*Editorial Note:

*Editorial Note:

This content is not provided or commissioned by the credit card issuer. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

What's the best way to pay down a credit card balance as quickly as possible, while paying the least in interest, and without hurting your credit? What follows is a powerful method recommended by the most astute personal finance experts* to achieve exactly those objectives. It's extremely effective, completely legal, and leverages programs created by credit card issuers to your advantage.

Follow these steps and start to become credit card debt-free.

Step 1: Use A Powerful Tool To Immediately Stop Paying Interest On Your Balance

Think of someone carrying a credit card balance like a patient who enters an emergency room bleeding badly. The first thing a doctor will do is stop the bleeding. It's no different when attacking a credit card balance; the first thing you do is stop the interest charges.

There's a simple way to do this, and it's brilliance is that it actually uses the banks' marketing offers to your advantage: find a card offering a long "0% intro APR balance transfer" promotional offer, and transfer your balance to it. These are cards which offer new customers a long period of time (often as much as 18 months) during which the card charges no interest on all balances transferred to it. We constantly track all the cards in the marketplace in order to find the ones currently offering the longest 0% intro periods.

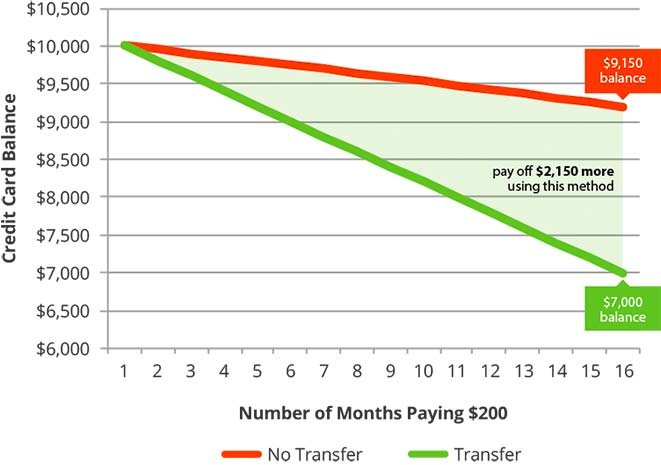

If you need more motivation, just think of this: on a $10,000 balance, $150 of a $200 monthly payment would get vacuumed up by interest charges.** That leaves only $50 of your $200 that actually reduces your balance, the rest vanishing into bank pockets. That's just brutal. Use our reviews to find a card which offers the longest possible no-interest period while charging low, or even no fees. Moving your balances to the card you choose will stop the bleeding, allowing you to move on to step two.

Step 2: Power Through Your Balance During The 0% Period.

Once you've transferred your balances and put a stop to the interest charges, it's time to capitalize on the interest-free period to really break free of the debt. The best part of this is how simple it is: just keep making the payments you used to make when you had to pay big interest payments, except now 100% of your payment will go to reduce your balance.

As you can see, without using the 0% card, the same $200 monthly payments barely make any headway. It's like swimming upstream, or walking while taking a step back for every two steps forward. That's no way to swim or walk, and attempting to pay off your cards while paying high card interest rates is no way to manage your finances. Move your balances onto one of the cards below, stop getting crushed by interest, and start making real progress toward getting rid of your card debt.

This credit card comes with 0% intro APR for 21 months on purchases and balance transfers. With 0% Intro APR for 21 months you can pay off your balance all the way into 2018. You’ll also gain access to Citi Private Pass for exclusive presale tickets and a Personal Concierge Service available to assist you 24/7. You’ll also earn City Easy Deal points with each card purchase redeemable for discounts on online merchandise, travel tickets, gift cards, and more. This card is perfect for people looking to get out of debt or making a large purchase who want 21 months to pay it off.

The Verdict: Getting a loan this cheaply for this long is pretty amazing. If you’re interested in transferring a balance to a 0% card, this is the one that offers the longest 0% term. Period.

Most Appropriate For: Because the Diamond Preferred card has the longest 0% balance transfer term, it’s our highest rated card for anyone carrying a large balance. The extra interest-free time will allow folks to make significantly more headway paying down their debt, even factoring in the transfer fee.

Least Appropriate For: Those who can pay off their balances in under 15 months. For these folks, we recommend the Chase Slate, which offers 15 interest free months without requiring a transfer fee.

The Amex EveryDay® Credit Card from American Express is the best of the balance transfer and rewards world wrapped up in one amazing card. American Express didn’t skimp with the generous terms on this new offer. Get a $0 intro balance transfer fee with long 0% intro APR with bountiful rewards all for $0 annual fee.

Transfer your high interest debt to this card and get a reprieve with intro APR 0% for 15 Months on balance transfers. When you act fast this transfer will cost you nothing: $0 balance transfer fee. Balance transfers must be requested within 60 days of account opening. This card also comes with intro APR 0% for 15 Months on purchases. Unlike the bare bone nature of many low interest cards, the The Amex EveryDay® Credit Card from American Express whets your appetite with 10,000 Membership Rewards® points after you use your new Card to make $1,000 in purchases in your first 3 months. The rewards keep coming with a satisfying 2x points at US supermarkets, on up to $6,000 per year in purchases (then 1x), 1x points on other purchases..

The Verdict: This tempting offer checks all the boxes for anyone looking to pare down high interest credit card debt. The signature feature is the $0 intro balance transfer fee, the rewards are icing on the cake.

Most Appropriate For: If you want to get out of debt, this card means you don’t have to sacrifice rewards. Get this card for the balance transfer. Keep it for the rewards.

This card has a sign-up bonus loaded with potential: you can turn $200 into $400 with Cashback Match. If you’re a new card member, you can automatically double your rewards within the first year of having the card. You also earn 5% cash back from rotating categories like gas stations, department stores, Amazon.com or restaurants for up to $1,500 every quarter. You’ll also get 1% cash back on everything else.

With 5% cash back from everyday spending categories and 1% cash back on everything else you can easily earn $200 cash back and turn it into $400 with Discover’s Cashback Match.

There is also no annual fee, and you will get 0% intro APR on purchases for 6 months and 0% intro APR on balance transfers for 18 months.

While the Discover It - 18 month balance transfer offer has some rewarding cash back benefits, it lacks the 0% intro APR length of other cards on this list and it has a balance transfer fee of 3%. You also need to remember to opt into the categories every quarter or you will not receive the 5% cash back rewards.

Most Appropriate For: People who enjoy both cash rewards and lengthy balance transfer offers.

Least Appropriate For: People looking for a simple balance transfer card. This card will reward you the more you use it, however if you're looking to just transfer your current balances there are other cards out there with similar offers.

Verdict: If you looking for a balance transfer credit card that teams up with a cash back rewards system, this card is right up your alley. It has a unique sign-up bonus system that doubles your cash back at the end of your first year. So if you’re in the market for a rewards card and would like to transfer your current balance, this card is perfect for you.

0% intro APR on purchases and balance transfers for 9 months, unlimited 1.5% Cash Back on every purchase, every day, One-time $150 cash bonus after you spend $500 on purchases within 3 months from account opening. No annual fee.

Turbo charge your plans to ditch debt with this easy-to-use card that will pay you unlimited 1.5% Cash Back on every purchase, every day. Use the cash-back rewards to pay down your debt even faster! You earn cash in two ways when you use this card. First, earn a one-time $150 cash bonus after you spend $500 on purchases within 3 months from account opening. Second, you'll take home an unlimited 1.5% Cash Back on every purchase, every day. No headaches remembering rotating bonus categories, you will earn cash on everything you buy. Pile those unlimited cash rewards back onto your balance and say goodbye to your debt even faster! This card offers a 0% introductory APR on balance transfers and purchases for 9 months. Music lovers get an extra bonus: Use your Quicksilver card and get 50% back as a statement credit on your monthly Spotify Premium subscription, now through April 2018. There is a 3% balance transfer fee, but the cash rewards could easily offset that over the long run for you.

The Verdict: Many credit cards with introductory 0% interest don't offer rewards. You win in four ways if you use this card to pay down debt. 1) Earn a one-time $150 cash bonus after you spend $500 on purchases within 3 months from account opening. 2) Get unlimited 1.5% Cash Back on every purchase, every day that can also be used to speed your way to being debt-free. 3) 9 months of 0% introductory APR to pay off your balance transfer. 4) No annual fee makes it a cost-effective choice for ditching debt.

Most Appropriate For: If you want to earn cash back rewards, while you pay down your debt, this card gives you a straight-forward deal. Earn unlimited 1.5% Cash Back on every purchase, every day. If your credit has a few blemishes, don't worry. This card is a fantastic option if you have good credit.

Take control of your finances with the Wells Fargo Platinum Visa® Card. This no-annual fee card gives you a long 0% for 15 months on balance transfers.

If you only make the minimum payments on high-interest credit card debt, it could take years to pay it off. Using a card like this means every cent you pay during the intro period will go toward paying down your balance. Wells Fargo is one of the few card issuers to offer generous cell phone protection. This card offers up to $600 protection on your cell phone (subject to $25 deductible) against covered damage or theft when you pay your monthly cellular telephone bill with your Wells Fargo Platinum Visa® Card. If you need breathing room on upcoming purchases before interest kicks in, this card also gives you a very long purchase intro rate of 0% for 15 months. There is a typical balance transfer fee of 3% Intro for 15 months, then 5%.

The Verdict: This is the total debt fighting package all wrapped up in one offer. This card gives you all the tools you need to get out of debt, plus unique cell phone protection that make this card shine. If you are budget-conscious, having $600 protection on your cell phone could make a big impact if your cell phone is stolen or damaged.

Most Appropriate For: This card is perfect for people looking to get out of debt and want to pay it off over time with no interest and no annual fee.

The Card With Long 0% Intro APR AND Cash Rewards Programs.

Pros: Chase's new Freedom Unlimited card is essentially an improved version of the old Freedom. They bumped the base cash back rate all the way up to an industry leading 1.5%, and pay that full 1.5% on all spend, with no limit or spend category restrictions. Unlike most other high paying cash back cards, you don't have to worry about categories or have to activate anything. You'll receive the full 1.5% back as you make your spend, on all spend, automatically. In addition, Chase is offering a cash bonus to new card-members: if you charge $500 on it in the first 3 months, you'll earn a $150 cash bonus. Finally, Chase is also offering new card-members 15 months of 0% Intro APR on Purchases and Balance Transfers. So during that period, you can use the card without paying any interest on balances you tally, while still earning cash back. The card requires good to excellent credit, making it easier to get in.

Cons: Charges a 5% balance transfer fee. This is on the high side, so we recommend looking at the Chase Slate or BankAmericard Credit Card if your goal is to transfer a balance. The Freedom Unlimited should be viewed as a cash back card.

The Verdict: One of the strongest cards available to those with good (but not perfect) credit. The card combines industry leading cash back rates (1.5% on everything) with a strong 15 months of 0% Intro APR on Purchases and Balance Transfers and a $150 cash bonus when you use the card to make $500 in spend in the first 3 months.

Most Appropriate For: Those with good credit seeking a daily-use card offering great cash back rewards and 0% Intro APR on Purchases and Balance Transfers. Best for new charges.

Least Appropriate For: Balance transfers, as it charges the 5% fee while offering no more free term than the Slate (which has no transfer fee).

Going back to the $10,000 example above. (just be aware that we're using the $10,000 number as an example to demonstrate how the process works. You may be approved to transfer an amount greater or less than $10,000). If you transferred that balance onto a card which offers 15 months of 0% intro APR with no transfer fee, and maintained the same $200 monthly payment, you can see how much faster you'll be reducing your balance in the chart below.