Review

WePower is an ecological energy distribution network based on blokchain

WePower enables renewable energy suppliers to raise capital by distributing power tokens.

These tokens are the energy that are dedicated to generating and delivering. Standardised energy validation makes it possible to facilitate and open up the global energy investment ecosystem that currently exists. As a result, energy consumers will be able to trade their products directly with investors and buyers of green energy (consumers and investors) and raise capital by selling energy in advance, at below-market prices.

It ensures the availability of liquidity and increases access to capital. The WePower blockchain solution is currently recognized by Elering, one of the most innovative transmission network operators in Europe.

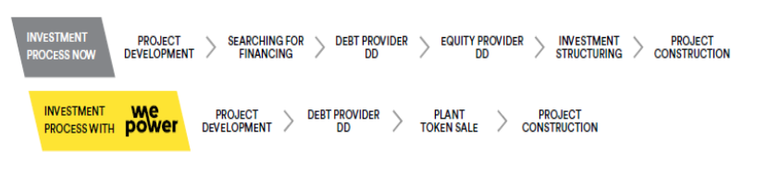

In order to take full advantage of the financing process and free access to the resource, WePower enables energy validation. Tokenized energy is a mechanism of contracts between a manufacturer and a buyer of energy.

People who own WPR tokens will be able to participate in auctions to purchase tokenized energy on a privileged basis once the renewable energy plant is installed on the grid.

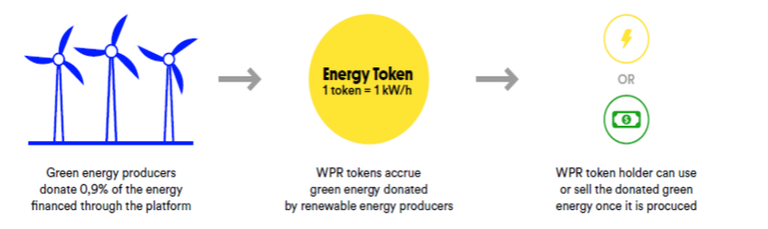

The distribution of energy resources will be based on the number of WPR tokens that the user has. On the other hand, holders of WPR tokens are awarded no less than 0.9% of the tokenised energy directly contributed by renewable energy suppliers WPR token bearers will be able to use or market this energy.

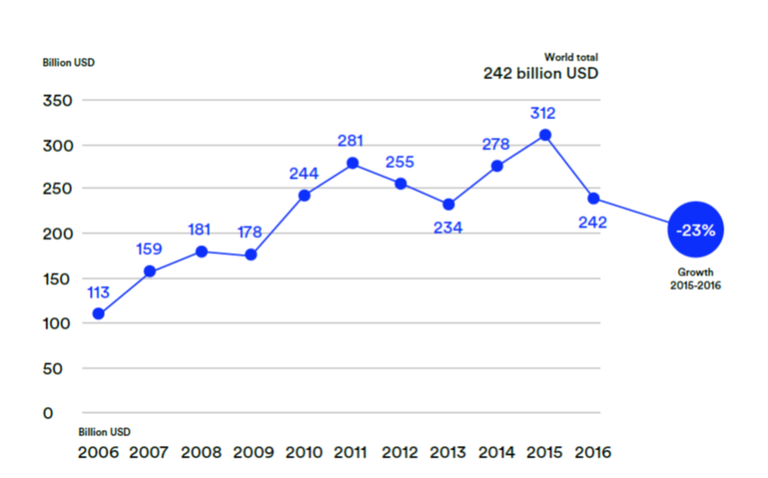

WePower presents itself on the market in a key period. As a result of declining premiums and the increased development of renewable energy that would compete at market prices, banks initiated a growth in domestic capital requirements, decreasing the debt-to-capital ratio. The ratio went from 20:80 to almost 50:50 for recent sustainable energy development projects. Share capital became a limited source of financing, which helped to reduce investment (-23% year-on-year) thanks to lower indebtedness.

Energy certification and the platform created on a decentralised public database opens up the global green energy market to a large number of investors. On a free platform, future energy projects are not based solely on domestic investors. We believe that the rationalisation of the investment system from WePower will make it possible to significantly reduce investment costs, which are eventually divided between regenerative energy producers and users/investors.

The WePower system is ready. You can try the demo version on the website. We are working on the development of our pilot program with an Elering driving system manager. Thanks to current cooperation agreements with renewable energy suppliers, WePower can start working within 9 months of the main sale. These partnerships will bring with them a set of funding programmes for the first 2 years of WePower's operation. Having new customers in the Spanish market and being admitted to the Startupbootcamp Energy Track in Australia, WePower expands at the same time on two continents.

This project is supported by the Ministry of Energy of the Republic of Lithuania, due to its potential for social impact in the process of controlling global warming. WePower will distribute part of its techniques to countries that use renewable energy and CO2 accounting, using blockchain technologies.

The innovative WePower token concept was clearly defined with the European regulator. It is structured as a collective financing system based on incentives, where participants benefit from free energy that can be used or traded on the platform.

State of the energy market today

According to Bloomberg New Energy Finance (BENF1), the level of investment in the alternative energy sector in 2016 has reached USD 242 billion, a 23% drop compared to last year. At the beginning of 2017, the figures indicate that investment in renewable alternative energies has fallen by 20.9% in the first quarter of 2016 from 64,250 million to 50,840 million. Banks, PE funds, hedge funds that prevent all others from entering the market for energy investments and do not respond to the needs of the renewable energy community with adequate access to the heritage and the demands of final energy consumers.

WePower aims to address the current problems of accessibility to the capital of renewable energy producers and access to investment in cost-effective projects directly for end-users. The most agile and transparent form along the blockchain network and electrical validation is used for this purpose. Using WePower technology, it addresses the following shortcomings in the energy sector:

- Global access to capital for green energy projects

- Global access to markets and investments in renewable energy (i. e. liquidity)

- Speed and clarity

WPR - The next generation of tokens

WePower is the stage that follows the evolution of the digital economy. Most of the tokens that are currently launched on the market, tokenize equity or future cash-flow of the entity, both without own value. WePower tokenises energy, which has a well-established market and quantifiable value.

Distribution of Token

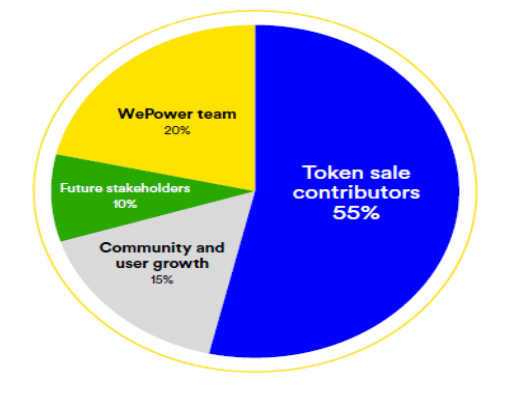

The offer of WPR tokens is distributed as follows:

WePower will market 55% of all token offerings in the pre-sale and main sale. WPR tokens sold will represent 55%. Unbought tokens will be destroyed. Tokens assigned to the team will be retained for 3 years with a purchase plan and tokens for future use will be insured for 4 years.

Tokens Sales Goals

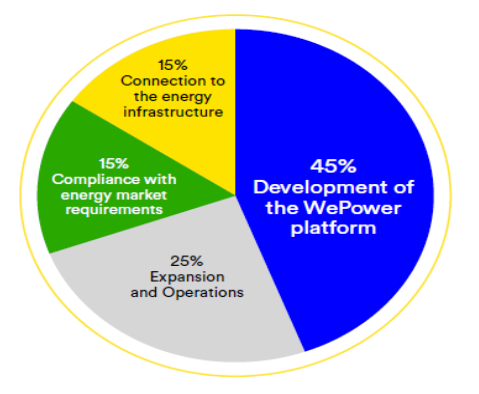

The money collected during the contribution period will be used only for the development and benefit of WePower. A budget has now been drawn up, which is a hypothetical case in which our upper limit has been reached:

WePower will allocate 45% of its revenue to the development of the WePower platform. 15% of the funds will be used to include WePower's current energy infrastructure in key target markets. A further 15% of the revenue will be used to ensure WePower's compliance with the energy sector criteria. Growth and operations - 25% of funds received. If WePower achieves its maximum limit, staff must complete all 3 stages of the project as detailed in this Whitepaper.

The WePower team

Nikolaj Martyniuk. Co-founder and CEO

Artūras Asakavičius. Co-Founder

Kaspar Kaarlep. CTO

Heikki Kolk. Complex system architecture

Jon Matonis. Block Chain Advisor

Eyal Hertzog. Consultants in locking chains and symbolic economics

Lukas Kairys. Blockchain and smart contract developer

David Allen Cohen. Energy Advisor

Trevor Townsend. Startupbootcamp Australia Energy Program Manager

Liraz Siri. Security

Tadas Jucikas. Director of EI

Brad Yasar

Aryan Saber

Aaron Bichler.

Darius Rugevičius

Henri Laupmma

Nimrod Lehavi Payment Advisor

Mantas Aleksiejevas Digital Reach and Sales

Rene Fischer Public Relations Partner

Vytautas Alkimavičius Senior Software Engineer, Metasite

Gytis Labašauskas. Digital Marketing

Auks Siaudzionyte. Community management

Links of interest

Website: https://wepower.network/

ANN: https://bitcointalk.org/index.php?topic=2207367.0

White paper: https://drive.google.com/file/d/0B_OW_EddXO5RWWFVQjJGZXpQT3c/view

Twitter: https://twitter.com/WePowerN

Facebook: https://www.facebook.com/WePowerNetwork

Telegram: https://t.me/WePowerNetwork

Reddit: https://www.reddit.com/user/WePower

Youtube: https://www.youtube.com/channel/UCsocTWqQzDvoLBf2sVj96lQ/featured

By Bitcointalk user: Cjota

Profile: https://bitcointalk.org/index.php?action=profile;u=1640898

Myetherwallet: 0x90b07af0aAA4A705bCC441c2B1D0B581F42bcDB4

by Cjota

great project to invest