Formerly called RaiBlocks, NANO is one of the fastest cryptocurrencies on the market. NANO supporters often boast about how NANO transactions can be even faster than other fast cryptocurrencies such as DASH, XRP, XLM or Litecoin. It is believed that the NANO transaction speed can be as fast as 0.27 seconds, which includes the entire process, from the transmission of the transaction to completion.

Using a lattice architecture of Directed Acyclic Graph (DAG) blocks, in theory, NANO should not have many problems to scale and can maintain its speed even in a scenario where the network has much more traffic than today. Not only is it known for its advantage over speed, but NANO also has no transaction fees. The fact that it is unlimited makes it even more attractive.

But, here comes the most important question. Is it worth investing your money in the NANO cryptocurrency? This article will cover all angles that can help you answer this question. Let's start immediately!

NANO - Summary

NANO is a decentralized cryptocurrency based on DAG that has been trying to solve the most important problems in the digital money space. Currently, there are two major problems in the digital money space: decentralization and scalability.

Usually, the more decentralized a cryptocurrency is, the slower it becomes. On the other hand, the faster it is, the more centralized it becomes.

Then, we have NANO, a cryptocurrency that can maintain its decentralization aspect, even though it is extremely fast. NANO can achieve this impressive feat due to its basic structure. NANO uses a lattice architecture of directed acyclic graph blocks (DAG).

For your information, DAG is a system of individual transactions that connect to several other transactions. DAG has no "blocks" of transactions. For an analogy, blockchain can be compared to a linked list, while DAG is more a tree with different branches that represent different transactions.

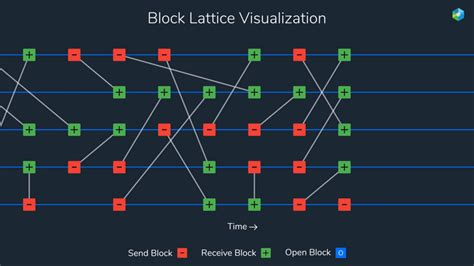

Visualization of the block-lattice system

NANO uses a combination of elements between blockchain and DAG. Basically, each account within the NANO ecosystem has its own blockchain that can store its transactions and account history. This concept is called an account chain, and only the owner of the account chain has the ability to control it. And then, these account chains can be updated non-parallel with the entire NANO network.

Now, when the account chain owner sends some NANO coins, a "shipping block" is added to their account chain to update the balance. The recipient of the account will automatically add a "receiving block" to their own account chain to update the balance.

With this system, the most recent block in all chains always contains the current balance of the same account. NANO can maintain its fast processing speed due to the use of this structure. Not only that, but NANO also uses a hybrid consensus mechanism they call Open Representative Voting (ORV).

With ORV, each account can openly choose any representative to vote, and you don't need to be online to do so. Representative accounts are configured on the online nodes. Due to the fact that NANO accounts can always delegate their vote to any representative at any time they wish, it shows that users of the NANO ecosystem have great control over consensus.

And considering that there are no financial incentives for nodes, this consensus mechanism (ideally) should be able to mitigate centralization concerns among the representatives.

With all these characteristics that I wrote earlier, NANO becomes very fast and immaculate. NANO is focusing its development on trying to be the best digital currency among peers, maintaining a good level of decentralization. Technologically, NANO has all the right ingredients to succeed.

Analyzing NANO Team

Of course, when it comes to cryptocurrency investment, we need to learn more about the core team itself. What generally happens is that we invest in a cryptocurrency because we believe that the same currency will be used for more important use cases in the future. And who can help the future of that currency if it is not the central team of the same project?

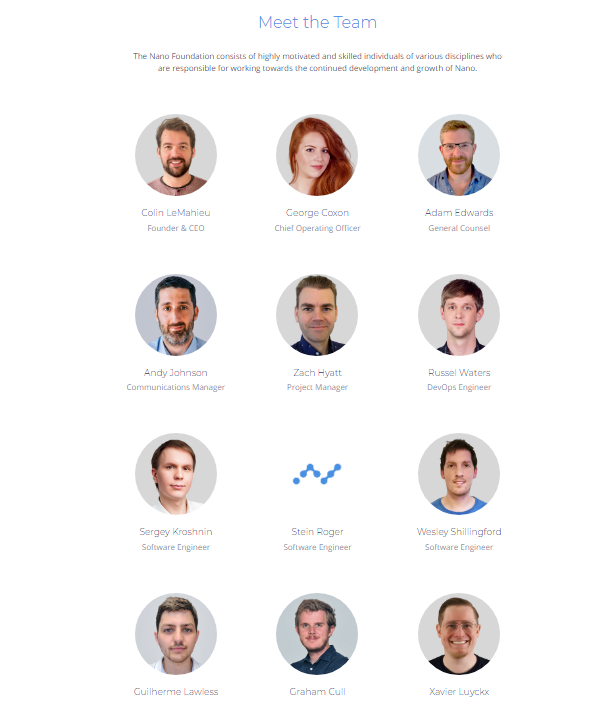

So how about the NANO core team? The main man of the NANO Foundation is Colin LeMahieu, who is also the only founder of the coin. With the NANO Foundation, he is the Executive Director. Prior to his full-time commitment to NANO, he was an LLVM software tools engineer at Qualcomm and a staff software engineer at National Instruments.

It is believed that Colin previously only worked part-time in the development of NANO until the peak of the high season in the fourth quarter of 2017. At that time, Colin finally quit his job at Qualcomm and chose to focus completely on the NANO Foundation. Among NANO supporters, Colin is often seen as NANO's "Vitalik Buterin", with his memes and his face often appearing in the cryptocurrency subreddit.

Then, we have George Coxon, who acts as Director of Operations for the NANO Foundation. Before obtaining the position of director of operations, I was working in the field Operations and associations in the same NANO Foundation. George is a very important individual on the team. She has been with the NANO Foundation since January 2018.

Prior to her time with NANO, she was a senior account executive at Nonsense London for two years, from 2015 to 2017. Nonsense London is a creative digital agency that tries to connect brands and audiences in the form of content worth sharing.

After George Coxon, we have Adam Edwards, who acts as general advisor to the NANO Foundation. His experience includes his 7-year time with Wedlake Bell as a consultant and partner.

Then, we have Andy Johnson, who is basically the Communications Manager of the NANO Foundation. He has been with NANO for more than a year. His other experiences include his time as co-founder at KitePay and The Nano Center. He was also the owner of Nanothings.store. Apparently, Andy was hired because of his great enthusiasm for NANO.

Next on the list is Zach Hyatt, the Project Manager. He has been with the NANO Foundation since December 2018. Previously, Zach was the organizer of Nanoble and co-founder of Stateless Labs.

Of course, when it comes to amazing technology like NANO, we must give credit to software engineers. In addition to Colin LeMahieu himself, there are some great developers in the Foundation. The DevOps engineer is Russel Waters, and he has been working for NANO since January 2018.

Before his time with this project, Russel was the Application Specialist at Zmanda and then at Carbonite. He was also promoted to Technical Training Specialist at Carbonite in December 2016 before leaving the company in 2018 to join the NANO Foundation.

Software engineers are Sergey Kroshnin, Stein Roger and Wesley Shillingford. Last but not least, the Foundation's software developer is Guilherme Lawless. All of them link their github pages to their profile photos on the NANO page about us.

In my opinion, the team seems extremely capable of developing a good cryptocurrency from a technological perspective. However, they don't seem to have a solid name when it comes to partnerships and marketing.

Visualization of NANO transactions

Well, NANO is not a dApp platform, and it has no other use case other than to be used as peer-to-peer digital money. Basically try to be like a digital fiat. For transactions, and that's it. The difference is that NANO is decentralized while the digital fiat is controlled by the central bank.

For that reason, the way in which NANO becomes the mainstream is if people or institutions begin to transact with each other with NANO. It is different from the likes of VeChain or Ethereum or other newer blockchain platforms where they try to solve different use cases, and their native cryptographic tokens are used to pay transaction fees, stakeout or other things.

With NANO, they expect their popularity to grow when people in different countries pay each other with NANO. Another possibility is when banks and financial institutions attempt to transport fiat currencies using NANO as an intermediate currency (similar to how XRP is used in RippleNet).

Partnerships

Unlike many altcoin projects, NANO's marketing efforts are not aimed at "official partnerships" with other companies. For the most part, they encourage other new companies to integrate NANO into their technology or adopt NANO in their stores.

In terms of integration, NANO has been integrated into BrainBlocks, CoinGate and Kappture. CoinGate is a payment gateway to buy and sell cryptocurrencies. By partnering with CoinGate, NANO can be used in 4000 registered CoinGate merchants.

NANO integrations so far

As for Brainblocks, it is an instant "pay with NANO" solution with the long-term vision to integrate automatic conversion to fiat. If BrainBlocks becomes a great company, the goal is to be able to automatically convert fiat to NANO and then return to fiat, eliminating the concern of most people about the volatility of cryptocurrency prices.

There are also many different online stores where you can pay with NANO. You can find the list at UseNano.org. That said, most of the names there are not really big companies. Most of them are small stores that don't have a lot of traffic.

Possible obstacles

NANO has incredible technology, and is very fast and unmatched. However, the NANO team has been criticized again and again by some of its own followers due to lack of visibility and marketing efforts. It is believed that NANO would do much better in crypto rankings if he hired an employee with a strong marketing background. So far, they have not been listening.

The NANO core team has hinted that the best technology always wins in the end, especially if that technology is totally open source, but this is not always true. There have been many stories in the last 20 years in which the best technologies really lost to their competitors due to the lack of marketing and adoption efforts.

When it comes to speed and transaction fees, NANO can be considered one of the best. But once again, having super good technology is not enough. The biggest obstacle to NANO's future is its lack of visibility compared to the larger altcoins. For example, Ripple and Stellar have partnered with large institutions, but this type of approach is not used by the NANO Foundation.

External Factor And NANO Price

Bitcoin trend will affect NANO price

We have learned the most important things about NANO, but is it enough to make our decision to invest in the currency or not? Unfortunately not. When it comes to altcoin prices, we must think of a great external factor. That factor is called Bitcoin price action.

Yes, like it or not, we must admit that the price of Bitcoin affects altcoin prices since the beginning of cryptocurrencies. When Bitcoin enters an uptrend, most altcoin prices also rise. When Bitcoin enters a downtrend, most altcoin prices also go down. NANO will not be an exception.

When NANO had its greatest moment (it went from less than $ 0.15 to more than $ 30), it happened in less than three months. However, most of the other altcoins also enjoyed a great uptrend during the same period of time (November 2017 to January 2018). When other altcoins and Bitcoin fell in the rest of 2018, the price of NANO was also affected.

Unfortunately, most cryptocurrency prices move in the same trend. So, if you decide to invest in NANO, you should pay close attention to the Bitcoin price action.

conclusion

NANO is a really good cryptocurrency with extremely fast speed and zero transaction fees. It has a great advantage over its competition when it comes to technological aspects, but it still needs to prove its worth in regards to visibility and marketing. No one knows if NANO can become one of the most used cryptocurrencies in the future, but it still seems like a good investment.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.publish0x.com/investments/nano-good-investment-depth-analysis-and-near-longer-term-exp-xoyonq

Nano has always lacked marketing, but i feel like thats because the coin is trying to grow in terms and price and adoption naturally. Rather than focusing on price, devs are constantly working on improving and expanding the existing tech. Price has definitely not reflected development accurately with this coin though over the past year, hopefully that is going to charge soon!

Overall thanks for the in-depth article