Receive my regards.

I want to talk about compound interest applied to cryptocurrencies.

But first, I will explain what compound interest is about.

compound interest

Compound interest represents the accumulation of interest that has been generated in a period determined by an initial (CI) or principal capital at an interest rate (r) during (n) periods of taxation, so that the interests that obtained at the end of each investment period are not withdrawn but are reinvested or added to the initial capital, that is, capitalized. It is that interest that is charged for a credit and when liquidated it is accumulated to the capital (Capitalization of the interest), reason why in the following liquidation of interests, the previous interest forms part of the capital or base of the calculation of the new interest.

Source of article

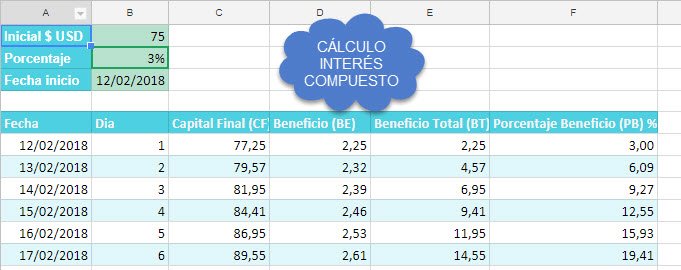

I explain it in a simple and graphic way.

With an initial capital CI of $50 USD to trade them in cryptocurrencies, obtaining a daily benefit of only 1%, I ask:

What would happen at the end of 1 year, 365 days, if we apply the power of compound interest?

Well, let's see.

- The first day we would have a profit of $0.50 USD, and so our 1st day and our final capital, product of the sum of the initial capital CF ($50 USD) plus the benefit of our day BE ($0.505 USD) would be $50.50 USD and this would be our new capital.

Our new capital CF + BE = $51.52 USD.

Our new capital CF + BE = $ 52.03 USD, which represents a percentage of PB profit of 4.06%

Our new capital CF + BE = $ 55.23 USD.

In just 10 days we have a total BT benefit of our CI of $ 5.23 USD.

PB = 10.46%

How much would it be in the first 31 days? let's see ...

CF + BE = $ 67.39 USD.

BT = $ 18.07 USD.

PB = 36.13%

In how much time do you get $ 1 USD daily? On day 71, 2 months and 11 days.

CF + BE = $ 101.34 USD.

BT = $ 51.34 USD

PB = 102.68%

In 3 months?

CF + BE = $ 122.43 USD.

BT = $ 72.43 USD.

PB = 142.44%.

In 6 months?

CF + BE = $ 299.79 USD.

BT = $ 249.79 USD.

PB = 499.58%.

1 year?

CF + BE = $ 1,889.17 USD.

BT = $ 1,839.17 USD.

PB = 3,678.34%.

growth of our balance exponentially!

THIS IS THE POWER OF COMPOSITE INTEREST!

THIS IS THE POWER OF COMPOSITE INTEREST!Fuente: property of @alfredogarc

Here you can use a calculator to do your CI calculations and percentage of profit on a sheet of calculation in Google Drive that I did.

Author: @alfredogarc

Traductor de Google para empresas:Google Translator ToolkitTraductor de sitios web