Forbes says 2017 has been a breakout year for crypto with a mind-bending appreciation of cryptocurrencies, transaction volumes for Bitcoin increasing 100x (in USD) from what they were at the beginning of the year, and appearance countless new blockchain projects. I’d say it’s just the beginning of the crypto expansion to the multi-trillion dollar markets, that will be led by less volatile asset tokens.

Up It Goes!

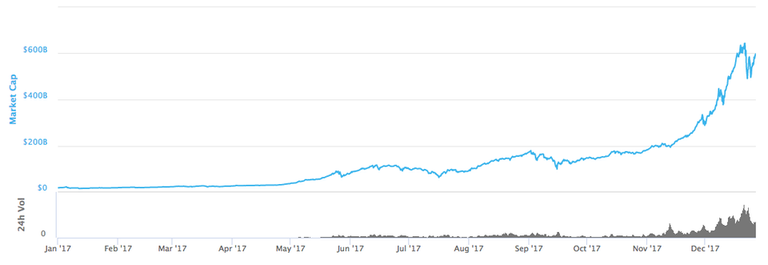

Last summer, we made a research estimating that the total cryptocurrencies capitalization can exceed $5 trillion by 2025, and this number already seems conservative — the market is growing faster than we expected.

To illustrate, we estimated that the market cap would reach $400 billion by the end of 2018, but the latest news about major exchanges launching futures on bitcoin and the growing interest from institutional investors towards cryptocurrencies speeded up the growth, so we already have $600+ billion market cap (4x since we published the report).

Crypto capitalization in 2017

Source: coinmarketcap.com

We believe that in 2018 volatility of the crypto market can increase even more, as the rapid capitalization growth of late 2017 was not yet accompanied by a similar growth of the number of crypto wallets.

However, the long-term trend stays: the crypto market will grow exponentially within next 5–7 years mostly thanks to the high adoption rate of cryptocurrencies, just like those of the cell phones and the Internet. The advantages the blockchain provides, like the ease of cross-border transactions, low transaction costs and security, are huge, and we estimate that the number of bitcoin wallets alone will double next year reaching record 40 million wallets.

Moreover, the institutional investors, from hedge funds to family offices and VCs, and high-net-worth individuals are getting more and more serious about the crypto. Some central banks, for example in Russia and Japan, are planning to issue a full central-backed cryptocurrency that will be fungible against BTC and the leading cryptos. And others announced plans for holding digital currencies starting next year.

2018 is the year for crypto to go up even further.Safe Haven of the Crypto World

Whilst the adoption of crypto is going to increase dramatically, we expect the landscape of the market to change as well. The attention of the crypto holders can shift to asset tokens, whose price is linked to hard assets, ranging from equity and debt to real estate and even works of art, and here’s why. The volatility of the cryptocurrencies is not for the faint of heart, it can repel some of the traditional investors, but less volatile asset tokens can be seen and used as a crypto safe haven.

We estimate that the furthergrowth of the crypto market will be led by those tokens that would be used to diversify crypto portfolios without converting to fiat and loosing 2–10% on commissions. By 2025 they can account for at least 80% of the total crypto market.

There’s another sign of the great potential of asset tokens. If you look at the structure of portfolios of traditional investors, you’ll see that they hold only ≈ 5% in cash or equivalents, and the rest is assets, like real estate, equity, bonds etc. We expect that a similar situation will exist in crypto market in few years. Only a fraction of the capitalization will be the “cash currencies”, like Bitcoin or Litecoin. The majority of tokens will be linked to different asset classes.

We believe, tokenization — creating asset tokens — is the next big thing in crypto. As Bradley Rotter, Principal Officer and Managing Partner of various equity and specialty-financing companies, notes, «everything that can be tokenized will be tokenized.»

The New Wave of ICOs

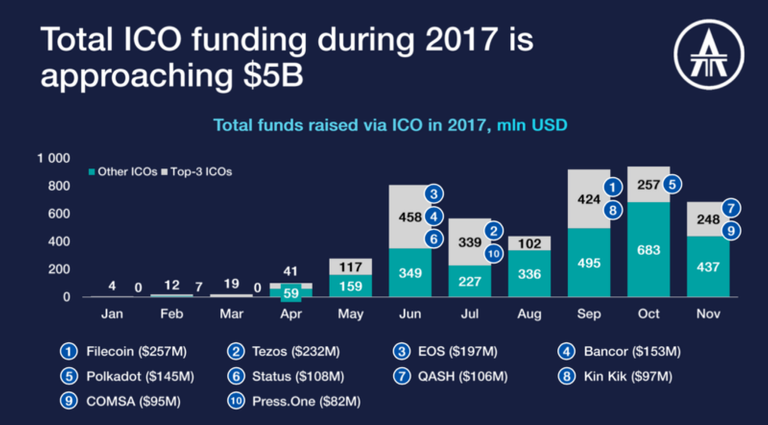

In 2017 holding an ICO event has become a viable alternative to VC funding. An average ICO proceeds have reached $15 million, meaning that blockchain startups could raise as much through crowdfunding as a mainstream startup from VCs during Series A or B. By the end of 2017, total ICO funding is going to exceed $5 billion with top-10 projects raising up to $100M-$250M from a single ICO event. So it’s no surprise that since June monthly number of ICOs have increased from 40 to 200 projects.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://blog.latoken.com/what-will-happen-in-the-crypto-market-in-2018-a7406faae961

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by skhayatali60 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Congratulations @skhayatali60! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @skhayatali60! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking