In recent days, the crypto market has taken a heavy hit, and a feeling of extreme fear has taken hold of investors. But is this the end or the chance many have been waiting for?

Let’s understand what happened and, more importantly, how you can protect yourself and profit even in turbulent times.

Sharp drop in Bitcoin and altcoins

BTC fell close to $87k, and ETH hit lows since October, trading close to $2.2k. But what happened?

Macroeconomic Uncertainty

US trade policies increase global volatility, driving capital away from risky assets.

Recent FOMC minutes have reflected growing concerns about inflationary pressures. The FED has indicated the possibility of keeping interest rates high for a longer period, reducing investors' appetite for risky assets such as cryptocurrencies. Additionally, there are geopolitical uncertainties, such as the US government's criticism of other countries and calls to expel Chinese companies near the Panama Canal, which have increased risk aversion among investors, contributing to volatility in crypto markets.

As if that weren't enough, Trump reignited the trade war yesterday with tariffs against Mexico, Canada, and the EU, saying they would be applied starting March 4.

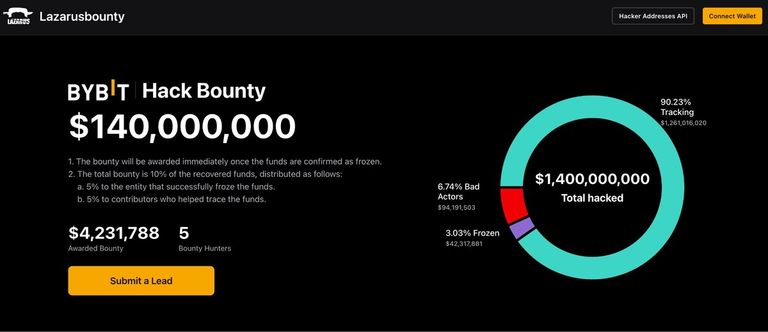

Bybit Hack

A cyberattack has drained nearly $1.5 billion worth of liquid staked Ether (stETH), Mantle Staked ETH (mETH) and other ERC-20 tokens, causing panic and mass withdrawals. This was the biggest hack in the history of not only the crypto world, but the financial market as a whole.

The attack led to a mass outflow of assets from the exchange. According to data from DefiLlama, the total value of Bybit’s assets has decreased by more than $5.3 billion, including the $1.4 billion lost in the hack. This indicates that customers withdrew approximately an additional $3.9 billion in response to the incident.

Despite this massive outflow of funds, Bybit stated that its reserves continue to exceed liabilities, ensuring that user funds remain fully backed.

The company processed over 350,000 withdrawal requests in 10 hours. Additionally, the exchange has received support from other crypto platforms and industry leaders, including emergency transfers of $50k in ETH from Binance, $40k from Bitget, and $10k from Du Jun, co-founder of HTX Group, to help maintain liquidity and user confidence.

Memecoin $Libra and the Milei Disaster

The Argentine president promoted the currency on his social media, which led to a significant appreciation of the asset in a matter of minutes. A few hours later, the value of $LIBRA plummeted, resulting in significant losses for thousands of investors, in a pump-and-dump scheme.

The Argentine Public Prosecutor's Office has launched an investigation to determine possible irregularities in the promotion and collapse of the cryptocurrency.

Information was requested from the Central Bank and the National Securities Commission, in addition to involving the specialized cybercrime unit to track operations related to $LIBRA.

In her defense, Milei claimed that she “only shared information” about the cryptocurrency, without the intention of promoting it, and claimed not to be aware of the details of the project. He also highlighted that investors participated voluntarily and were aware of the associated risks.

The scandal, dubbed "cryptogate", has resulted in multiple criminal charges against Milei and calls for his impeachment from the opposition, putting his government under intense political and media pressure.

Drop = Opportunity? How to Position Yourself Now

Building HOLD positions – Big dips are often opportunities to accumulate solid crypto assets at discounted prices. BTC remains the pillar of the market, showing resilience in past crises, while ETH, despite presenting more risk, remains a good bet for greater asymmetries in the future.

Protection and profit with Options – In times of high volatility, strategies with options allow you to both protect yourself against larger drops and generate profits from sudden price movements. This is without the risk of being liquidated, as occurs with Futures.

Following market signals and developing solid strategies make all the difference. Those who are well-informed get into the game before the recovery.

Posted Using INLEO