By Mark Adams

Guerrilla journalist James O'Keefe has done it again. On February 21 he posted on Twitter an undercover recording with an IRS agent, Alex Mena, who was bragging about the brazen criminality that pervades the organization. This may be O'Keefe’s biggest coup yet.

Mena who works in the IRS’ Criminal Investigations Unit went on to explain how IRS agents’ lack of humanity is inculcated by their training:

When I went to the criminal investigations unit, the guy is telling me, ‘the first person you shoot you’re gonna remember, but after that you’re gonna shoot like a hundred people, you’re not gonna remember any of them.

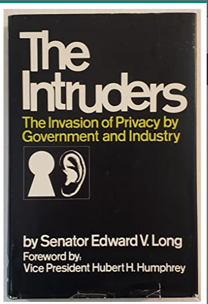

This callous remark hearkens back to what Senator Edward V. Long warned about almost 60 years ago when he declared:

The IRS has become morally corrupted by the enormous power which we in Congress have unwisely entrusted to it. Too often it acts like a Gestapo preying upon defenseless citizens.

https://www.azquotes.com/author/24154-Edward_V_Long

But the IRS was not the only federal agency that Long criticized.

Electronic use of transistors ushered in a new era of electronic eavesdropping and telephone tapping that alarmed Long who wrote a book about his concerns titled The Intruders. He also spearheaded congressional investigation to expose the pervasive use of the miniaturized electronic devices for snooping.

Modern Americans are so exposed, peered at, inquired about, and spied upon as to be increasingly without privacy--members of a naked society and denizens of a goldfish bowl.

https://www.azquotes.com/author/24154-Edward_V_Long

Senator Long’s crusading career was cut short by an article published in the May 2, 1967 issue of Life magazine. The article accused him of interfering with the government’s investigation of the teamsters’ union and accepting $48,000 as an illegal payoff.

Long denied wrongdoing, he explained the $48,000 payment was a legal finder’s fee from a prominent attorney which he had reported as income to the IRS. Long also pointed out that the allegations of wrongdoing only surfaced after he exposed how powerful government agencies were illegally spying on American citizens. A Senate investigation cleared Long but Life magazine never published a retraction and the May 1967 article took its toll. Senator Long lost the primary election in August 1968.

In his book Misuse of the IRS: The Abuse Of Power best-selling author Dave Burnham wrote how the IRS was “ecstatic” to be rid of Long.

On Aug. 6, 1968, William Lambert, an associate editor of Life magazine, reportedly received a phone call from Sheldon S. Cohen, then I.R.S. Commissioner. Lambert remembers that Cohen was ecstatic. ‘He just wanted to offer me the I.R.S.'s congratulations.’

https://web.archive.org/web/20150525104645/http://www.nytimes.com/1989/09/03/magazine/misuse-of-the-irs-the-abuse-of-power.html?pagewanted=6 (Emphasis added.)

Senator Ed Long may be regarded as the first victim of what we now call the DEEP STATE.

Seven years later the DEEP STATE weaponized corruption machine rolled on to devour its next victim. Senator Joseph Montoya (D-NM) chaired the Senate appropriations subcommittee that oversees the IRS. In 1975 he was sandbagged when IRS operatives colluded with The Washington Post’s ace reporter Bob Woodward.

IRS Chief Blocks Audit of Montoya’s Taxes was the blazing headline on the October 19, 1975 edition of The Washington Post.

At the beginning of the article Woodward states that Montoya “had been twice recommended for prosecution because he failed to file returns for 1945 and 1946.”

Yet four paragraphs later Woodward writes: “There is no evidence that Montoya has illegally evaded taxes.”

What Montoya was doing was making people nervous. In 1968 IRS was delighted to be rid of Senator Edward Long only to feel the heat again in 1972 when Montoya began lining up witnesses to testify before his subcommittee. Woodward mentions none of this. Instead he glibly states: “He [Montoya] is well known on Capitol Hill for his active interest in IRS matters.”

The same year that Montoya started probing IRS - 1972 - is when the IRS decided to “investigate” Montoya by examining returns dating back almost 30 years! This alone shows how apparently desperate IRS was to stop Montoya.

In his book Abuse of Power Burnham explained:

Although Woodward's story had noted that there was no evidence that Montoya had illegally evaded taxes or was aware of or sought special treatment from the IRS, the mere existence of a preliminary tax investigation was politically damaging.

Senator Montoya lost the primary election in 1976 as a result of misleading news stories planted by the IRS. Montoya was another DEEP STATE victim.

Over long decades the U.S. Congress has developed an established history of protecting draconian tactics that the IRS routinely unleashes to terrorize innocent and defenseless citizens.

On November 15, 1981 the CBS investigative program 60 Minutes aired a blistering segment about the IRS titled "Pay Up Or Else" that featured Congressman George Hansen (R-ID).

During the broadcast IRS Revenue Agent Charles Shefke summed up his career to 60 Minutes correspondent Morley Safer: "We go out and destroy people. We literally destroy their life, their livelihood, everything."

Incredulously, the broadcast was almost derailed by select staffers of the Ways and Means Committee – the very entity that is supposed to protect defenseless citizens from the ruthless IRS. While 60 Minutes producer Ira Rosen was working with Congressman Hansen to gather information, members of the staff of the Ways & Means Committee told Rosen that the Congressman was not reliable and in those instances where there was some truth to his allegations that they were old and had long been corrected. A 60 Minutes investigative team independently checked the allegations and confirmed their accuracy allowing the program to proceed.

The Monday after the program aired Rosen called Congressman Hansen to describe a phone call he received from a member of the Ways and Means Committee. The staffer demanded the names and addresses of everyone whom CBS had interviewed for the program, and that the demand constituted “an official order.”

This is not the only time that the Ways and Means Committee attempted to interfere with legitimate congressional inquiry into the perpetually corrupt IRS:

“When the House Government Operations Committee last summer [1989], under [Congressman] Doug Barnard, started investigating ... corruption [of the IRS], the Ways and Means Committee desperately tried to stop that investigation from happening, and they worked very, very hard to stop it. - NYT Best-selling Author David Burnham C-SPAN Booknotes

http://www.booknotes.org/FullPage.aspx?SID=11106-1 (Emphasis added.)

Here is an example of the nefarious works of IRS’ Criminal Investigation Division.

Destroy The Document Immediately

Government document 7072, titled Illegal Tax Protester Information Book was prepared by the Criminal Investigation Office of Intelligence at the Washington DC IRS headquarters in January 1986.

The introduction states:

This tax protester information document was compiled with limited information and is being disseminated in this form to promote an awareness of organizations and individuals who appear to be involved with militant protest activities.

The manual profiled 40 organizations that the IRS claimed were planning violent assaults against the government. Members of these groups had criminal records or allegedly threatened government agents. The “intelligence” manual also smeared innocent citizens by including their names together with “organizations and individuals who appear to be involved with militant protest activities.”

In fact a U.S. District Court found that Document 7072 contained “sensitive and defamatory material which could have been expected to seriously damage the reputation of persons named therein.”

https://www.leagle.com/decision/19901155742fsupp41311094.xml Section C

A cabal of concerned whistleblowers alarmed that the “intelligence” manual could be used as a pretext to stir-up violence with innocent citizens smuggled copies of the document out of various IRS regional offices. That was how Mr. Kostyu, a World War II veteran with no criminal record, learned that his name was included on a secret government document portraying him as a firebrand, violent fanatic.

https://news.google.com/newspapers?dat=19861202&id=_F0eAAAAIBAJ&pg=4473,229576&hl=en

When IRS officials learned that their secret document was no longer a secret, frantic orders were issued from the Director, Office of Investigations, that all copies of the document “should be destroyed immediately.” One such order was issued on August 8, 1986, just seven months after the document was printed ostensibly because it was “obsolete.”

IRS terrorizes a child care facility: Drop Your Scissors!

On November 28, 1984, IRS agents raided the Engleworld Learning Center in the Detroit suburb of Allen Park, Michigan, because of overdue taxes even though the owner, Marilyn Derby, had hired an attorney and was working with the IRS to amicably resolve the situation. Try to imagine her surprise when she returned to work after a doctors appointment but could not enter the building because marauding IRS agents changed the locks before locking the doors!

When she was admitted into the building by a federal agent she was shocked to discover that IRS agents set up a creative scheme to force parents to pay the center’s taxes when they came to pick up their children. As the Washington Times reported:

Inside the Learning Center were a handful of bewildered parents, unable even to see their children until they paid money for taxes they did not owe to two IRS agents sitting near the entrance. Allegedly, the children – as many as 30 of them – could not run to greet their parents…as ordinarily was their custom. IRS agents kept them closely guarded in Room C of the day-care center. At least one agent was posted in another room where pre-schoolers, some still in diapers, were detained.

The article spared no details, stating:

One parent observed: “It was like something out of a police state. They indicated you could not take your child out of the building until you had settled your debt with the school, and you did that by signing a form to pay the IRS. What we were facing was a hostage-type situation. They were using children as collateral.

Engleworld director Marilyn Derby said, “Parents were not allowed to see their children until they had signed an agreement with the IRS. It was a very scary situation, like the Gestapo was here. Children were crying, parents were trembling. I told one woman whose hands were shaking that she shouldn’t sign anything she didn’t want to. She signed anyway.”

https://washingtontimes.newsbank.com/search?text=Englewood%20Learning%20Center%20IRS%20raid%201984&content_added=&date_from=&date_to=&pub%5B0%5D=15090DF29750CF18 (Emphasis added.)

In a notarized affidavit Derby further described the Kafkaesque scene:

- I found one teacher crying and several others very upset. At no time did I observe any of the agents attempt to reduce the apprehension or fears of either the parents or children. They (the agents) were cold and very unfriendly.

- On this occasion, the parents were met at the door by an IRS agent who escorted them to a table to settle their bill before seeing their respective children. It appeared to me that the parents believed that they had to come to some kind of a settlement before they could see their children.

- She also described how immediately after entering a room where children were making Christmas decorations a revenue agent brusquely commanded: “Drop your scissors!”

- The affidavit also described how, “One incident occurred where a child rode over the foot of one of the agents with a toy truck. The agent got very angry and picked up the child’s truck and through it across the room and told the little boy not to do it again.”

- According to Derby, “Agents guarded every door including both the girls and boys bathrooms.”

Derby wrote, “They opened their suit jackets leaving their guns in plain view. This was very intimidating to me. They specifically asked me to write the words: To my knowledge no child was denied access to their parent.”

Needless to say Dingell’s promised investigation went nowhere at the speed of light.

Fast forward 50 years with this headline from Vox:

Biden invested big in more tax audits. A new IRS analysis claims it’s working. A fully funded IRS would bring in twice as much money as they previously thought, a Treasury report finds.

https://www.vox.com/politics/2024/2/7/24063380/irs-inflation-reduction-act-audit-returns

What they still haven’t revealed is who gets to audit the Biden Crime Family.

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Minds, MeWe, Twitter - X, Gab, and What Really Happened.

Provide, Protect and Profit from what's coming! Get a free issue of Counter Markets today.

The poor get tex, the rich never pay tax

irs is taking a lot of money.

It is not new that people are affected by them But such an organization has to be kept

Why and how to dismantle the state (5th edition, 12 pages):

https://odysee.com/@livingfreedom:3/Udy5S7g3He9TqeJ:6

At some point I usually feel the world is not making the proper use of tax

That’s crazy!

Why won’t parents allowed to see their children?

What a world!

Typically how the system works...

Luckily we're smart enough to educate ourselves!

!WINE

The system is actually corrupted and that is why it is looking everything is no more working as it should be

~~~ embed:1762270532295070141?t=7zhJXKM_i39RpdDmW9SOEw&s=19 twitter metadata:V2F5U2hvbGE4NDE1Nnx8aHR0cHM6Ly90d2l0dGVyLmNvbS9XYXlTaG9sYTg0MTU2L3N0YXR1cy8xNzYyMjcwNTMyMjk1MDcwMTQxfA== ~~~

Share on X

#hive #posh

~~~ embed:1763006007431610770?t=-QayH4Oue7gfo1GWrLdH3w&s=19 twitter metadata:YWRlbmlqaWFkZXNoaW43fHxodHRwczovL3R3aXR0ZXIuY29tL2FkZW5pamlhZGVzaGluNy9zdGF0dXMvMTc2MzAwNjAwNzQzMTYxMDc3MHw= ~~~