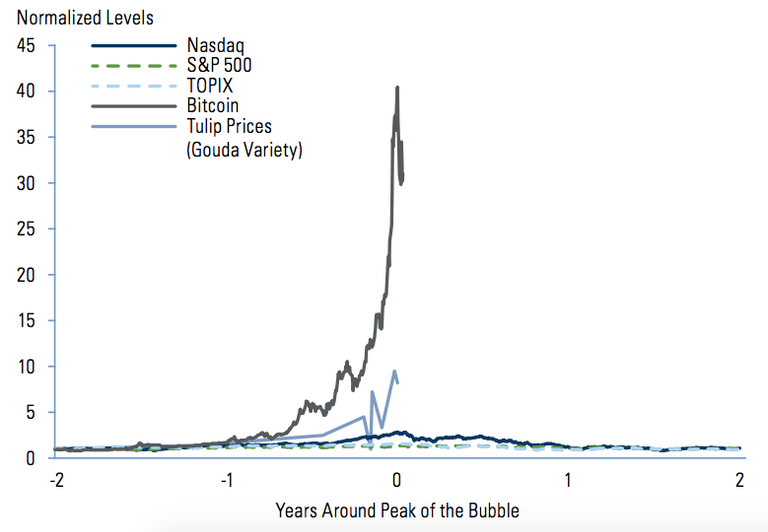

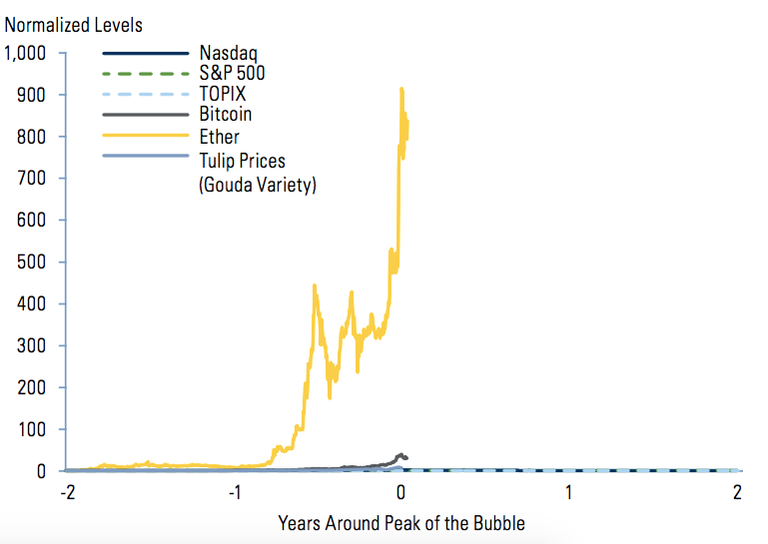

Mossavar-Rahmani referenced data from a public report by Goldman Sachs’ Investment Strategy Group, comparing price trends of Bitcoin (BTC) and Ethereum (ETH) with equity bubbles of the past like the TOPIX in 1990, and Nasdaq in 2000.

Mossavar-Rahmani argues that TOPIX and Nasdaq look “like a flat line” compared to crypto, and even compared to the infamous Tulip bubble in the early 1600s, Bitcoin’s price is too high. Mossavar-Rahmani added that the Ethereum price is “is even more astronomical,” as the bubble on the graph far outstrips even that of Bitcoin.

Normalized Levels

Normalized Levels

When considering the impact of a cryptocurrency “bubble burst”, Mossavar-Rahmani suggested that it wouldn’t lead to a global financial crisis, as cryptocurrencies make up a smaller part of the global economy than previous bubbles.

“Cryptocurrencies are a much smaller part of the global economy, whether you compare it to US GDP or global GDP, it's less than 1% of global GDP,” Mossavar-Rahman stated.

She admits as there has been significant investment in building exchanges, infrastructure, and hedge funds in the crypto space, when the bubble bursts some people “will get hurt… But it's a very, very small part of global GDP.”

On Jan. 31, Lloyd Blankfein, CEO of Goldman Sachs, denied that Goldman Sachs would be opening a cryptocurrency trading desk, even though the New York bank has owned a stake in a crypto trading desk Circle since 2015.

Digital currency exchange and wallet service Coinbase has resolved the issue of intermittent availability for BTC buys and sells, the platform reported today

Thnks for gour relevent content

A new cryptocurrency: the Cultural Coin

The company plans to introduce crypto ticketing in 2019, with all customers being offered a wallet for Cultural Coins. Fees associated with buying entry to exhibitions, galleries, gigs and landmarks would be set at 6 percent - a stark contrast to the 30 percent commission demanded by some current ticketing providers.

This 6 percent fee is going to be divided in four ways. Cultural Places would take a 3 percent share of the revenue, 1 percent would be returned to customers through a loyalty scheme, another 1 percent would go to all users in the ecosystem who hold Cultural Coins, and the remaining 1 percent earmarked as royalties for the institutions offering engaging content to the public.

Audio guides and shop memorabilia would also be on sale through the app, allowing visitors to skip queues and make the most of their time.

One of Austria’s first ICOs

Under the leadership of CEO Patrick Tomelitsch, the focus now for Cultural Places is its initial coin offering – one of Austria’s first.

A total of 900 mln Cultural Coins are being made available to the public. The company’s pre-ICO of 90 mln coins ends on March 4, with the rest being offered across four phases from March 5 to April 5.

Thanks for your relevent content

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cointelegraph.com/news/goldman-sachs-investment-chief-crypto-bubble-burst-will-affect-1-of-global-gdp