- Jay-Z expands into the Crypto Business!

- Bitcoin Private: Just another Bitcoin Fork or noteworthy?

- Bitfinex announces decentralized Crypto Exchange EOSfinex on EOS!

- Will it soon be possible to pay the Transaction Fees with Tokens on Ethereum?

- Coinhive on PCs, Malware on Telegram: Vulnerabilities used for mining!

- World-wide Crypto Regulation for IMF Managing Director Lagarde "inevitable"!

After Nas and Snoop Dogg support the Robinhood trading platform, rapper Jay-Z will now be working for their subsidiary, Arrive. Robinhood currently has assets of nearly $ 1.5 billion and has recently announced its own Robinhood cryptocurrency.

Jay-Z and Crypto

Shawn Carter, better known as Jay-Z, leads the management company Roc Nation, which is looking for new artists, to promote concerts, record and record new music and produce films. To this list, the 21-time Grammy winner and music mogul can now also add crypto CEO.

In the spring of last year, Carter confirmed the leadership of the subsidiary Arrive Venture Capital, which will focus on startups. Already in the past, Carter had highlighted himself by investing in new technologies and concepts such as Away, Jetsmarter and Uber.

Arrive's Neil Sirni said the company will use its expertise in "brand building, consumer development, artist management and professional sports representation". It wants to support especially young entrepreneurs and brands in the management.

The parent company Robinhood confirmed in January to expand its services to the trade in bitcoin and ether. Although the company does not plan to operate as a crypto exchange in the future, the platform could be a competitor to existing Bitcoin exchanges, because within a week, over one million people signed up for the platform's services.

Robinhood, Arrive and Jay-Z

"Robinhood can always count on our support as it pursues the long-term goals of our company," added Sirni. The platform already has over 3 million users and a value of nearly $ 1.5 billion. In addition, the business model leaves investors with a great deal of room for maneuver. Furthermore, the company has recently released their Robinhood Crypto, which is already celebrated as a success.

Arrive is the third subsidiary and was made public only a short time after the confirmation of bitcoin and ether trading. She has also invested in other projects such as Insite Applications and Deivalet.

Jay-Z was one of the first rappers to publicly talk about his investment and cryptocurrency projects. During his "Soldier Field" tour he sold several tickets in cooperation with the Chicago Sun Times in Bitcoin.

Bitcoin is only two weeks away from experiencing another fork. This seems to be different at both the first and the second glance, as the numerous previous Forks. Bitcoin Private will be a cross between Bitcoin Gold and ZClassic. This means that apart from the advantages of Bitcoin Gold, Bitcoin Private will also have the anonymity of ZClassic integrated in the form of zk-snarks.

The aim of Bitcoin Private, or BTCP for short, is, as the name implies, to make Bitcoin private again and completely anonymous. Although it is still written in numerous media that Bitcoin transactions are anonymous and can not be tracked. However, this is proven not the case.

Zk-snarks forms the basis for placing the transactions in a public block chain, but the sender, the recipient, and other transaction metadata are not publicly available. Zk-snarks is typical of the "Z-Coins" - ZCash, ZClassic and ZenCash. Zcash was the first application that implemented zk-SNARKs. Zclassic is a fork from ZCash that happened just a few days after the release of ZCash on November 5, 2016.

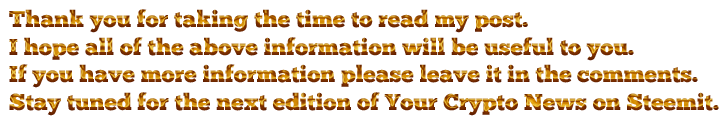

The face and founder of Bitcoin Private is Rhett Creighton, co-founder of ZClassic. In early December 2017, he announced that he would team up with co-founder of ZClassic Joshua / @ movrcx and both would like to revive the Zclassic project together.

The naming of the ZClassic Bitcoin Fork was decided and announced in a voting on Twitter just five days later. It was also clear at the time that it would actually be a rebranding of ZClassic:

While Creighton has stated that the development of ZCL will continue, whether and how the development will continue after the release of BTCP is still pending.

Bitcoin Private Fork

On February 28, 2018, a snapshot of the Zclassic and Bitcoin blockchain will be made. The holders of these two cryptocurrencies receive a ratio of 1: 1 Bitcoin Private Coins. Example: As the owner of a Bitcoin and 10 ZClassic, the owner receives an additional 11 BTCP (1 BTCP for the one BTC and 10 BTCP for 10 ZCL).

The combination of outstanding coins at the time of the snapshot of ZCL (approximately 3 million) and BTC (more than 17 million expected) will create a total of slightly more than 20 million BTCP coins.

Already two days after the snapshot the BTCP-MainNet should start. Bitcoin Private, as well as Bitcoin Gold and ZClassic, will use the mining algorithm Equihash to support GPU mining.

Currently ZClassic trades on Bittrex, Cryptopia and CoinExchange. Whether these platforms will write the free coins well, is not fixed at the time of writing. None of these exchanges has commented on this until now.

What is certain is that the Coinomi Wallet will support the fork:

Alternatively, the ZClassic can also be kept on the official wallet of ZCL.

A few days ago, the Bitcoin Private Team shared the following tweet. Maybe Binance will also support Bitcoin Private. Details are not known here either.

When the fork became known last December, Zclassic's price was still below 4 euros. After announcing the forks and other details, the price skyrocketed, reaching an all-time high of € 189.54 on January 7th.

Why could the Bitcoin Private Hard be "different"?

Unlike the numerous Bitcoin Forks last year, aside from Bitcoin Cash and perhaps Bitcoin Gold, Bitcoin Private seems to have a real use case and eliminates an actual problem.

In addition, behind the project with the founders of ZClassic is not an anonymous team, but seasoned developers. Rhett Creighton is a familiar face in the crypto community.

In contrast to many Bitcoin Scam Forks, Bitcoin Private can already provide a working program code before the snapshot. This is accessible and controllable on Github for everyone. In addition, when looking at the Github repository, it can be seen that the code is actively working.

The only accusation that we can make to Rhett Creighton and his team in our view is that the project uses the Bitcoin name for its rebranding to get more attention.

All in all, from our point of view, at the moment, it is not possible to estimate how the project will develop. Nevertheless, Bitcoin Private is one of the more interesting Bitcoin Forks in our opinion.

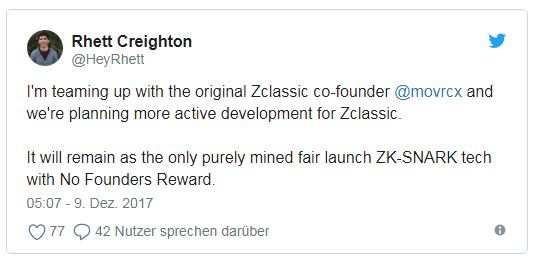

On February 12, 2018, Bitfinex announced that it will develop a decentralized exchange based on EOS blockchain technology. EOSfinex will use the scalability and speed of the EOS blockchain and realize an on-chain exchange.

Unlike an off-chain transaction, an on-chain transaction occurs on the original blockchain rather than outside it, on another blockchain (for example, Ethereum). The cryptocurrency exchange EOSfinex will accordingly only support transactions on the EOS blockchain (between the native tokens of the EOS platform).

J.L. van der Velde, CEO of Bitfinex said:

Details and timetable for the launch of the exchange EOSfinex are not yet known. According to the opinion on Medium further announcements will follow, as soon as the development is further advanced.

EOS course

Whether the announcement is a groundbreaking news, as discussed on some platforms remains to be seen. Already in the middle of last year Bitfinex had announced a decentralized Exchange on the Ethereum Blockchain: Ethfinex and started largely unnoticed on 27.12.2017. In any case, the EOS course reacted very strongly to the announcement last night and rose within a very short time by 0.50 euros to more than 7.50 euros per EOS. Currently, the mood seems rather modest. EOS is trading at 7.30 euros at the editorial time.

The EOS Blockchain

EOS is still in the conceptual stage and currently has only one test network. The EOS ICO will run until June 1, 2018. Recently, EOS released the latest version of the Dawn Protocol, 3.0 in a first alpha trial. It is unlikely that the launch of the EOS platform and generation of the Genesis Block will take place before June 1st.

Nevertheless EOS already has the second project with EOSfinex on the future own blockchain. Back in December, it became known that Everipedia will move the entire article creation, release, editing and data storage process to the EOS platform. Everipedia was founded in 2014 and aims to become a better alternative to Wikipedia. a. eliminated the problem of censorship. By using the Smart Contracts of the EOS platform, a completely censorship-protected system is to be created. The EOS-based cryptocurrency token is intended to create an incentive for contributors.

The Everipedia and EOSfinex tokens could thus, in addition to EOS itself, be the first exchangeable digital currencies on the EOSfinex Exchange.

The token economy on Ethereum would be wonderful - if there was not the small, somewhat uncomfortable fact that every token transaction costs a small amount of ether fees. To change this, the community is currently discussing ways to pay for the tokens themselves. Now there is even an EIP for it, which is an important step towards implementation.

There are now thousands on the Ethereum blockchain. Thanks to the ERC20 standard, it is easy to generate these tokens and to receive and send them through the usual wallets. With the tokens you can represent on Ethereum just about any good - stocks, gold, silver, coffee, government bonds, euros, dollars and so on.

For many users of these tokens, however, there is still a problem that you have to add a small amount of Ether as a transaction fee to each token transaction. Because this means that the publisher either with its say coffee tokens also send a bit of Ether or that the recipient of these tokens must still buy ether. Without the Ethers, the tokens are virtually frozen. The most convenient solution for everyone involved would be to simply pay the transaction fees into the token rather than the Ether.

However, this comes with some problems. So far, the fees for the miners are calculated exclusively in Ether. Of course you could soften that rule, and say the fees can also be paid in all ERC20 tokens. In this case, however, somehow it would have to be possible for the prices to be comparable. A decentralized market could be a solution here, but it's hard to find a way around the volatility of token prices in Ethers. Softening the monopoly of Ether on fee payments makes it much more complicated to get the right amount of transaction fees - and to estimate them as miners.

Therefore, the current discussion is taking a different approach: trying to get the channels paid in tokens but giving the miners Ether. In other words, you build a channel that switches the tokens into Ethers. A bit like BitPay does when you pay with Bitcoin, but the dealer gets euros, just decentralized and stronger at the protocol level. How to do that is the subject of various proposals, one of which has recently reached the status of an EIP, an Ethereum Improvement Proposal.

Jim McDonald describes the basic construction in a blog post. The ERC20 contract for tokens has an Approve () function. This allows another address to transfer a certain amount of tokens. Now, if you intend to pay your transaction fees with tokens instead of Ethers, you can allow a third party to pay out a certain amount of tokens from the account. This allows this third party to complete the entire transaction in Ether and make another charge.

A concept of how to pay for tokens has already been presented status. Status is a mobile Ethereum client funded by issuing SNT tokens. "By placing an Ethereum-signed message in the token contract, SNT accounts can sign messages in which they map transactions and propose a gas price [a fee] in SNT for anyone else to bring the transaction into the blockchain." Users would have the advantage that they can pay fees with the SNT tokens, while the status wallet could form a small ecosystem of alternative services.

Recently, Ethereum developer Ludovic Galabru has submitted an EIP, an Ethereum Improvement Proposal, to bring such a channel into the Ethereum client. The EIP number 865 describes "a standard function that a token contract can implement to allow a user to delegate the transfer of tokens to a third party. The third party pays the Gas [the fee] and receives a token fee. "

How does it work in detail? It's a little complicated. The sender takes a message in which all the information about the payment is sent - who sends how many tokens, who is the delegate who sends the transaction in his place, how many tokens he pays for the fees - and uses this to form the three values V, R, S, which are the outputs of an ECDSA signature. He sends this together with the message to the delegate, who checks the values and then executes the transaction through his account. I can not explain the cryptographic subtleties.

Of course there are still questions. At least for me. Because to implement this concept, you would probably need an offchain channel, and a method so that the transmitter finds the delegate. This is challenging - but it can also be an opportunity to build a network of such channels through which one can also realize networks of payment channels (Raiden) or decentralized exchanges.

In the first days of February, around 4,000 state websites in the US and the UK were infected via the alienated WordPress extension, browsealoud. The infestation with the Monero Mining software Coinhive discovered the British security researchers Scott Helme. In addition, there is a new vulnerability in the Messenger Telegram, which also serves by means of malicious software unwanted mining.

The commercial software texthelp of the company of the same name automatically translates posts to read to visitors to a website in different languages. Using the browserealoud plug-in, you can make the software available in all WordPress blogs. The cyber criminals have just changed a tiny script called ba.js to install the Coinhive mining malware on the weblogs. The reading software and plug-in runs on countless state websites, which has made the activities of cyber criminals extremely easy. In addition, such a mining software is worthwhile only if enough visitors are online on the infected pages. The hackers were so picky about their victims.

British security researcher Scott Helme has noticed the infection and has informed several operators via Twitter. The manufacturer of texthelp has removed the WordPress extension browsealoud on February 11, to protect users from further damage. To protect yourself against such malware, you can do so with one of the numerous mining detectors or blockers available on the Mozilla Chrome Web Store and on the add-on page. In addition, NoScript prevents the execution of any scripts, which cyber criminals also have no chance to mine.

Crypto-mining: Kaspersky Lab discovers new vulnerability in Telegram

At the moment there is also a previously unknown vulnerability in the desktop app of the messenger service Telegram. Either the computer is prepared for a later takeover of cybercriminals or immediately infected with different malware. As messengers become increasingly popular, they also make it a popular target for hackers. In addition to conventional malicious software and spyware, Telegram's vulnerability also allows Mining software for Monero, Zcash or Fantomcoin to be played on the infected computers. The users should be encouraged via their messenger to download infected files and display the primary images, which begins the acquisition of the computer. The zero-day vulnerability is based on the RLO Unicode method (right-to-left override) and can be exploited on Mac OS X and Windows PCs, according to Kaspersky Lab. The manufacturer of telegram was informed about the vulnerability. Since then, according to Kaspersky Lab, no further infections have occurred.

Who wants to play it safe, should never accept files from unknown chat partners via Telegram. Particularly critical is, for example, the display of images or PDF documents, as over the acquisition of the computer can succeed. Initial evidence in the investigation of the malicious software suggests a Russian background of cybercriminals.

According to IMF head Christine Lagarde, global regulation of cryptocurrencies is "inevitable". She said this in an interview at the current World Government Summit in Dubai last Sunday. The head of the International Monetary Fund IMF sees the reasons for this primarily in the dangers of their illegal use. Following repeated prudence and coordinated action, Lagarde's renewed warning does not just suggest a future IMF intervention, but rather makes the end of the global regulatory patchwork more likely.

If you ask Christine Lagarde, the answer to the question that so many of the rulers of today are dealing with is already on the table. How to deal with the increasing influence of cryptocurrencies, she is on Sunday at the Political and Technology Summit World Goverment Summit sure.

said the 62-year-old Frenchwoman in an interview with CNNMoney. She warned against "dark activities" in the orbit of digital currencies.

Above all, this need lay in the dangers of illegal use. She emphasized that the IMF is actively pursuing efforts to curb the possibilities of money laundering and terror financing through digital currencies. However, regulators would have to relate much less to individual currencies, but rather to look at those who use them. Here it is necessary to check who uses the currencies for what and if there are licenses and competent supervision.

Lagarde had often warned against the criminal potential of cryptocurrencies in the past. Nevertheless, a call for joint regulation is new.

From Davos to Buenos Aires: Crypto regulation on the highest economic parquet

Most recently, the head of the IMF spoke on the subject of crypto regulation at the World Economic Forum in Davos last month. Here she reaffirmed that the IMF is already working intensively on the opportunities and challenges of cryptocurrencies. Illegal transactions made with the help of cryptocurrencies are unacceptable. Nevertheless, she acknowledged the innovative power of currency newbies.

In Davos, for example, US Secretary of State Steven Mnuchin or British Prime Minister Theresa May had made more determined statements. For their part, they signaled forthcoming regulatory initiatives, following Echo Lagardes. May announced that her government would be "very serious" about the criminal uses of cryptocurrencies.

Meanwhile, German Finance Minister Peter Altmaier and his French counterpart Bruno LeMaire are calling this month to put cryptocurrencies on the summit agenda of the upcoming G20 summit. For example, Germany and France are urging host country Argentina in a joint letter to the G20 presidency to consider the issue of cryptocurrency regulation at the March summit. There, it was important to develop international solutions to deal with the emerging crypto trade in the future.

Buenos Aires confirms what Davos has already announced: cryptocurrencies are determinedly finding their way onto the big stages of the World Economic Summit.

At present, however, there is still a veritable patchwork of global rhetoric regarding the regulatory responses of individual countries. When governments, state institutions and public authorities are asked, there is no consensus about how to deal with digital payment alternatives. If the IMF now coordinates, this would be a real game changer.

Image source:

- Post header created by myself

- Article headers created by myself

- https://twitter.com/@HeyRhett

- https://twitter.com/ZclassicCoin

- https://twitter.com/bitcoinprivate

- https://twitter.com/bitcoinprivate

- https://www.cryptocompare.com

If you missed my last crypto news just click here!

I wish you all a great Wednesday!

ⓁⓄⓥⒺ & ⓁⒾⒼⒽⓉ

Best regards

@danyelk

Forked Bitcoin fork will fork Bitcoin again! And it's done by Rhett Creighton who is the guy that said creating new coins is like creating a web page. Just keep printing more "money". And the distribution of coins is just ridiculous. Clearly Zclassic is gonna get pumped by the dummys who fall for this cheap trick.

Guess who (Rhett Creighton) is going to profit from that.

There will be always one who is making the big profit and in this case you are right it looks like it will be Rhett Creighton. Let's just see how the coin and project will perform in the future.

I will as I always do keep the free coins from the fork and smile :)))

Have a nice day and thanks for your input.

you just gained a follower! :)

Thank you :)

well, all the information in one click. thank u for share the crypto-news.

Your welcome :)

Important news @danyelk

Awesome post! I invite you to visit our blog and enjoy our content :)

You got a 6.41% upvote from @postpromoter courtesy of @danyelk!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

I wonder why cryptocurrencies are so popular among rappers?! First 50Cent with his "surprising" discovery of bitcoins. Didn't know about Snoop Dogg or Nas though and now Jay-Z.. also in Germany the 2 most popular rappers don't hide their passion for cryptos. A good thing for sure! Great post btw!!