Alright

On 27 February 2018, Malaysia's central bank, Bank Negara Malaysia has finally issued a cryptocurrency regulation for us.

Image Source: Bank Negara Malaysia

The name of this regulation would be:

Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) –Digital Currencies (Sector 6)

Or... Let us just call it "Sector 6". Ain't no one has time to read the long name!

This policy paper covers 2 parts, the overview in Part A and requirements of a reporting institution in Part B. It has close to 60 pages and if I were to dissect everything in and share my opinion on the implications would be TL;DR.

You may refer to the full policy paper here.

NB: All quotes here are in pursuant to Sector 6 unless otherwise stated.

Let's dive in!!

Due to rapid development in the field of digital currencies, increasing functionality of its use, growing adoption and its global nature, governments around the world have adopted various approaches and regulatory measures to address risks associated with and posed by digital currencies. - 1.1

This opening paragraph basically means Malaysia doesn't wanna miss the fun in addressing risks associated around digital currencies. Reason being this is a global risk and failing to address these risks would result in a lot of repercussion. FYI, Malaysian banking system happens to be one of the most complex and secured in the world. So, it's a good thing that BNM has been very conservative all along.

Promoting greater transparency in the use of digital currencies serves to protect the integrity of the financial system and strengthen incentives to prevent their abuse for illegal activities. With this in view, “any person offering services to exchange digital currencies either from or to fiat money, or from or to another digital currency” is subject to obligations under the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA) as a reporting institution pursuant to First Schedule of the AMLA. - 1.4

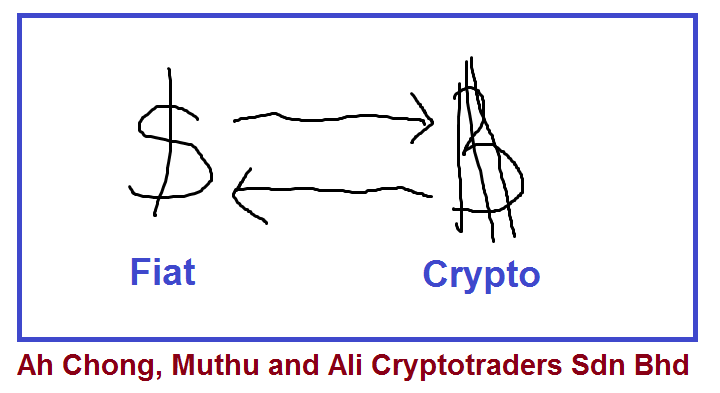

Let me get this straight... It would actually mean any [legal entity] person offering services [hereby referring to reporting institution, covered in Part B] to trade to and from fiat money [physical currencies] and digital currency, is subject to obligations under AMLA.

If you still don't see it clearly, let me just draw it out for you.

FYI, a reporting institution is covered under AMLA. It is defined to be

... any person, including branches and subsidiaries outside Malaysia of that person, who carries on any activity listed in the First Schedule... - Section 3, AMLA

In short, companies involved in offering financial services mostly are banks and capital management companies registered in Malaysia under various acts listed in the First Schedule, in relations to cryptocurrencies are bound by this policy and the obligations under AMLA.

In other words, traders like us, generally are not affected by this regulation. You may say that we are rather protected by this regulation.

So, with the implementation of Sector 6, can I say that crypto-trading is finally legal in Malaysia?

GIF Source: Giphy

The Bank reiterates that digital currencies are not recognised as legal tender in Malaysia. - 1.6

What the fiat?!

What about all my money?

Does it mean I cannot liquefy them ever again?

OH NO!

CALM DOWN!

GIF Source: Giphy

Back to reality. How many of you have done "trading" before, without involving money? Perhaps even exchange of services, like, "If I write this post on cryptocurrency, you upvote me well?" Just sayin'!

The regulation continues to add on by saying...

Members of the public are therefore advised to undertake the necessary due diligence and assessment of risks involved. -1.6

It basically means that you should be careful with which institution you're trading with. Pretty much, everyone should be careful with your personal information and money.

So, you're saying if I found out an institution ran away with my money, I can sue them and get my money back?

Hmm, well. If you're able to evidence all the documents before the judge stating that the institution is clearly breaking promises (aka breach of contract) then yes. But if they have already ran away with your money and there's no way to find them back, let's pray that our police would be able to do something with it.

Do remember, I am an accountant, not a lawyer. I wouldn't be able to provide you any further opinion on how should you proceed with legal actions. My opinions are based on the assessment and understanding on few basic acts, such as Contracts Act 1950 and Sales of Goods Act 1957. And of course some stories I learnt during Business Law classes in the past.

Applicability of Sector 6

I give up explaining with words. I'll draw this horrible diagram, and proceed with the explanation. After all, pictures worth a thousand words.

If a reporting institution engages in the activities shown in the above picture, then Sector 6 applies.

(i) exchanging digital currency for money;

(ii) exchanging money for digital currency; or

(iii) exchanging one digital currency for another digital currency

whether in the course of carrying on a digital currency exchange business or otherwise. - 4.1

Wait. What does it mean by "whether in the course of carrying on a digital currency exchange business or otherwise"?

It means regardless if crypto-trading is your nature of business (like our fictitious Ah Chong, Muthu and Ali Cryptotraders Sdn Bhd) or not, as long as your daily operations involve receiving and/or transferring cryptocurrencies, you're bound by Sector 6.

But... my nature of business is not covered under First Schedule of AMLA. Would I still be bound by Sector 6?

GIF Source: Giphy

Why?

To protect the public interest, basically, common folks like you and me dealing with businesses as well as protecting the national interest as a whole.

Let's revise Paragraph 1.4 of Sector 6

Promoting greater transparency in the use of digital currencies serves to protect the integrity...

Now, imagine Johnny registers a company under SSM and the nature of business is to sell lemonades. Each cup of lemonade costs ETH0.05. His nature of business (trading in F&B) clearly is not TRADING digital currencies, but because he uses a digital currency as a form of trade for his products (ETH0.05 for 1 cup of lemonade), he is bound by Sector 6.

The rationale of this is again, to promote greater transparency in the use of digital currencies. By reporting Johnny's earnings according to the guidelines under Part B of Sector 6, Johnny is making his business transparent. This makes BNM happy when they know Johnny is not secretly funding terrorism with his hard-earned etheriums selling lemonades.

Did you just say TERRORISM?!

GIF Source: Giphy

Yes. AMLA is written in 2001 for this reason.

... to provide for the offence of money laundering, the measures to be taken for the prevention of money laundering and terrorism financing offences... - PU(B) 15/2002.

Transparency in the era of digitisation

Everything is going digital, and cyber-security is now getting more and more in focus. There is a super high chance now that everything may be hacked if we don't protect our data properly. The implementation of Sector 6 has proven to be a very helpful mechanism in establishing transparency of the financial system and regulation in Malaysia.

In Part 2 of this series, I will attempt to cover further on the applicability of Sector 6, followed by the meaning behind the definitions of terms covered in that policy paper. Should you have further questions, feel free to comment below and I will try my best to answer according to my knowledge and understanding.

I'm sorry I was being hacked! I have deleted the spam and working on clean up! Love and Kisses @marie

Good read... but I need to reread the article as I am new to both the policies or cryptocurrencies

Sure, take your time. Comment below if you require me to explain further. I'm even caught in explaining some things here earlier. Haha!

You’ve been upvoted by TeamMalaysia community. Here are trending posts by other TeamMalaysia authors at http://steemit.com/trending/teammalaysia

To support the growth of TeamMalaysia Follow our upvotes by using steemauto.com and follow trail of @myach

Vote TeamMalaysia witness bitrocker2020 using this link vote for witness

This will be very informative for many especially those fully into cryptocurrency. Thanks for your time and effort in writing this post. ☺

Awesome effort and educational. Waiting for your part two :)

wow! this still takes time for me to digest. but overall I’m glad it seems that our country aims to protect us :)

No worries, in my sequel, I will summarize this part further before jumping deeper.

cool. will look out for it :)

What about those Trading on Remitano! I regularly sell and buy Crypto on there. Would I get in trouble for doing so? I'm technically exchanging a Virtual Currency for Money deposit my Bank Account. However, since it's a P2P, is subject to anti-money laundering law? By the way, this is a great post (deserved to be shared all over the internet), it's great to see more Malaysia contribute to the space like this

wrote an article similar to this but didn't get much response and yours is much better. Keep up the good work!