There are issues that is authentically hampering the world's financial system. This include: The traditional financial industry is highly centralized. Financial transactions rely heavily on the endorsement and support of sizably voluminous financial institutions, with substantial transaction fees paid out to these institutions. Monopolistic financial institutions have in fact raised lending rates for borrowers and reduced the interest income minimally for lenders.

Cost

The core model of a credit agency is to apportion the costs of non interest-earning elements and deplorable debts by charging the faithful client who can pay back the mazuma. For borrowers, it brings an adscititious cost.Distributed Credit Chain (DCC) is the world’s inaugural distributed banking public blockchain with an intent to establish a decentralized ecosystem for financial accommodation providers around the world. By empowering credit with blockchain technology and returning ownership of data to individuals, DCC’s mission is to transform different financial scenarios and realize true inclusive finance. You can visit the project's website here for more precise information: https://dcc.finance/

Viability

From the credit agency's perspective, a plethora of time and efforts are wasted in verifying the credit of borrowers who do not meet the agencies’ risk criteria, which leads to wasting resources and decrementing efficiency.

Profiteering

A centralized credit model entices many financial institutions to deviate from their primary purpose— accommodating customers. Aiming for profitability, they deduct lenders while constricting borrowers, and expand their profits by elongating their customer base.

Distributed Credit Chain working to ameliorate the above quandaries raised in the inequitable financial world systems through the following ways:

1 Borrowers: Individuals with categorical borrowing demand are to establish blockchain account to sanction data accommodation provider and Initiate borrowing request. This will engender a system that is official and organized devoid of any corruption.

2.Data Accommodation Provider: DCC will Integrate individual data and store them on the chain, emaculate dirty data, and provide data standards which will be secured and accessible.

3.Algorithm & Computation Accommodation Providers: DCC will employ a system that will Extract characteristics from data, make judgments predicated on policies and quantify judgment predicated on characteristics to authenticate the whole system.

4.Credit History Feedback; The approved credit history reports engendered on blockchains obviate quandaries such as long-term borrowing and reiterated test borrowing making the system liberate from error.

5.Funding Providers

Not directly involved in lending but provide funding (such as ABS-purchasing institutions).

6.Risk Postulating Institutions

Operate a credit business by earning income from bearing concrete jeopardies, manage loans in progress and amass after loan.

WHY SHOULD YOU HEEDFULLY AURICULARLY DISCERN DCC

Break the Monopoly

With an ecumenical distributed banking ecosystem, DCC aims to break the monopoly of traditional financial institutions and to return earnings from financial accommodations to all providers and users involved in such accommodations so that each participant may share the return of ecological magnification. distributed banking will ultimately be a way to authentically achieve an inclusive system of finance.

Decentralized Cerebrating

Through decentralized mentally conceiving, distributed banking will be able to transmute the cooperation model in traditional financial accommodations, building an incipient peer-to-peer and all-communications model of cooperation across all regions, sectors, subjects and accounts.

Transform Business Structure

As it pertains to business, distributed banking will thoroughly transform traditional banking's debt, asset, and intermediary business structure. The tree-like management structure of the traditional bank will thus evolve into the flat structure of a decentralized bank, establishing distributed standards for sundry businesses and ameliorating overall business efficiency.

Regime Regulation

As it pertains to regulation, the fact that all records registered in the blockchain cannot be tampered with will enable regulators to perforate the underlying assets in authentic time. Immensely colossal data analysis institutions will additionally be able to avail the regulatory bodies understand and respond to industry risks more expeditiously predicated on blockchain data analysis.

The distributed credit chain can be applied in many scenes in financial area, among which a DApp accommodating the personal loan market has been launched and in utilization, the others are under developing and will come anon. Which includes the following:

-Loan registration accommodation.

-Consumption Loan

-Consumption Installment.

-Blockchain Credit card

-Token Loan Accommodations

-Mortgage Claim registration

-ABS Asset Distribution

Distributed Credit Chain is in the market to raise fund which will give the public the opportunity to buy token and be a component of this innovative project which will empower credit and enable finance. The token sale is already on since 23rd May 2018 and will run through till August 15th 2018. Why not avail yourself this opportunity to own this awe-inspiring token for better tomorrow. Have an optical canvassing of the gregarious network for more intriguing aspect of the project.

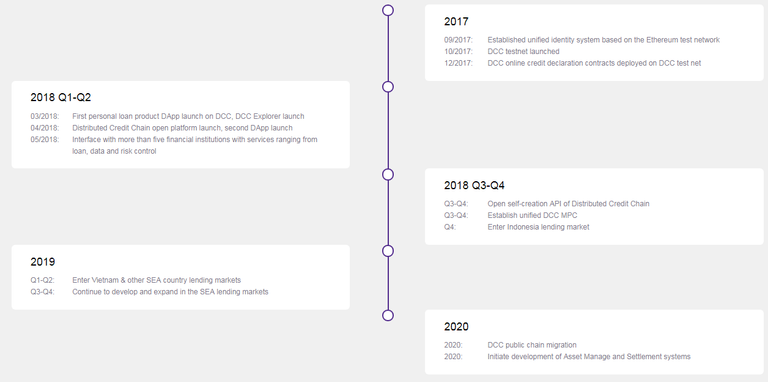

Road Map

Website: https://dcc.finance/

Whitepaper http://dcc.finance/file/DCCwhitepaper.pdf

Twitter: https://twitter.com/DccOfficial2018/

Facebook: https://www.facebook.com/DccOfficial2018/

Telegram: https://t.me/DccOfficial

Authored By: https://bitcointalk.org/index.php?action=profile;u=1156227

Great project that will definitely bring a new phase of solutions in the blockchain industry

The concept of DCC is good one. It is feasible