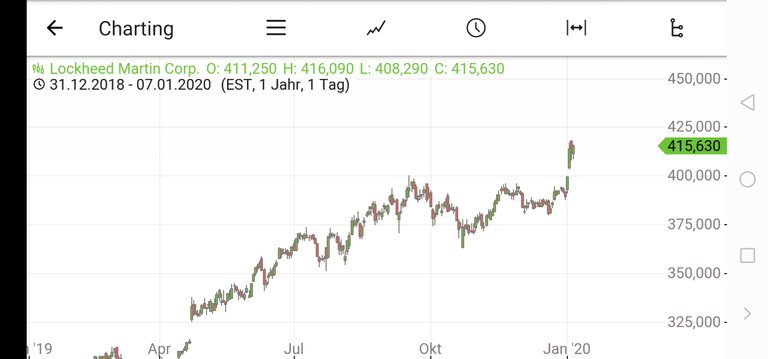

The T Show push gold and some interesting stocks, very interesting because movement was before news 🤔

Agree, I have to assume this applies to break out trades as well. The movement before the news was the Smart Money getting in beforehand, they already knew what the news was.

Yes, waiting is important in any strategy and is especially difficult for me as a short-term trader. PGs give me clear rules but buying high is always not easy.

Smart Money or maybe T. FAMILY or friends or Putin............

Gold cracked $1600 on news of the Iranian retaliation. We might see some elevated gold prices while this sabre rattling and escalation continues. Interestingly a lot of the gold mining stocks seem to be lagging and don't seem to be pricing in the move. So either this is a short term spike or we are going to see some big moves on the miners very soon!

Great observation, noticed the same thing with the miners. Watching silver as well, I think it has more upside than gold.