Following regulators around the world, technology giants like Facebook, Google and Twitter are now taking actions against initial coin offerings (ICOs) and cryptocurrencies in terms of advertising.

Will this dent the popularity of cryptocurrencies? Nope.

Can this cause a short-term blip in the prices? Definitely.

The popularity of the cryptocurrencies is based on the underlying technology and not on advertising. Also, Bitcoin and altcoins have faced lot more serious problems in the past and have emerged stronger. This time is not going to be any different.

We consider these dips as an opportunity to get a “piece of the future” at a discount. Read on to see what we can buy today.

BTC/USD

We had beforehand demonstrated that the underlying stop misfortune for Bitcoin was $7,600, however this has not activated. Right now, there is a tussle between the bulls and the bears at the $8,000 stamp.

The pattern is down as costs are citing beneath both moving midpoints. The 20-day EMA is falling and holds the key at the close term cost development. On the off chance that the bears break beneath the March 18 lows of $7,715, the BTC/USD combine will debilitate further, welcoming further offering.

Then again, if the bulls push costs higher from the present levels, we may see a range create. The 50-day SMA is smoothing as opposed to falling, which focuses to a range bound activity in a couple of days.

Imperative backings to watch on the drawback are $7,850, $7,285 and $6,075. On the upside, the protection levels to search for are $8,912 (the 20-day EMA) and $9,412.41 (the intraday high of March 21).

Though the risk is high, we suggest holding the long positions with the stipulated stop loss. The traders can add to their positions once the cryptocurrency shows signs of bottoming out.

ETH/USD

The Relative Strength Index (RSI) readings on Ethereum are in the profoundly oversold domain not seen since Dec. 2016. All in all, should the merchants start long positions?

No. In a downtrend, the RSI can stay in the oversold region for quite a while. In any case, brokers should look at an inversion in the cost activity in light of the fact that an oversold perusing demonstrates that the offering has been overcompensated.

On March 27, the ETH/USD match broke beneath the March 18 lows of $452.32. In a perfect world, the offering ought to heighten and the cryptographic money should tumble to the following help of $385.

On the off chance that the business sectors dismiss the lower levels and the value begins to move go down, it will be the principal sign that a base is set up. Once the value revitalizes above $600, it will show a twofold base development. Subsequently, we propose holding up until the point that Ethereum indicates quality.

BCH/USD

Bitcoin Cash has retested the March 18 lows of $884.7951, as figure in our past investigation. The following help on the drawback is a tumble to the February 06 lows of $778.2021. On the off chance that this level breaks, the slide can reach out till $600 levels.

Any pullback to the upside will confront offering at the 20-day EMA, which has gone about as a critical protection on past events.

The leveling 50-day SMA focuses to a range bound activity, however we ought to propose a purchase on the BCH/USD match simply after we get an affirmation of a base development. We trust that $1,200 is a decent level to enter long positions.

XRP/USD

Swell is clutching the basic help of $0.56270 with the skin of its teeth. The present costs are far from our suggested purchase levels of $0.71. Our stop misfortune is at $0.52 and the digital currency plunged to a low of $0.55703 on March 27.

In the event that the bears maintain underneath $0.56720 for three days, a brisk slide to $0.22 is conceivable on the grounds that there is no significant help in the middle.

The XRP/USD pair will confirm a range bound trading action if it rallies above the $0.72 levels.

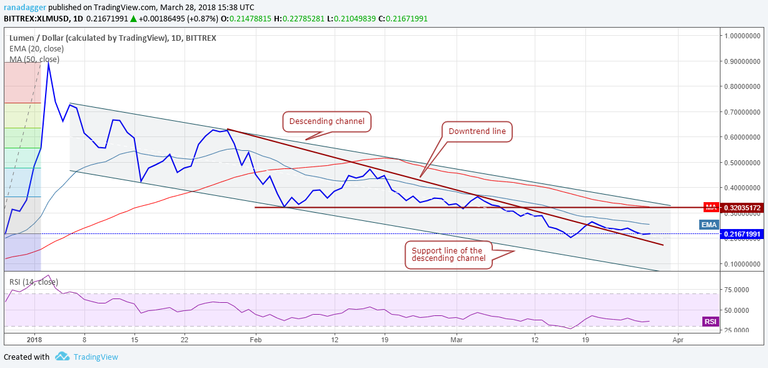

XLM/USD

Stellar has figured out how to remain over the March 17 close (UTC) of $0.20263635. This shows absence of offering at the present levels, however we are yet to see stable purchasing.

The XLM/USD match will show a plausible change in incline on the off chance that it can close over the $0.27 stamp. Until at that point, costs may stay in a tight range.

A break of the $0.2 levels will be a bearish advancement and can sink costs to $0.1 levels. In this manner, we are not proposing a long position at the present levels.

LTC/USD

The long position in Litecoin recommended at $165 was closed when it hit its stop loss at $142 on March 27.

The LTC/USD combine now has bolster at the trendline of the symmetrical triangle at $128. On the off chance that this help holds, the bulls will influence another endeavor to pullback to towards $187. In any case, if the help breaks, the digital money can tumble to the February 02 lows of $107.102.

The 50-day SMA has smoothed out, which focuses to conceivable range bound development. We will turn bullish when the value breaks out of the 20-day EMA and the downtrend line.

ADA/BTC

We expect Cardano to remain range bound between 0.00001690 and 0.00002460 for the next few days.

The following leg of the down move will begin if the ADA/BTC match breaks beneath the backings. In any case, it has low odds of happening.

On the upside, if the digital money breaks out of 0.00002460, it is probably going to begin another uptrend. We prescribe long positions once the breakout keeps on. The creating positive uniqueness on the RSI shows that a rally is in the offing.

NEO/USD

Despite the fact that the bears have broken beneath the bearish sliding triangle design on NEO, the bulls are attempting to protect the March 18 lows of $49.04.

If the NEO/USD pair breaks below $49.04, it will become negative and can slide to $31.15 levels.

The first sign of strength will be if the bulls push the cryptocurrency above $65 levels and settle there.

EOS/USD

EOS has been the most grounded one among the best digital forms of money. It is exchanging great over its March 18 lows and is near the 20-day EMA.

On the off chance that it breaks out of the dropping channel and the 50-day SMA, we trust it will begin another uptrend. Along these lines, we prescribe a long position on the EOS/USD match at $7.5. The stop misfortune can be kept at $5 and the objective goal is $11.

Our bullish view will be invalidated if the price declines and stays below $5.

thank you for sharing, I need the analysis!

I'm glad you liked the article